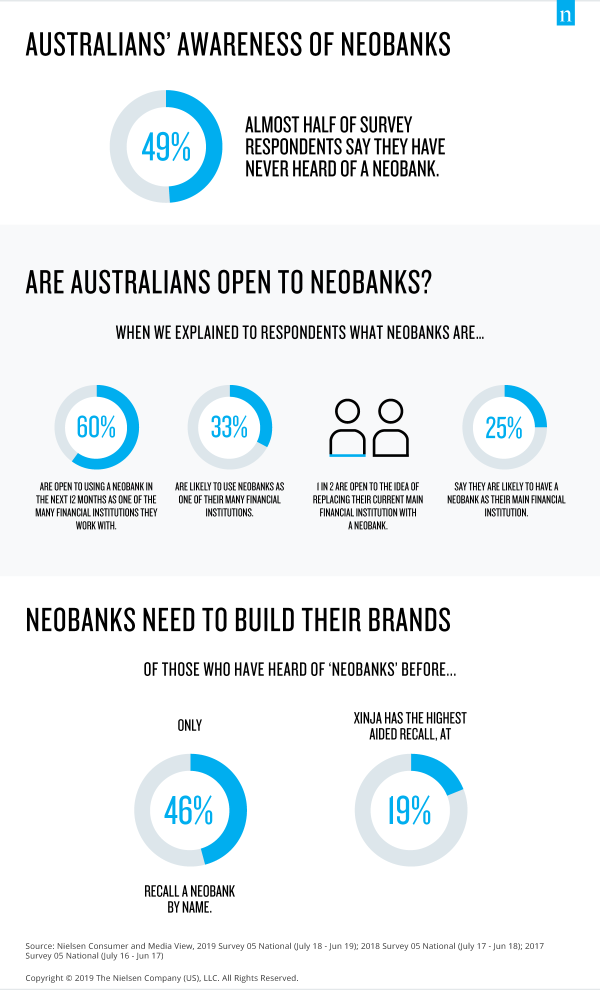

호주인들은 아직 전통적인 은행 업무 방식에서 네오뱅크의 새로운 모바일 전용 환경으로 전환할 준비가 되어 있지 않습니다. 호주인 2명 중 1명은 현재 주거래 금융기관을 네오뱅크로 전환할 의향이 있다고 답했지만, 호주의 금융 문화와 인식 변화를 위해 해야 할 일이 더 많습니다. 기존 은행과 디지털 은행의 디지털 오퍼링은 이 분야에서 긍정적인 변화를 이끄는 핵심 요소입니다. 그 결과 네오뱅크에 대한 인지도가 높아질 것으로 예상하지만, 현재로서는 아직 시장 입지를 구축하는 단계입니다. 네오뱅크는 호주 소비자들의 금융 포트폴리오에서 고려 대상이 되기 위해 브랜드 자산을 지속적으로 구축해야 합니다.

기존 은행이 직면한 가장 큰 과제 중 하나는 불만족입니다. 지난 12개월 동안 310만 명 이상의 호주인이 주요 금융 기관에 불만을 표명한 가운데, 금융 기관은 고객의 이탈과 불만을 해결하는 것이 매우 중요합니다. 기존 은행의 마케팅 및 브랜드 속성과 실제 경험을 오버레이해 보면 고객이 기대하는 것과 실제 제공되는 것 사이에 큰 약속의 차이가 있다는 것을 알 수 있습니다. 이 문제를 신속하게 해결하지 않으면 디지털 은행이 이러한 잠재 고객을 공략할 수 있는 기회가 사라집니다.

은행에 대한 소비자 불만족도는 작년에 비해 3% 상승했으며, '빅4' 은행을 이용하는 소비자(+6%)의 불만족도가 더 높았습니다. 은행왕립위원회에 대한 언론 보도와 오픈 뱅킹 및 새로운 시장 경쟁으로 인해 소비자는 이제 자신이 원하는 은행 서비스를 더 잘 제공할 수 있는 다른 기관을 찾기가 더 쉬워졌습니다. 현재 향후 6개월 이내에 주거래 금융기관을 변경하려는 호주인의 수는 12%(250만 명)로 1년 전(219만 명)보다 9% 증가했습니다.

향후 6개월 내 주거래 금융기관을 변경하려는 호주인 250만 명

네오뱅크에 대한 현재 인지도

호주에서 네오뱅크의 규모는 작지만 인지도는 점점 높아지고 있습니다. 네오뱅크에 대해 들어본 호주 소비자 중 46%는 브랜드 이름을 기억할 수 있었으며, 신자는 다른 브랜드에 비해 가장 잘 알려진 브랜드로 19%의 인지도를 기록했습니다.

하지만 네오뱅크에 대한 브랜드 인지도 비선호도를 살펴보면, 볼트뱅크(27%), 신자(26%), Q페이(24%)가 상위 3개 브랜드를 떠올리며 1위 자리를 놓고 박빙의 승부를 벌이고 있습니다.

호주에서 네오뱅크는 아직 비교적 새로운 개념입니다. 지난 2년간의 금융 서비스 부문의 변동 상황을 고려할 때 호주 시장은 네오뱅크의 성공을 위한 무르익은 시장입니다. 이 모든 것이 기존 은행에 드리운 먹구름처럼 들리지만, 실제로 얼마나 많은 사람들이 주거래 금융기관을 네오뱅크로 바꿀지 아직은 알 수 없습니다.