With the growing sea of choice across the content landscape, it’s easy to get caught up in big-budget program titles, technology acronyms and all things streaming. But there’s a bigger story beneath the headlines about who’s watching what and which OTT service is going to carry tomorrow’s big theatrical release at the same time it hits the big screen: traditional, linear programming is passing the baton to digital.

That shift obviously includes consumption, but that’s just one aspect of a larger evolution. More broadly, the dramatic rise in connected TV (CTV) adoption, accelerated by the pandemic, has ushered in new commercial models that are fragmenting the landscape in much the same way that the myriad viewing options are. Until recently, traditional commercial models have determined the value exchanges within the media industry. These models have been steadfast for decades, but the widespread adoption of internet-connected devices and accompanying services to meet growing demand have opened new commercial opportunities that didn’t exist in traditional linear experiences.

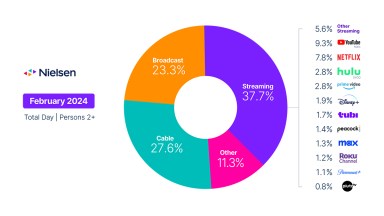

The implications here are significant, as monetization opportunities are no longer limited to the buying and selling of ads within a scheduled, linear program. That’s not to say, however, that these opportunities no longer exist. Linear television remains the best way to reach a mass audience, and global ad spending on traditional TV has rebounded stronger than other media spending has. That spending now has company, but it’s all still connected to the physical television set—the most valuable 52 inches of real estate in the home.

CTV, defined as content delivered to the television set through an internet connection, has significantly broadened the commercial opportunities within the video realm—and for more parties. CTV is also nearing ubiquity in certain markets. In the U.S., for example, Nielsen data shows that CTV reaches nearly 142 million adults each week. And in Western Europe, eMarketer forecasts that OTT subscribers will reach nearly 187 million in 2022.

With direct access to consumers, networks, broadcasters and new media companies are investing in building and acquiring direct-to-consumer offerings, following in the well-established footsteps of Netflix, which pioneered subscription video on demand (SVOD) back in 2007. Today’s OTT and CTV options span beyond SVOD, also encompassing ad-supported VOD and live streaming, either through a multichannel video programming distributor (MVPD) like Comcast and Verizon, or a virtual MVPD (vMVPD) like YouTube TV, fuboTV and Sling.

Outside of traditional SVOD platforms, CTV and addressable advertising represent budding opportunities, but they remain largely unfamiliar to many marketers. Media investment company GroupM forecasts that CTV ad revenue will grow to exceed $31 billion globally by 2026, but the newness of the multifaceted advertising options outside of traditional models has many marketers unsure of their footing. In our 2021 Annual Marketing Report, we noted that 46% of marketers across brands with small, medium and large budgets reported internal knowledge gaps with respect to adopting CTV marketing strategies. Beyond adoption, nearly half (47%) of marketers at brands with large budgets ($10 million or more) say they’re facing measurement challenges in the space even though an equal percentage say real-time targeted ads in linear programming is important moving forward.

CTV has also expanded the commercial opportunities beyond the content landscape. For example, it’s fashionable to be a consumer electronics manufacturer again, as devices, especially TVs, now hold the keys to consumer access (and data). In addition to the fact that modern televisions are manufactured to be internet-capable, a growing array of over-the-top (OTT) devices also provide consumers with access to online content. In addition to facilitating content delivery and consumption, OEMs have realized the upside of selling ads and access instead of simply relying on one-time hardware sales.

The evolution of CTV has also welcomed an abundance of marketing technology options to help businesses track the evolution and stay ahead. The martech industry has evolved to include 8,000 solutions—that’s growth of 8X since 2014. And that growth can add to the complexity of the space.

Digital truly represents a new frontier for the television industry, and answers a nagging question that comes up from time to time as new innovations arrive: “Is TV dead?” The answer is a resounding “no.” It’s alive, well and introducing a wealth of opportunity for content creators, distributors, advertisers, OEMs, agencies and consumers.

For additional insights, watch the on-demand recording of our recent State of Global Media event.