Indonesia’s mobile phone penetration has surged in the past five years while the number of landlines is declining, according to new research by The Nielsen Company. In 2005, handphone ownership stood at 20 percent while landlines were in a quarter of Indonesian homes. Five years on, mobile ownership is up to 54 perecent while the number of landlines has dropped to 11 percent.

“The Indonesian telecommunications market is unique. While consumers in most countries progress from ‘no connections’ to adopting landlines and subsequently cellular or mobile devices, consumers in Indonesia have mostly headed straight to mobile phones as their communication tool. This is a key reason why landlines or fixed lines have never really taken off in the country, with penetration remaining relatively flat over the years,” said Viraj Juthani, Director Telecom Practice Group, The Nielsen Company, Indonesia.

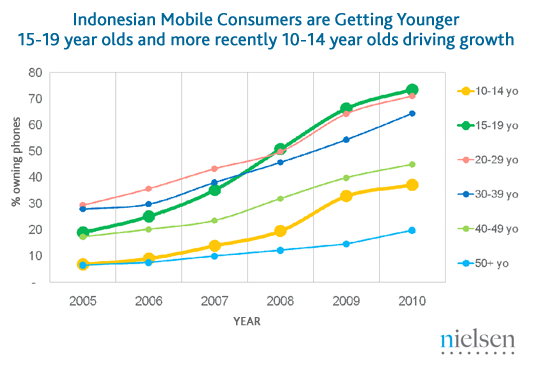

Much of this growth is being driven by teens, with more than 70 perecent having a mobile phone connection, while the number of tweens aged 10-14 having mobile phones increased more than five times during the five year period. Instant messaging or chatting is the top use of the phones for today’s young Indonesians, who prefer this use of the devices over voice calls or texting.

What’s more, Indonesian mobile subscribers are spending less now than they were five years ago, with 58 perecent of consumers spending less than Rp. 50,000 (@USD 5) per month in 2010 compared to only 18 perecent in 2005.

“The decline in average monthly spending is driven by two factors: Tariffs over the last few years have headed south and, more importantly, new consumer segments with limited spending capacity are entering the market,” said Viraj.

Low rates remain the top factor for consumers when selecting a service provider, but most consider the reputation of networks and recommendations of friends and family, indicating that while dropping tariffs are starting to drive operator choice, consumers continue to be concerned about service quality when making their choice.