사하라 사막 이남의 아프리카에서 비즈니스를 운영하는 것은 다양한 도전과제로 가득할 수 있으며, 전형적인 아프리카 소비자를 파악하고자 하는 사람은 누구나 어려움을 겪을 것입니다. 국경을 공유하고 있음에도 불구하고 한 국가의 주민들은 태도, 구매 및 미디어 선호도에 있어 이웃 국가의 주민들과 차이가 있습니다. 이러한 지역 내 및 지역 간 다양성을 고려할 때, 마케터는 틈새 고객과 대중 고객 모두에게 도달하고 공감을 얻기 위해 뻔한 것을 넘어서야 한다는 것을 보여주는 닐슨의 새로운 연구 결과가 있습니다.

지난 10년간 사하라 사막 이남 아프리카에서는 생활 수준 향상, 임금 상승, 소비 수준 증가와 함께 디지털 연결성이 크게 발전했습니다. 동시에 소비자들은 일반적으로 브랜드와 메시지를 자신의 삶에 받아들이는 방식에 점점 더 능숙해져 마케팅 활동이 더욱 어려워졌습니다.

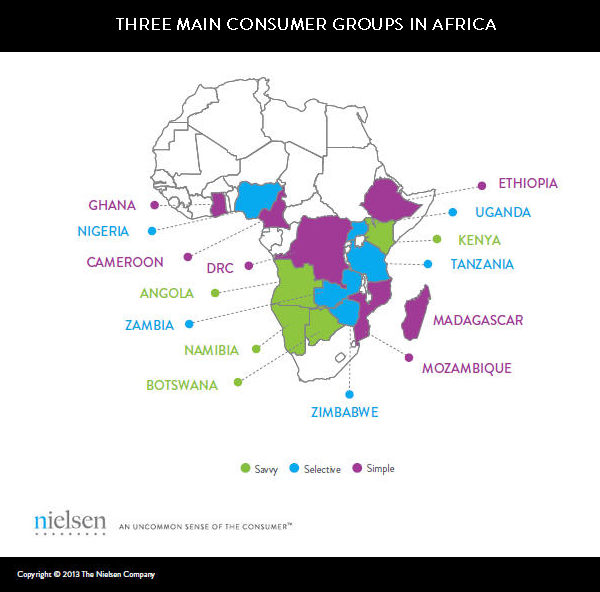

닐슨은 인구 통계, 라이프스타일, 태도 및 미디어 소비에 대한 구매 행동의 추세를 관찰하여 사하라 사막 이남 15개국을 세 가지 미디어 소비자 그룹으로 분류할 수 있는 주요 패턴을 파악했습니다: 정통형, 선별적, 단순형. 이러한 세그먼트는 사하라 사막 이남 아프리카 소비자의 다양한 미디어 행동과 선호도에 대한 인사이트를 제공하여 마케팅 성공을 위한 보다 명확한 로드맵을 제공합니다.

예를 들어, 소비자에 정통한 국가에서는 인스턴트 메시징과 소셜 미디어 사용률이 높습니다. 사용자들 사이에서 소셜 미디어에 접속하는 빈도는 매일입니다. 반면, 선택적 소비자 국가는 미디어에 덜 관여하는 단계부터 더 많이 관여하는 단계까지 다양한 발전 단계에 있는 가장 크고 다양한 소비자층을 보유하고 있습니다. 반면, 단순 소비자 국가는 미디어 참여도가 가장 낮고 1인당 GDP도 가장 낮습니다.

세 국가의 소비자마다 선호하는 미디어와 이용 가능 여부는 다를 수 있지만, 대면과 디지털 모두에서 대화의 힘은 모든 소비자에게 유효합니다. 이들 국가에서는 인쇄 매체와 전자 매체가 인지도를 높이는 데 효과적이지만, 구매 결정에 있어서는 입소문이 진정한 게임 체인저가 될 수 있습니다. 설문조사 결과에 따르면 응답자들은 다른 모든 형태의 광고보다 가족이나 친구의 추천에 따른 구매를 더 높게 평가했습니다.

일부 국가에서 소셜 미디어 플랫폼이 빠르게 성장함에 따라 가상 입소문 메시지는 직접 대면하는 대화만큼이나 강력한 힘을 발휘할 수 있습니다. 소셜 미디어 대화에 관심을 기울이는 소비자들은 유명인이나 커뮤니티의 유명 인사 등 개인적으로 알지 못하는 사람들의 입소문을 활용할 수도 있습니다.

아프리카에서는 메시지와 메신저가 매체만큼이나 중요합니다. TV와 라디오 채널, 인쇄, 디지털, 옥외 및 모바일 매체 등 미디어 노출이 증가하고 있지만 입소문 커뮤니케이션은 마케팅 및 미디어 캠페인에 통합될 경우 매우 강력한 힘을 발휘합니다. 하지만 가장 효과적인 효과를 거두기 위해서는 국가별 소비자층에 맞게 조정해야 합니다.

더 많은 인사이트를 얻으려면 아프리카의 미디어 전략을 위한 닐슨 청사진 보고서를 다운로드하세요.

아프리카를 위한 미디어 전략 보고서 정보

사하라 사막 이남 아프리카에서 비즈니스 기회를 모색하는 기업을 지원하기 위해 닐슨은 15개국 8,100명 이상의 도시 및 도시 주변 소비자를 대상으로 설문조사를 실시했습니다. 이 조사를 통해 닐슨은 라이프스타일, 태도, 인구통계, 구매 행동 등의 변수를 사용하여 아프리카의 다양한 소비자들의 마음에 대한 인사이트를 얻기 위해 7개의 소비자 세그먼트를 식별했습니다. 또한 미디어 참여의 광범위한 패턴을 관찰함으로써 닐슨은 국가를 세 가지 미디어 소비자 그룹으로 분류할 수 있는 주요 패턴을 도출할 수 있었습니다: 현명한, 선택적, 단순한.