Relevance

Newest

Oldest

X Clear Filters

Insights

-

Featured

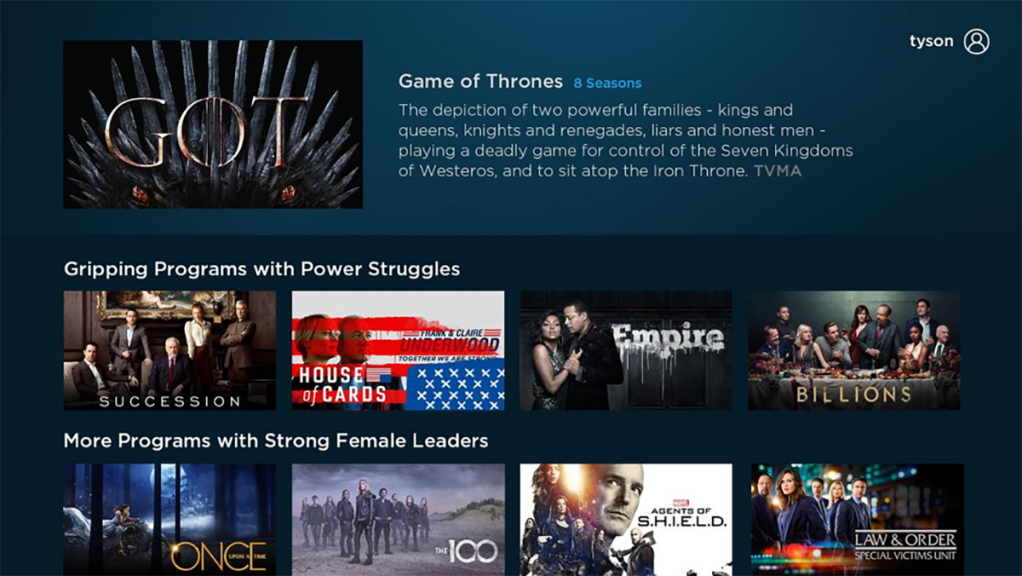

Need to Know: What’s an identity graph and why do marketers need them?

For consistent, comprehensive and comparable audience measurement across platforms, marketers need a robust ID system…

Marketing performance7m read