Don Kellogg, Senior Manager, Research & Insights, Telecom

It’s hard to turn on the television in the United States and not see an ad for a wireless carrier touting their new 4G network.

But how well do consumers understand 4G or its benefits? Is all that advertising paying off for mobile carriers eager to lure U.S. consumers?

The Nielsen Company recently fielded a survey of more than 2,100 U.S. adults to gauge consumer awareness and perceptions of 4G as well as purchase intent. What have consumers learned from watching 4G advertising and what will it take to motivate them to buy?

Defining 4G

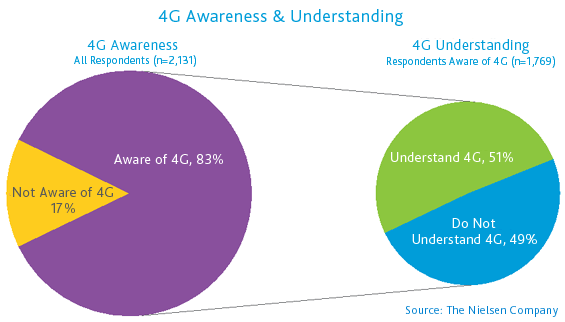

Mobile carriers’ aggressive advertising campaigns have been successful in raising awareness of 4G, but may have a ways to go in terms of education about the benefits of 4G. About one in five wireless consumers are not aware of 4G, of the remaining four that have heard of 4G, only two claim to understand it. That’s not surprising since in this case consumer confusion mirrors industry confusion.

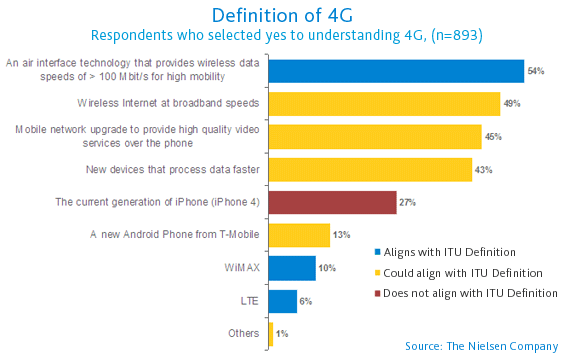

Up until recently the International Telecommunications Union’s (ITU) official definition of 4G was a standard that no U.S. carriers met. Under pressure, the ITU revised their definition of 4G to include any technology that was a ‘meaningful improvement’ over 3G. Under that definition, all three U.S. 4G technologies now qualify (WiMAX, LTE & HSPA+).

When asked to define 4G, 54 percent of those that responded selected the original ITU definition: mobile data speeds of more than 100 MBits/s, even though no carrier worldwide currently reaches speeds that high. Also of note, 27 percent of respondents thought that the iPhone 4 was 4G (it’s not), likely due to the naming conventions of the last several iPhone devices: iPhone 3G, iPhone 3GS & iPhone 4. Additionally, a number of respondents selected slightly ambiguous definitions of 4G – for example, several of T-Mobile’s new Android phones are HSPA+ (the MyTouch 4G and the G2), but not all new android phones at T-Mobile are HSPA+.

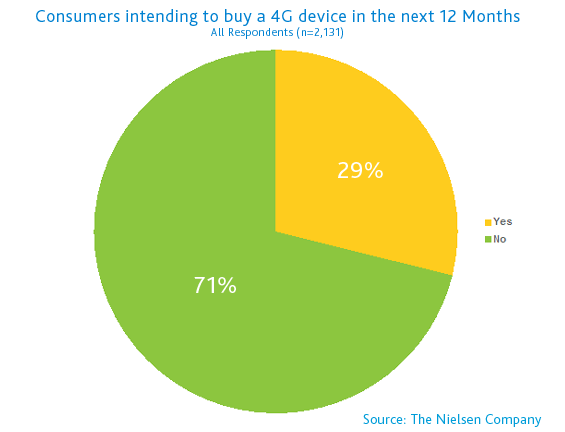

Despite confusion about what constitutes 4G, almost 3 in 10 consumers surveyed said they were planning on buying a 4G device within the next 12 months. While there’s not yet data to suggest how many of those subscribers will actually purchase a 4G device in the next year, a new device is only a contract away.