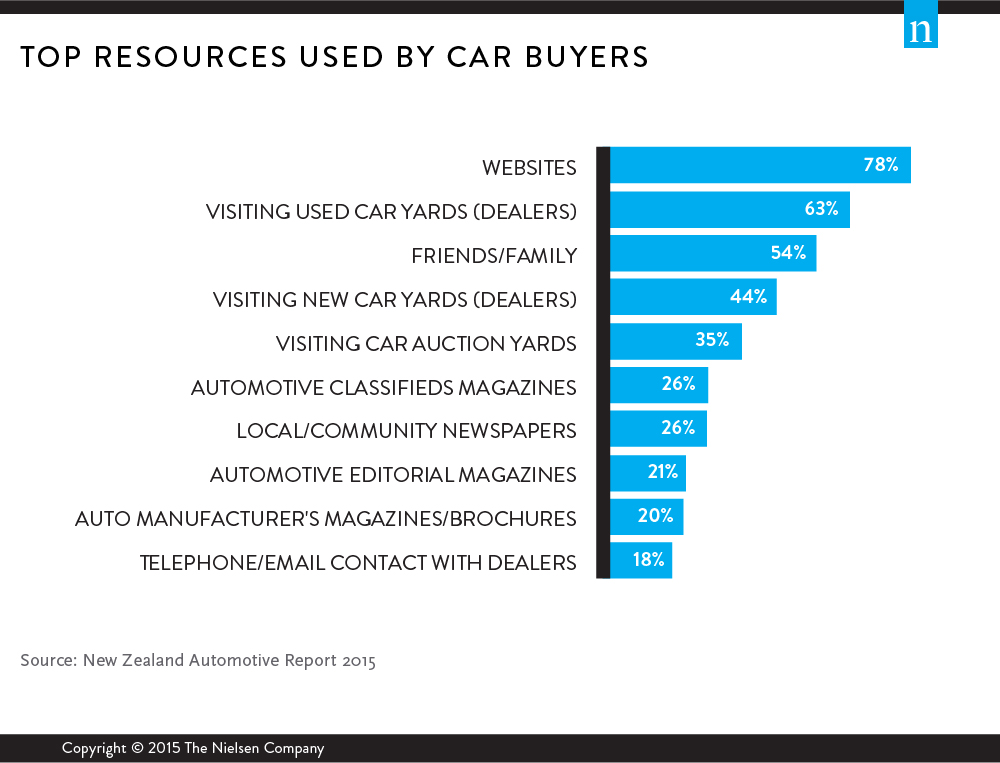

Three-quarters of a million New Zealanders plan to buy a car over the next year and most (78%) of them are reaching for their keyboards to help them make a purchase decision.

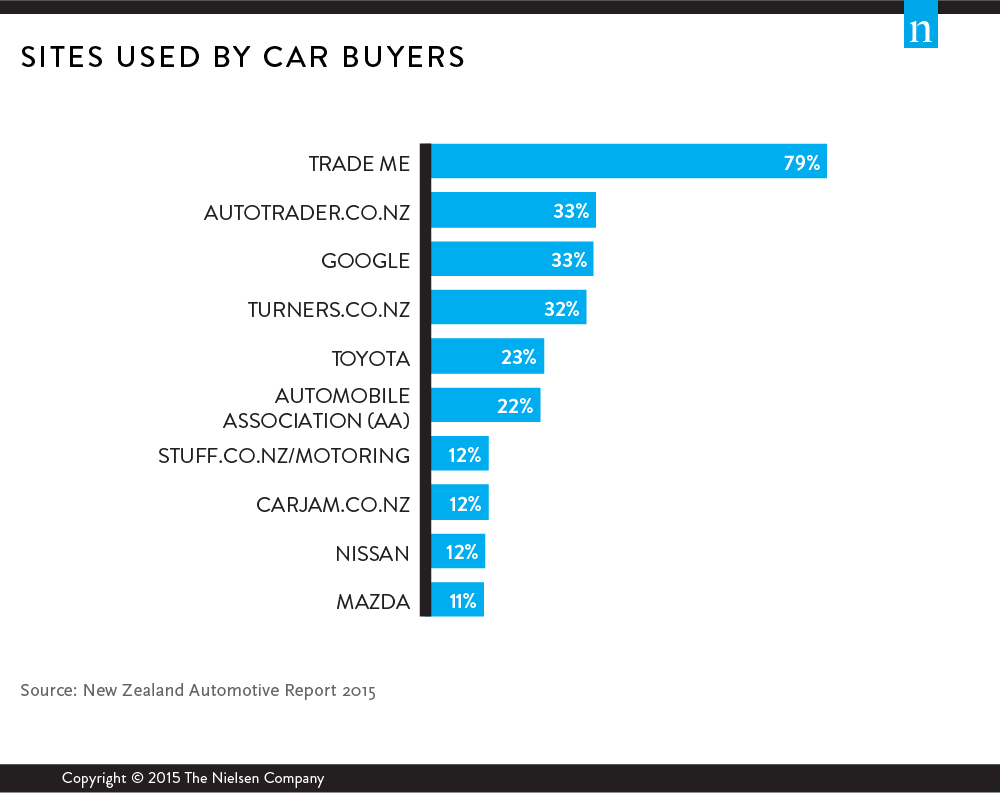

Trade Me is the most used website by prospective buyers with the site attracting 79% of all online vehicle researchers. Its use is more than double that of their nearest competitors – Autotrader (33%), Google (33%) and Turners (32%). Toyota is the highest ranked of the car manufacturer websites with nearly a quarter (23%) of buyers having used their site. The AA (22%), stuff.co.nz/motoring (12%), carjam.co.nz (12%) Nissan (12%) and Mazda (11%) round out the top 10 websites used by online car researchers.

Although digital media is the primary resource used, many others are still used in the process of buying and selling a car. An average buyer uses 4.6 resources in their decision making. Of those in the market to buy a car, over half visit used car dealers (63%), many talk to family and friends (54%) and others visit new car yards (44%) and auction houses (35%). A quarter use classified magazines and local newspapers (both 26%) and around a fifth use automotive magazines (21%), auto manufacturers magazines or brochures (20%) and email or call dealers (18%).

Even with the strong visitation to automotive sites, there is still potential for further growth by improving the amount of content provided. Users of online auto sites are after easier ways to compare vehicles – including specific features, performance and pricing information. They would also like to see condition reports including independent checks from AA and service history.

Although it is important to have an online presence for selling cars, buyers make use of a variety of resources during the path to purchase. For advertisers, this means integrating their campaign messages and making the most of the variety of channels and media available to them to ensure a smooth path to purchase for their customers.

ABOUT THE NIELSEN NEW ZEALAND AUTOMOTIVE REPORT

With rapid technological innovation, consumers – and car culture – are transforming. From initial interest to final purchase, understand how New Zealanders choose the make and model as well as the sources they go to to make decisions when buying a vehicle.

Effectively plan your strategy and leverage new commercial opportunities with actionable insights on the auto industry, the report includes:

- Manufacturer brand rankings by consideration and purchase

- Market size (people who purchase new or used cars)

- Price range, brand and type of vehicles purchased

- Most important factors about vehicles when purchasing

- The consumer’s preferred media and path to purchase

- Websites and online tools consumers use when purchasing