Shan Phillips, Vice President, Greater China, Telecom Practice, The Nielsen Company

On the streets of Guangzhou, Harbin and Shanghai, the mobile phone has become ubiquitous. Once the domain of the elite, it now seems that just about everybody has one. Widespread ownership of mobiles is only a fairly recent development in China, but consumers there have fully embraced the technology and in some ways are using it more robustly than their American and European counterparts.

For many people in China, the mobile Web is the only one they need. When they think of the Web, they don’t think of tethering themselves to a desktop PC and the accessories of mice, keyboards, mouse pads, printers and monitors. Not only do many homes in China not have (or need) landlines for voice communications, but also they don’t require hardwired Internet access for their fix of the Web. With mobile phones, everything they need is in the palm of their hand.

In a short amount of time, mobile consumers in China have surpassed their American counterparts when it comes to using the devices to access the Internet (38% of Chinese mobile subscribers compared to 27% of American mobile subscribers), despite less advanced networks. Whether it’s kids in Beijing downloading games or adults in Shanghai requiring real-time information about the stock market and the ability to act on it on the go, the mobile Web is becoming an integral part of Chinese life.

To gauge where this important market stands – and where potential opportunities lie for retailers, device manufacturers, service providers and content producers – The Nielsen Company has just released its most recent Mobile Insights Report on China. The report offers a glimpse into just how powerful the opportunity is to satisfy the needs of mobile Internet users in China. These are just some of the highlights.

Who is Using Mobile Phones and What Are They Looking For?

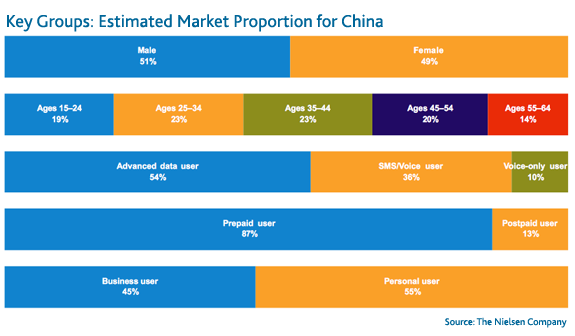

Today, there are 755 million cell phone subscribers in China – more than half of the population. That makes China the world’s largest mobile device market. That number will (of course) only rise as the populace becomes more affluent. Nielsen found that the split between the sexes was almost equal: women comprised 49% of users while men made up 51%. Adults aged 25-34 and 35-44 made up the largest percentage of users (23% each).

The majority of consumers (54%) used their devices for advanced data such as e-mail, gaming and music, while 36% used their phones for text/SMS and voice only (another 10% said they used their phones for calls only).

With the consolidation of the telecom market in China over the past year, three carriers now dominate the market. China Mobile is the clear leader with more than 70% market share, followed by China Unicom and China Telecom.

In terms of handset brands, Nokia dominates followed by Samsung and Motorola. However, the real story is that the top international brands are losing share to local brands that have designed low cost phones with features that appeal to Chinese consumers, such as extra loud volume settings, funky shapes and designs and extra long battery life. This trend has been accentuated by the government’s requirement that leading operator China Mobile deploy a 3G technology (TD-SCDMA) that is not used in other markets- forcing global device brands to make difficult choices about whether to develop devices for this new standard.

While price was the most important factor for consumers when considering buying a new device, we see increasing interest in device style and device features as well as considerable brand loyalty.

The average Chinese mobile user spent just over US$ 10 per month for their service (for context, US$500 is considered a good blue collar wage in China’s more prosperous urban areas) . Men spent more than women, while consumers using their device primarily for business spent the most. As youth 24-35 are the biggest data users, it is not surprising that they are the biggest spending age group as well.

How Are Chinese Using Their Mobile Phones?

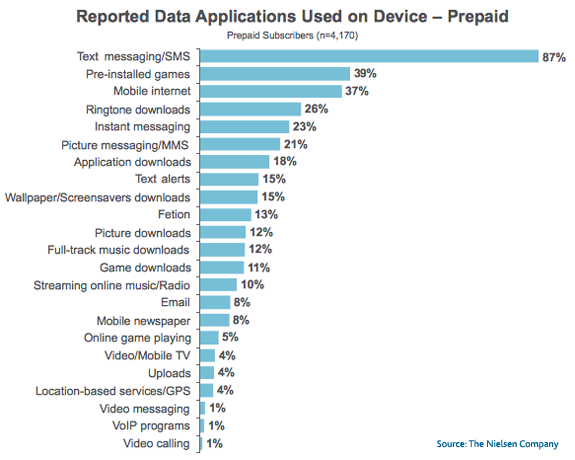

Both pre- and post-paid subscribers used their devices for text messaging/SMS (87% and 80% respectively). Games were the second most popular followed by the mobile Internet and are also more prevalent among post-paid subscribers. Video services such as mobile TV, messaging and video calling were used by only a small percentage of users, largely due to network speed issues. Once 3G expands, it is likely that these services will gain in popularity.

It’s perhaps not surprising that Chinese youth surf the net while on the go more than adults – they’ve grown up with the Internet. Likewise, urban dwellers – with access to better network coverage – use their mobiles for Internet access more than their rural counterparts.

Market Opportunities

While almost 40% of Chinese phone users access the mobile Internet, they don’t use as many data intensive applications such as mobile video and content uploads. There are a number of reasons for this: 3G launched just last year; penetration of smartphones such as the iPhone and Android is still low; the Mobile Application ecosystem remains fragmented, and social networking platforms are less developed. However, as mobile penetration is just crossing 50%, China’s fixed phone line connections are decreasing as more users “cut the cord” and access to the Internet via computers is less prevalent than in the U.S. The demand for mobile devices and data will continue to expand, leading to many opportunities for service providers, device manufacturers, retailers and content providers.

China’s growth over the last decade has been extraordinary and shows few signs of abating any time soon. As such, it’s only natural that Chinese consumers would wholeheartedly adopt technology and products that enable them to be productive – and stay connected – on the move.

China versus the U.S.: How usage differs

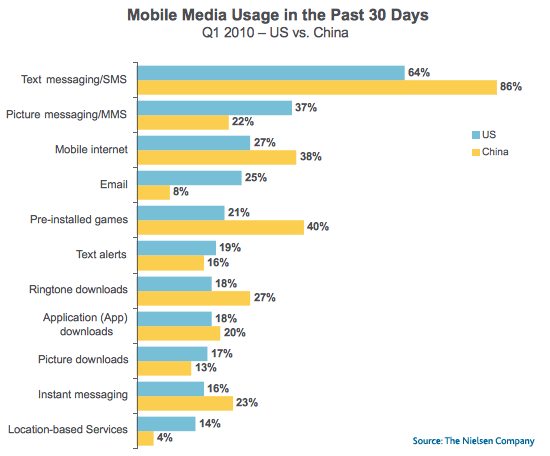

In China, the vast majority of mobile consumers (87%) use pre-paid plans. In the U.S., less than 20% of mobile consumers use them, as most Americans prefer subscribing to post-paid plans. Even though Chinese have less 3G network coverage and own fewer smartphones, they tend to use their mobile phones to access the Internet while on the go more than Americans (38% vs. 27%). Chinese also texted (86% vs. 64%), and instant messaged (23% vs. 16%) more often. Meanwhile, Americans used their mobile devices more than Chinese for e-mail (25% vs. 8%) and picture messaging (37% vs. 22%).

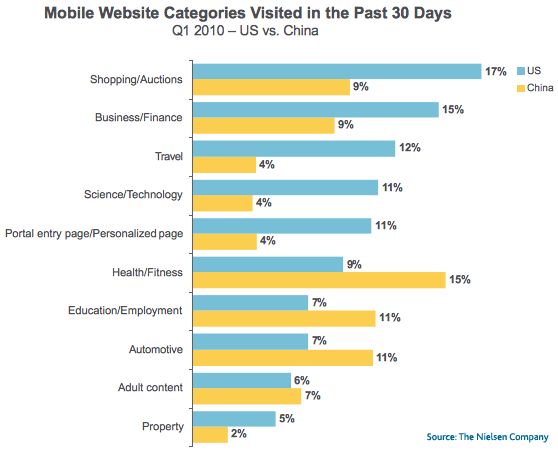

Because 3G development in the U.S. is widespread, Americans used bandwidth-intensive applications such as content uploads, video messaging and mobile video more than Chinese. Americans also visited a wider variety of sites, although health/fitness, education/employment and automotive sites were more popular in China than in the U.S.

Nielsen’s Mobile Insights Report on China is based on face-to-face surveys with 4,946 consumers age 15 and up in 19 cities around China. The interviews were conducted in March 2010.