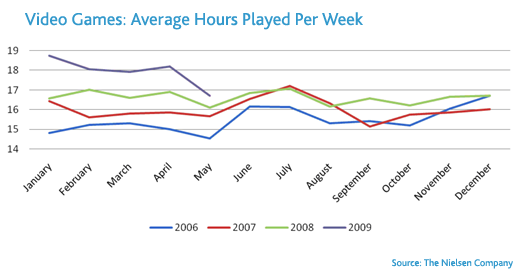

How have gamers responded to the recession? While much of the conversation has focused on fluctuations in new game sales, a new study “The Value Gamer: Play and Purchase Behavior in a Recession” by the Nielsen Company shows there is much more to the story. Over the past several months, the number of hours that gamers claim to be playing is at an all time high, part of a rising trend in gameplay that began in 2007. Additionally, gamers have increased their purchase of used games to record-breaking totals since the Video Game Tracking survey began asking about this in 2006. The same is true for subscriptions to video game rental services by mail. Taken together, these trends point to gamers’ continued engagement with the category even as their budgets have come under pressure. Overall, the recession has not abated the trend of increasing gameplay and may have in fact accelerated it as gamers look to get more value out of the games they own.

“Primarily, we believe mainstream gamers are playing more of the broadly appealing games (i.e Wii Fit, Guitar Hero and Rock Band) pushing their hours of gameplay up,” said Michael Flamberg, director of client consulting, Nielsen Games. “The social aspects of these games have engaged them. We don’t believe hardcore gamers are driving up the usage averages we’ve observed. Second, gamers may be looking to stretch their entertainment dollar further through playing games they own more. The importance of value for them is evident in the findings on used game purchase.”

In terms of why new game sales have been soft, Nielsen offers three contributing factors that explain this:

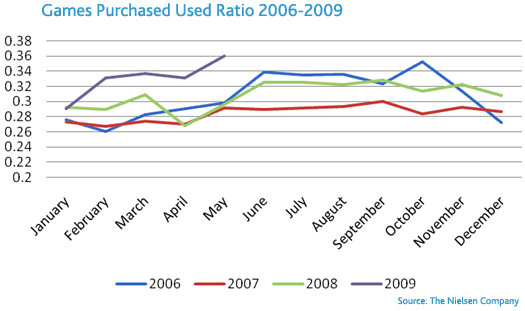

- Used game purchasing is at all-time highs in 2009, looking back since 2006. Claims about how many used games are being purchased in absolute terms and as a share of the total (used vs. new) have increased substantially (see graph). This is corroborated by GameStop’s record-breaking first quarter financial results, on the strength of used game sales. Best Buy recently announced it was getting into the used game market as well and Wal-Mart is testing this out.

- There has been an uptick in claimed subscriptions to video game rental services by mail, to all-time highs since 2006 (14% of gamers in May). This is a plausible substitute for new game purchasing.

- New game sales have been soft compared to last year in part because of unfavorable title comparisons in terms of how popular the releases have been this spring vs. last spring. This is a hit driven business and there haven’t been as many hits. Awareness of new titles, when prompted with their names, has dipped in 2009 to lows not seen since 2007.

For more, download The Value Gamer: Play and Purchase Behavior in a Recession and read the coverage in the Los Angeles Times.

A gamer is defined as claiming to have purchased a title in the past 6 months and played for at least 1 hour per week on any of the current consoles or the PC.