Melissa Panganiban, Associate Director – Consumer Research, The Nielsen Company

First launched in Japan in 2001, the speed of Third Generation (“3G”) networks have changed the way consumers use mobile phones, extending them beyond calls and simple text messages to mobile video viewing, Internet browsing and other data-intensive functions not previously available on older, slower networks. 3G rolled out across Vietnam in 2009, and The Nielsen Company used the anniversary of its launch as a check point to survey consumers’ attitudes and assess market awareness of the technology as well as examine the challenges facing mobile service providers in attracting customers to their networks.

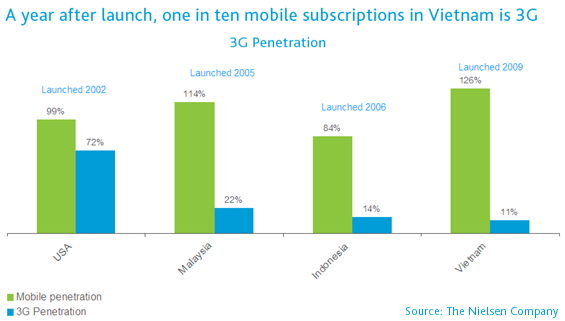

Six months after 3G launched, just under half (48%) of Vietnamese mobile users were aware of it, and only 3 percent subscribed. The latter number has risen to 11 percent one year on, a result on par with other markets.

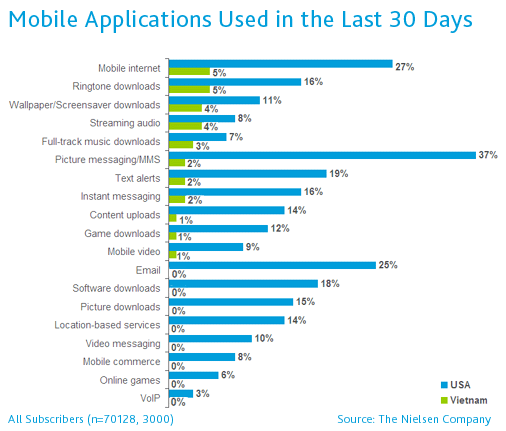

Given the strong overall penetration of mobile phones in Vietnam, however, one might have expected a faster rate of adoption. It’s not that consumers don’t know what 3G can be used for: the vast majority of those surveyed knew that 3G phones were capable of mobile TV viewing, video calling and browsing the Internet. But a glance at what consumers are currently using their mobile phones for now might provide some insight as to why functions like those are not yet more popular.

The user of the mobile Internet in Vietnam still falls into the category of “early adopter,” and to get beyond this initial group, service providers can focus on several key areas to expand usage of their networks:

- Promote smartphones

- Price data packages creatively

- Cultivate the youth market

The Rise of Smartphones

Until 3G was widely available, there was little use for devices such as the BlackBerry or iPhone. The faster network enables the devices to show off their many functions. In the U.S., the smartphone has steadily taken off, with just 18% market penetration in early 2009 to 25% one year later. In fact, Nielsen forecasts that smartphones will become the most popular device in the U.S. in 2011. The iPhone, BlackBerry and, increasingly, Android-based devices continue to surge in popularity as mobile providers offer free or low-priced handsets and attractive data plans. In conjunction with the rise of smartphones has come increased demand for their many features including e-mail, video and the all-popular “apps.” By contrast, smartphones currently make up a tiny proportion of the overall mobile market in Vietnam.

Marketers in the U.S. and Europe have realized that the devices’ form and function drive data adoption and consumption more than other factors. In other words, if the consumer has a device that features applications such as mobile video viewing or Internet browsing, he is likely to use them out.

The brand of handset to offer customers is up to the mobile service provider. Offering branded BlackBerry or iPhone devices are safe options, but the Android makes generic or operator-branded phones worth investigating.

The experiences of two neighboring countries can also offer lessons for Vietnam’s mobile providers. In Singapore, the two leading providers reported sharp increases in data traffic in 2009 and 2010, coinciding with promotions to boost adoption of the devices. All of the largest provider’s promotions in Q1 2010 were for smartphones, while 80% of the devices stocked for online customers of two other providers were smartphones. In Indonesia, two top mobile providers reported strong data use growth, coming at a time when BlackBerrys have gained a huge following among youth and students and the introduction of generic Chinese-made handsets featuring Android have brought the price of the devices below $200.

Innovate Pricing

The cost of data plans has been an issue in the U.S., where a leading carrier has sought to limit data use, while other plans have offered so-called all you can eat (AYCE) plans. In a developing country like Vietnam, cost will also play a factor in 3G adoption. “Data snacking,” or allowing consumers to access 3G data services for distinct periods of time for a set price, has been successful in a number of other countries where pre-paid services dominate, including in the U.K. and Malaysia. Free trials also allow consumers to test drive 3G functionality with little or no risk.

Again, the lessons learned in Singapore and Indonesia offer some insight as to how Vietnam’s mobile providers can attract more 3G subscribers. In the city-state, even smartphones such as the iPhone are offered free with data plans, making the cost of entry a non-issue. In Indonesia, monthly data rates as low as $11 make 3G service affordable to more people.

Marketing a 3G lifestyle: Cultivating the Young Generation

The real key to boosting 3G service in Vietnam is nurturing the young generation, who typically adopt new technology more quickly than their elders. In Vietnam, people under age 24 represent more than half (54%) of the population. Narrowing the scope of our investigation to people age 15-24 (who comprise 20% of the Vietnamese population), half (48%) are subscribed to mobile services. Initially given phones by their parents as a way to keep in touch, youth gain more control over usage and handset selection as they mature. They occasionally use their devices to make calls, but prefer to use them for texts/SMS. They are much higher than average data users, which would seem to make 3G networks and smartphones natural fits for them. But to date, the majority of young Vietnamese know very little about 3G and/or don’t see a need for it. By the time they are young adults, they have very definite preferences when it comes to how they use service and selecting devices.

Seizing the Opportunity

By taking a few relatively simple actions, mobile service providers and handset manufacturers can attract a greater number of young consumers to 3G:

- Get them: start by focusing on parents, who will buy kids their first mobile phones and develop and promote parent/child calling plans. Incentivize current customers to recruit friends to sign-up for service.

- Educate them: Advertise on channels popular with youth such as VTV3, HTV (HCM) and subscription channels including Disney, HBO, Star Movies, and on local websites Like Hi Hi He He, ZingMe, etc. Offer discount coupons with 3g information.

- Keep them: Younger mobile users will change handsets often – sometimes as much as once a year. Make sure they are buying your brand by staying atop of trends and pricing devices at the right point. If smartphones are too expensive for most, try marketing media phones which feature many of the same kinds of functions. Service providers should promote network quality. It’s not a key concern for teens, but young adults tend to stick with those networks they view as having good coverage and quality. Offer services of interest such as English tutorials via video (sure to appeal to parents!), Disney programming or the latest Korean soap operas – but make sure revenue comes from advertising, not subscribers.

- Sell to them: The young use multimedia but budget is a concern; try using advertising-driven models, such as sponsored text messages for service discounts. Be creative in pricing data plans; apart from standard monthly top-ups, try daily or weekly pricing plans. Or offer one time credits when they run out of minutes

Whether it is attracting more adults or the young generation, mobile telephone service providers have a number of tools at their disposal to accelerate adoption of 3G in Vietnam. Adults can clearly benefit from the features enabled by 3G, but converting the young generation to 3G will pay dividends in the long run. Once they have access to and become familiar with services such as mobile video viewing and Internet access, real-time instant messaging, they are more likely to adopt service upgrades and enhancements in the future.