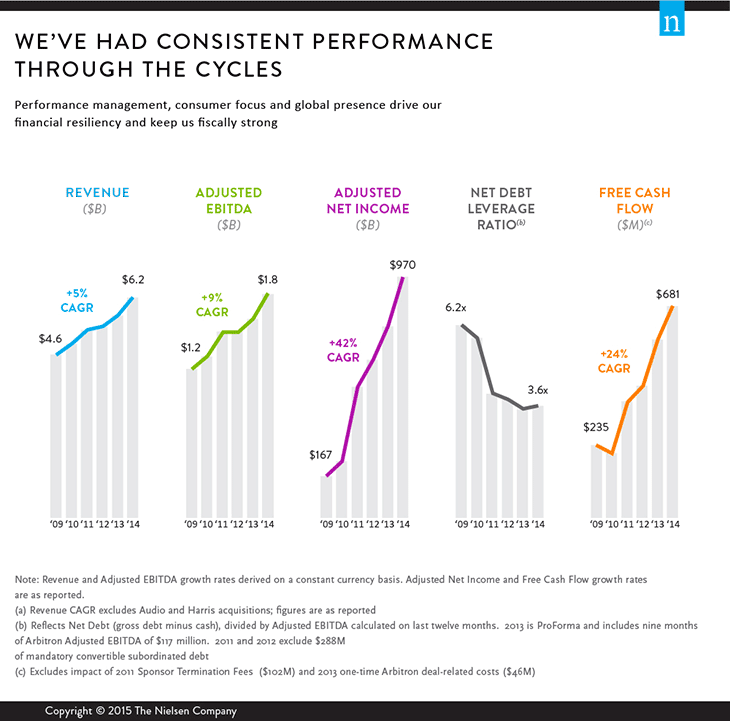

Performance management, consumer focus and global presence underlie Nielsen’s ability to deliver consistent performance through multi-year cycles. They also drive our financial resilience and keep us fiscally strong.

Nielsen continues to achieve steady, single-digit revenue growth. An EBITDA-to-debt-leverage ratio that is normally in the range of 1.5x or more relative to revenue, strong adjusted net income growth and a 42% compound annual growth rate (CAGR) since 2009 (which reflects our ongoing deleveraging efforts) have all yielded strong free cash flow growth, with 24% CAGR over this time period.

“Our business model is incredibly compelling,” said Jamere Jackson, Nielsen’s Chief Financial Officer. “Our teams are executing and delivering outstanding financial results. We’re delivering consistent, steady mid-single digit revenue growth that has been remarkably resilient through the cycles. We have 35 consecutive quarters of constant currency revenue growth, and we’re investing in key growth opportunities around the world.”

In addition, approximately 70% of the company’s revenues are committed under long-term contracts, providing a strong foundation for our solid revenue model.