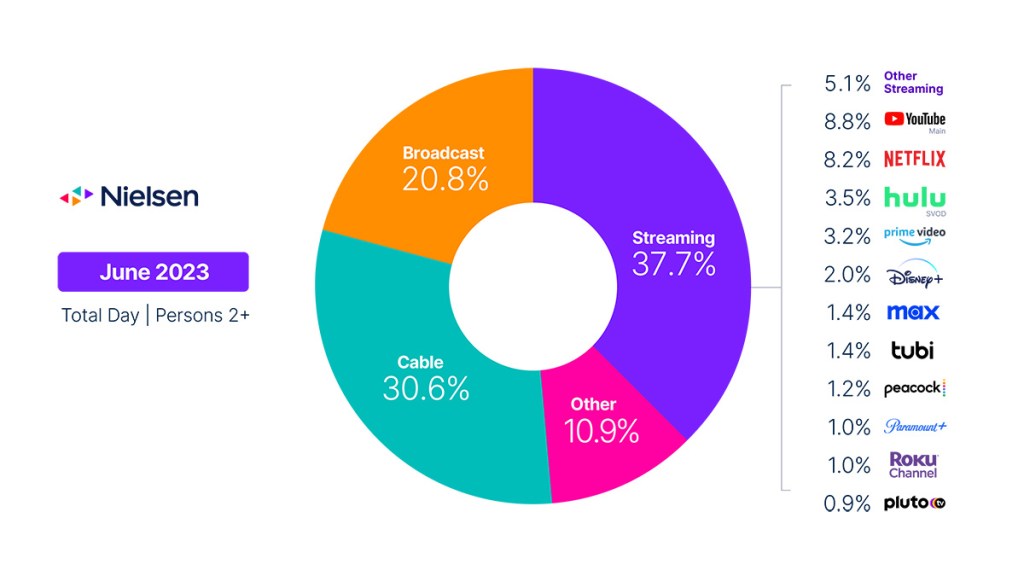

流媒体占电视总收视率的 37.7%;Paramount+ 占电视使用率的 1%。

随着孩子们又一个学年的结束,电视使用趋势在经历了从二月份开始的四个月的季节性低迷之后,在六月份开始出现转机。对于 2-17 岁的孩子来说,流媒体和视频游戏让他们从课堂中解脱出来,所有年龄组的电视总使用率增长了 2.2%。

在 2-17 岁的儿童中,非传统电视选择占其使用时间增长的 90%。与 5 月份相比,2-11 岁儿童看电视的时间增加了 16.3%,12-17 岁儿童看电视的时间增加了 24.1%。

- 在 2-11 岁的儿童中,流媒体使用占增长量的 62%,"其他 "使用占 30%,主要归因于视频游戏机的使用。

- 在 12-17 岁的儿童中,流媒体和其他媒体所占的时间比例相当平均,分别为 43% 和 46%。

在有线电视使用量相对持平、广播电视使用量下降 6.6% 的情况下,流媒体使用量猛增 5.8%,占电视总使用量的 37.7%,创下新高。星际迷航:奇异世界》(S.W.A.T.)在 5 月中旬与 Hulu 和 Paramount+ 一起登陆 Netflix 后,吸引了近 50 亿分钟的观看时间。星际迷航:奇异新世界》(Star Trek: Strange New Worlds)是另一部吸引观众的影片,在第二季于 6 月中旬播出后,吸引了近 10 亿分钟的观看时间。这一增长帮助 Paramount+ 占据了 1%的电视收视率,并在The GaugeGaugeTM 中获得了独立覆盖。其他流媒体亮点包括

- Tubi TV 是领先的 FAST 服务,其使用率增长了 12.1%,占电视使用率的 1.4%(高于 2023 年 2 月的 1%,与 Max 并列)。

- Disney+ 受益于儿童收视率的增长,使用率增长了 11.9%,占电视收视率的 2%。

- 最大使用率跃升 16.5%,获得 0.2 个份额点。

- YouTube 的电视使用率接近 9%,Netflix 的电视使用率上升了 0.3 个百分点,达到 8.2%。

在传统电视节目中,有线电视和广播节目的使用反映了夏季的典型趋势。广播收视率仅占电视总收视率的 20.8%,创下新低。有线电视收视率因故事片(增长 10%)和新闻(增长 6.6%)而上升了 0.4%,但因电视总收视率的上升而损失了 0.6 个份额点。NBA 总决赛是有线电视的热门节目,但不足以抵消有线电视体育收视率下降 38% 的影响。相比之下,他们帮助推动了广播体育收视率 31.7% 的增长。与去年同期相比,广播收视率下降了 5.6%,有线电视收视率下降了 11.6%。

即使广播和有线电视的新节目极少,但不断扩展的流媒体选项和引人入胜的内容展示了电视--以及它所提供的一切接入方式--的持续吸引力。对于那些选择躲避炎热天气、在室内度过炎炎夏日的人来说,电视所能提供的一切都将成为他们在客厅里享受生活的关键。

Brian Fuhrer 的六月数据趋势

The Gauge 每月对观众在主要电视传播平台上的收视行为进行宏观分析,包括广播、流媒体、有线电视和其他来源。它还包括主要流媒体分发商的细分。图表本身代表了每月电视总使用量,并按类别和各个流媒体分发商细分出收视份额。

方法和常见问题

The Gauge"是如何制作的?

The Gauge 的数据来自两个单独加权的面板,然后合并成图表。尼尔森的流媒体数据来自全国电视面板中支持流媒体计费器的电视家庭子集。线性电视资源(广播和有线电视)以及总使用量基于尼尔森整体电视面板的收视情况。

所有数据均以每个收视源的时间段为基础。代表广播月的数据是基于报告区间内的 Live+7 观看次数(注:Live+7 包括电视直播观看次数和线性内容七天后的观看次数)。

其他 "包括哪些内容?

在The Gauge中,"其他 "包括不属于广播、有线或流媒体类别的所有其他电视使用。这主要包括所有其他调谐(未测量来源)、未测量的视频点播(VOD)、音频流、游戏和其他设备(DVD 播放)的使用。

从 2023 年 5 月开始,尼尔森开始利用流媒体内容收视率来识别由该服务中报告的平台分发的原创内容,从而对通过有线电视机顶盒观看的内容进行重新分类。这些观看内容将记入流媒体和发布内容的流媒体平台。它也将从其他类别中删除,因为其他类别以前也反映过此类内容。在 "流媒体内容评级 "中未被确定为原创的、通过有线电视机顶盒观看的内容仍将包含在 "其他 "中。

其他流媒体 "包括哪些内容?

列为 "其他流媒体 "的流媒体平台包括任何未单独细分的电视高带宽视频流媒体。其他流媒体 "不包括旨在提供直播和有线(线性)节目的应用程序(VMVPD 或 MVPD 应用程序,如 Sling TV 或 Charter/Spectrum)。

线性流媒体在哪些方面做出了贡献?

线性流媒体(由 vMVPD/MVPD 应用程序聚合观看所定义)不包括在流媒体类别中,因为通过这些应用程序观看的广播和有线电视内容归入各自的类别。 这一方法上的变化在 2023 年 2 月的区间内实施。

Hulu 和 YouTube 上的直播流媒体如何?

流媒体类别中不包括通过 vMVPD 应用程序(如 Hulu Live、YouTube TV)进行的线性流媒体。流媒体类别中的 "Hulu SVOD "和 "YouTube Main "指的是不包含线性流媒体的平台使用情况。