While the state of the U.S. economy remains a hotly debated topic, the automotive sector may be well on its way to a road to recovery, according to Nielsen’s most recent Insight Into Action Series study. In fact, the auto industry is poised to sell some 15 million new vehicles in 2012—a sales number the industry hasn’t hit since 2007.

The unanticipated market growth has even made it challenging for some auto manufacturers to keep up with consumer demand. What’s more, the sector’s resurgence has sparked a fight for market share, leading to increased advertising. Spot TV ad spend in the auto industry increased 26 percent from Q2 2011 to Q2 2012. The auto industry currently spends almost $6 billion per year on advertising, and targets nearly half that ($2.8 billion) on spot TV. Mix in a robust comeback, and local print, cable and spot TV could all see nice gains.

Factories, local dealerships and dealer associations have different ad spending habits, and they each “tier” their ad spending in unique ways. Factory ad spend is generally spread across magazine, spot TV and broadcast and cable. Dealer associations tend to stick to spot TV advertising. Interestingly, local dealers continue to spend about two-thirds of their media dollars in print and only use about a third of their ad budgets on spot TV.

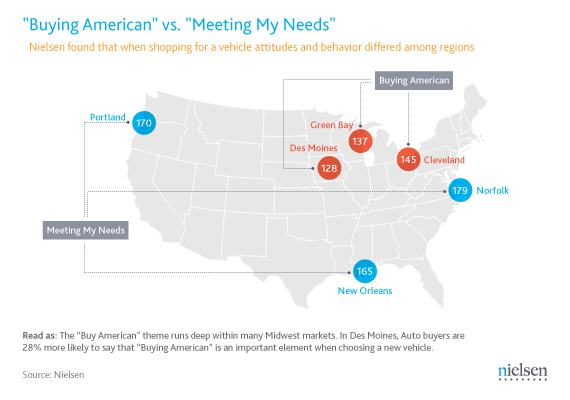

An American-made auto resurgence could also be in the works—especially in the Midwest, where buyers often prefer domestic vehicles. Cities like Des Moines, Iowa, Green Bay, Wis. and Cleveland each over index with respect to buying American. The luxury market is poised for potential gains, too, buoyed in part by the Hispanic consumer. In Seattle, for instance, over a quarter of auto buyers are looking at luxury are Hispanic, an important element when targeting this market.