Nic Covey, Director, Cross Platform Insights, The Nielsen Company

Will consumers pay for online news and entertainment they now get for free?

Nielsen asked more than 27,000 consumers across 52 countries, and the answer is a definite “maybe.” As expected, the vast majority (85%) prefer that free content remain free. Yet there are opportunities to be found in the details. Indeed, when asked to focus on specific types of content, survey participants are more willing to at least consider paying for particular categories, especially if they have done so before.

Will Pay / Won’t Pay

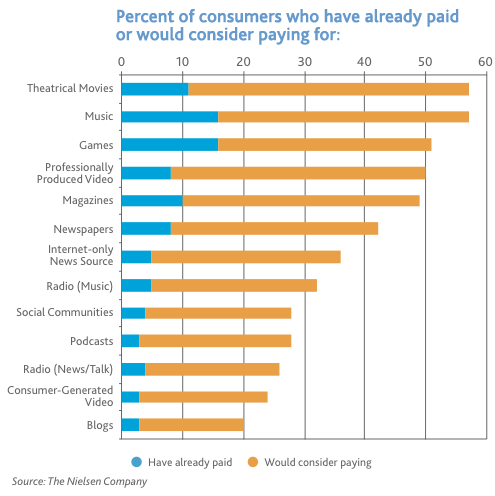

Online content for which consumers are most likely to pay—or have already paid—are those they normally pay for offline, including theatrical movies, music, games and select videos such as current television shows. These tend to be professionally produced at comparatively high costs.

Consumers are least likely to pay for content that is essentially homegrown online, often by other consumers at fairly low cost. These include social communities, podcasts, consumer-generated videos and blogs.

In between are an array of news formats—newspapers, magazines, Internet-only news sources and radio news and talk shows—created by professionals, relatively expensive to produce and, in the case of newspapers and magazines, commonly sold offline. Yet much of their content has basically become a commodity, readily available elsewhere for free.

Compensation Conditions

Whatever their preferences, consumers worldwide generally agree that online content will have to meet certain criteria before they shell out money to access it:

- Better than three out of every four survey participants (78%) believe if they already subscribe to a newspaper, magazine, radio or television service they should be able to use its online content for free.

- At the same time, 71% of global consumers say online content of any kind will have to be considerably better than what is currently free before they will pay for it.

- Nearly eight out of every ten (79%) would no longer use a web site that charges them, presuming they can find the same information at no cost.

- As a group, they are ambivalent about whether the quality of online content would suffer if companies could not charge for it—34% think so while 30% do not; and the remaining 36% have no firm opinion.

- But they are far more united (62%) in their conviction that once they purchase content, it should be theirs to copy or share with whomever they want.

Despite the growing consensus that the media may only be able to generate appreciable online revenues by charging consumers for content, there is little agreement on just how to do that. Companies are experimenting with a range of payment models, from full service subscriptions to individual transactions, or micropayments. Among those surveyed by Nielsen, about half (52%) favor the latter, albeit micropayments have proved cumbersome to implement in the past. But a more manageable system may be no more enticing. Only 43% say an easy payment method would make them more likely to buy content online.

Regardless of what systems they choose, media companies will almost certainly not abandon advertising; and consumers will doubtless still see ads along with paid content. For the 47% of respondents who are willing to accept more advertising to subsidize free content, that may be tolerable. Yet it will probably not sit well with the 64% who believe that if they must pay for content online, there should be no ads.

Find Out More

- How do responses from consumers around the world compare?

- Are developing markets more likely to embrace a pay-for model?

- Does age factor into a willingness to pay?

- Which payment methods are the most acceptable?

- Where are the best advertising opportunities?