Relevance

Newest

Oldest

X Clear Filters

Insights

-

Featured

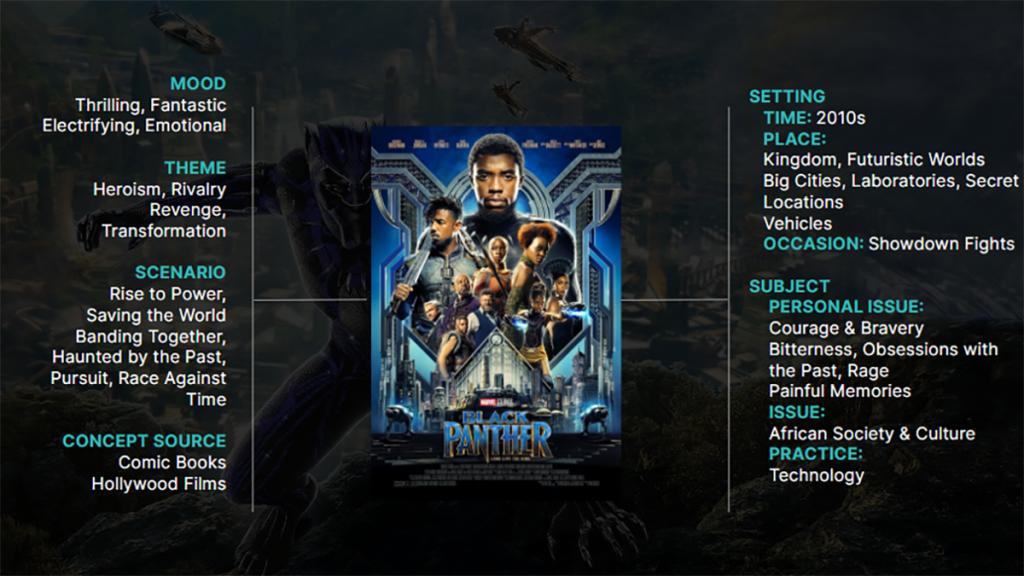

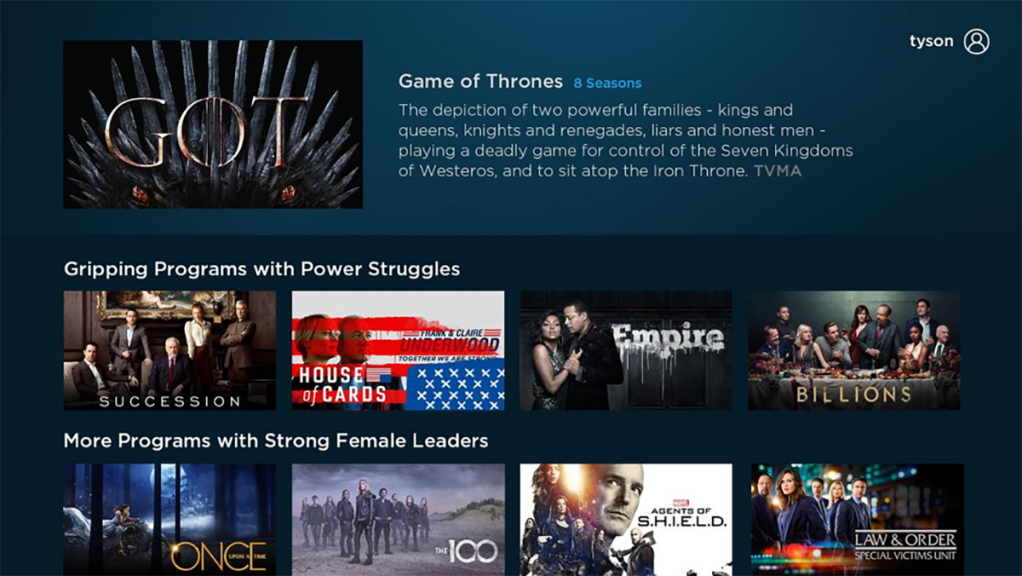

FAST has made linear TV cool again; personalization will make it cooler

Creators and publishers entering the FAST industry need to focus on metadata as they plan their distribution strategies.

TV & streaming5m read