While some things get better with age, other things can fall victim to inattention over time. Whether it’s because we’re strapped for time or simply not very interested in the subject, insurance often falls into the “I’ll deal with it later” bucket rather than landing at the top of our “to do” lists.

But why do consumers take such a passive attitude when it comes to protecting themselves, their belongings and the ones they love? In looking at findings from a recent Nielsen study, U.S. consumers aren’t really indifferent about insurance—they’re just apt to make their decisions and live with them, particularly as they get older.

Comparatively, switching insurance companies is fairly common among young drivers—those 39 and younger. And in addition to being finicky, findings from the recent report suggest that they’re harder to please than older consumers. Specifically, they’re the most likely to have switched auto insurers in the past three years and they’re the least likely to report being satisfied. They’re also the least likely to recommend their insurer to a friend.

While price is a likely reason for some of this behavior, the study results indicate two other factors that may be even more influential: policy features and customer service.

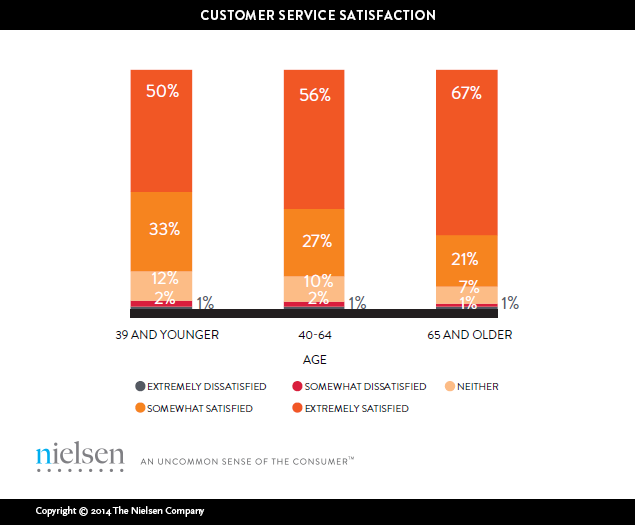

In aggregate, most satisfaction scores fare about the same across all age groups. There are subtle differences, however, within age groups—differences that present opportunity for insurers looking to better engage with consumers looking for something new. For example, half of respondents 39 and younger reported being “extremely satisfied” with customer service, whereas 56 percent of 40-64 year olds and 67 percent consumers 65 and older reported being “extremely satisfied.”

These differences may not seem extreme, but the subtle differences indicate how younger and older consumers view insurance. While older consumers have more experience as policyholders and know what to expect from their insurers, younger consumers may require more guidance and explanations about the terms of their coverage—guidance they seem to want.

And findings from previous surveys re-emphasize the connection and personal connection that certain demographics seek out in their daily lives. Millennials, in particular, want to feel like they have a personal, direct relationship with the brands they interact with—and in return, they’ll advocate and endorse the brand. The task at hand for insurance companies on that front hinges on technology and social media savvy—channels they need to be fluent with if they want to succeed with this large demographic that make up 24 percent of the U.S. population.

For more detail and insight, download Nielsen’s 2014 Consumer Insurance Sentiments report.

METHODOLOGY

Nielsen Insurance Track is a survey conducted biennially, collecting consumer-level data on behaviors related to auto, residential, life, and other insurance coverage types. Approximately 35,000 respondents, sampled to be nationally representative, participate.