Bruce Wilkinson, Vice President, Media & Communication, Nielsen Claritas

American consumers who don’t qualify for a traditional post-paid cell phone plan are driving the growth of the pre-paid wireless marketplace. This segment of the wireless market has grown at higher rates than the post-paid market, in part due to the recent recession.

However, even in today’s tough economy, this segment of low-credit prospects represents a discrete subset of the overall wireless market. Acknowledging this, pre-paid wireless marketers have expanded their horizons searching for other reasons people choose a pre-paid plan.

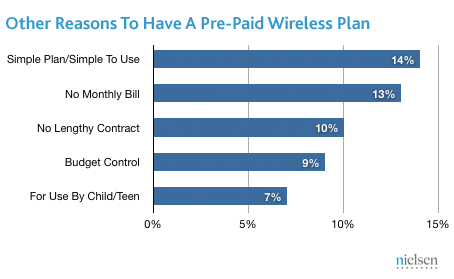

A close look at our latest Convergence Audit reveals the top non-credit related reasons consumers choose a pre-paid wireless plan. These reasons all boil down to the plans’ primary benefit – the simplicity of not having a long-term, uncapped contract.

Together, nearly 50% of the respondents who have a pre-paid wireless plan gave these as the primary reason they opted for this type of plan.

Understanding these factors better allows marketers to cast a wider reach within the marketplace and potentially capture increased market share.

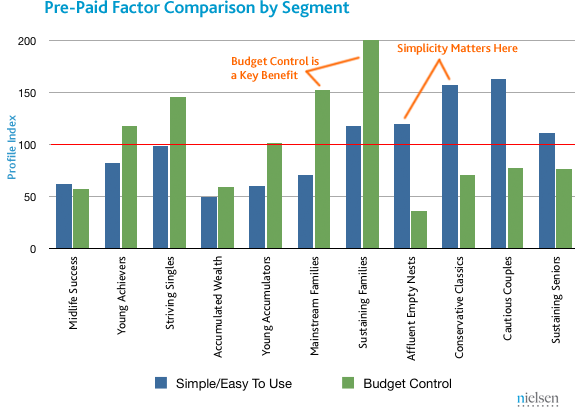

Of greater interest, the people who offered up these divergent reasons for having a pre-paid phone differ from one another. For example, certain groups value simplicity. For others, budget control is the focus.

As this chart below shows, when we look at these customers through Nielsen’s PRIZM Lifestage Groups, segments like Mainstream Families and Sustaining Families are more likely to have a pre-paid cell phone for budget control purposes. They consist of child-filled, middle- and working-class households as well as some decidedly downscale households. Residents share similar consumption patterns, living in modestly priced homes, including mobile homes. Their lifestyles are similarly modest: these households are into playing games and sports, shopping at discount chains and convenience stores, and tuning into nearly everything that airs on TV and radio.

On the other hand, Conservative Classics and Cautious Couples tend to have a pre-paid cell phone because of its simplicity. These mature empty nesters, age 55+, earn middle incomes and have tastes to match. They like to travel, but not extravagantly. For leisure at home, they enjoy gardening, reading books, watching public television, and entertaining neighbors over barbecues. When they go out, it’s often to a casual-dining or a family restaurant.

These differences have implications for the wireless carriers and suggest that their pre-paid offers might differ in different TV markets. The DMAs in which you are most likely to find people likely to buy a pre-paid phone are all smaller DMAs. You aren’t as likely to find these people in any of the top 25 DMAs.

In DMAs like Harlingen, Texas and Myrtle Beach, South Carolina you tend to find people who buy pre-paid phones to help control their budget. Here the pre-paid wireless carriers would do well to emphasize how their products can help people balance their budgets. A common response in this market might be: “You sweat for your money, don’t waste it on a cell phone plan designed for a celebrity wanna be.”

| DMA | HH Count | Simple Plan Simple To Use Index |

Budget Control Index |

|---|---|---|---|

| Harlingen et al, TX | 354,105 | 98 | 149 |

| Lafayette, LA | 231,653 | 104 | 134 |

| Myrtle Beach et al, SC | 286,392 | 116 | 131 |

| Wheeling et al, WV-OH | 134,164 | 129 | 99 |

| Medford et al, OR | 176,019 | 123 | 99 |

| Traverse City et al, MI | 249,402 | 122 | 112 |

| Source: The Nielsen Company |

People who like the simplicity of pre-paid wireless plans tend to live in places like Wheeling, West Virginia and Traverse City, MI. Prepaid marketers here can focus on how their products simplify people’s lives. In these towns a focus group attendee might say, “Cell phone plans just keep getting more and more complicated – daytime, nighttime, weekend, free friends, data charges, text messages – when all you need is to call your grandkids from wherever and whenever you want.”

In contrast, in the top DMA’s you don’t tend to find either of these types of people. Not one of the top 5 DMA’s has above average concentrations of either of these types of pre-paid phone buyer.

| Simple Plan Simple To Use Index |

Budget Control | ||||

|---|---|---|---|---|---|

| DMA | HH Count | Estimated Users | Index | Estimated Users | Index |

| New York, NY | 7,527,072 | 140,066 | 93 | 81,844 | 80 |

| Los Angeles, CA | 5,722,521 | 106,038 | 93 | 71,768 | 92 |

| Chicago, IL | 3,517,872 | 66,171 | 94 | 42,843 | 89 |

| Philadelphia, PA | 2,968,531 | 57,931 | 98 | 35,417 | 87 |

| San Francisco, CA | 2,529,326 | 45,740 | 91 | 23,841 | 69 |

| Source: The Nielsen Company |

However, due to the overall size of these DMAs, you do tend to find significant numbers of people interested in each of these messages. The implication for the wireless carriers is that advertising conveying their pre-paid plan’s benefits will resonate selectively in portions of major markets, rather than throughout the market. More geographically targeted media will help the carriers focus in on the specific areas in which to deliver this message.