Among many things, the arrival of this year’s World Cup validated the immense draw of live sports on traditional TV. While the appeal of live sports is widely known, this year’s U.S. viewership illustrates that the allure is strong enough to entice many Americans to put their lives on hold to watch the action.

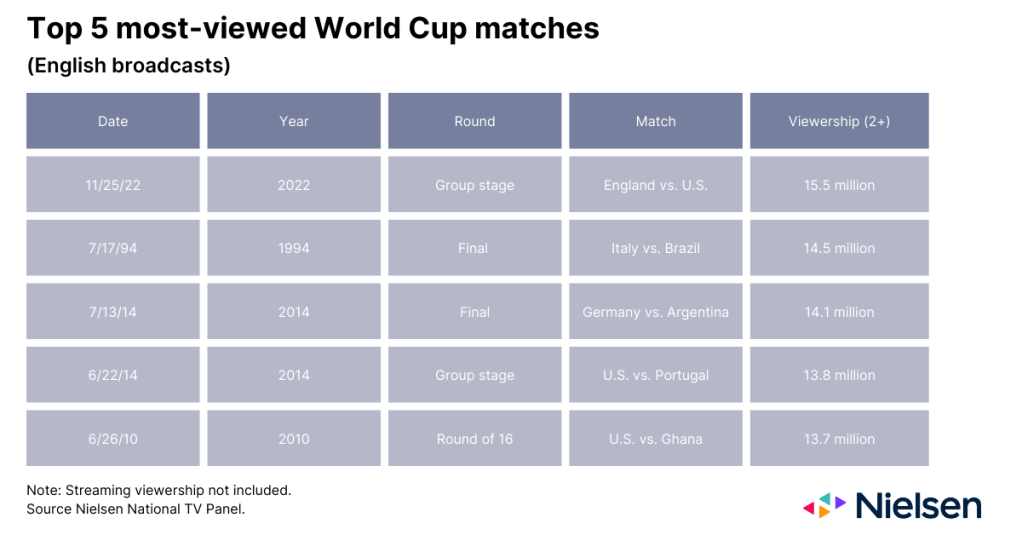

Compared with most live sports in the U.S., which air outside of traditional work and school hours, the majority of the World Cup games were held at times when many Americans would be otherwise indisposed. That fact notwithstanding, this year’s World Cup matches, especially those involving the U.S. team, attracted massive TV audiences in the U.S. In fact, three of the matches the U.S. team competed in this year are in the top 10 most-watched English broadcast World Cup matches in the U.S. dating back to 1994. And this year’s U.S.-England match boasted a U.S. audience of almost 15.5 million to the English telecast—the highest U.S. viewership of any men’s World Cup game to date.

For context, consider the viewership associated with new fall TV programming—the primary driver of the annual advertising upfronts. This year, the four primary English broadcast networks1 attracted an average of 3.9 million viewers for primetime programming airing in the first month of the new fall TV season2. The audience grows to 5.5 million when we factor in time-shifted viewing over one week, but the aggregate viewership still pales in comparison to that of the World Cup matches featuring the U.S. Those four matches engaged an average of 12.2 million viewers across English telecasts.

The viewership of this year’s tournament is perhaps more notable when Nielsen Fan Insights indicates that just 28% of U.S. respondents are interested in soccer. Overall, Americans remain most interested in the NFL, the Olympics, the NBA and MLB.

The appeal and interest in this year’s tournament has also withstood some intense competition. From an audience perspective, fall is when linear TV programming gets a boost, and this year was no exception, as sports viewing increased 222% in September as the new American football season kicked off. In October, sports viewing volume increased another 19%, just ahead of the start of the year’s World Cup, which is typically held in the summer.

By the time the tournament started, the matches that were broadcast on traditional cable began challenging other sports events for slots in Nielsen’s weekly top 10 listings. And over Thanksgiving weekend, possibly the biggest sports viewing period of the fall, survey respondents claimed the World Cup was their third choice for sports viewing, coming in behind NFL and college football. Yet perhaps more noteworthy is that the two matches listed in the top 10 cable listing for the week of Nov. 21-27, 2022, didn’t feature the U.S. men’s team:

- 4.1 million tuned in for the Argentina-Mexico match

- 3.6 million tuned in for the Spain-Germany match

Given the 90-minute matches, tuning in—especially midday—is a commitment. Most Americans acknowledge the need to balance their interest in the games with other aspects of their daily lives. While the majority of fans are keeping track of the action by watching highlights on TV, many are following on social media and hearing from others via word of mouth, including texting. And with 47% texting and 43%3 scrolling on social media, big moments in individual matches have attracted audiences who might not have already been tuned in.

Take the Group State match between Brazil and Serbia for example. Nielsen Gracenote had given Serbia a 32% chance of advancing, possibly limiting audience engagement for the Thanksgiving Day matchup with tournament-favorite Brazil. But when Brazil’s Richarlison de Andrade, known mononymously as Richarlison, made a dynamic scissor kick goal just before the 73-minute mark, viewership jumped 7% during the five minutes following the goal.

Given the wide appeal of live sports, sponsorship activations remain a key way that brands can engage with new and existing fans. And while long-term success will hinge on bridging the gap between awareness and conversion, sponsorship activations in the sports industry have risen in their ability to convert fans.

For example, our 2022 annual sports report noted that during the pandemic, when we controlled for the impact of changing levels of brand awareness and sponsorship maturity, levels of purchase intent among exposed fans were higher than levels of brand familiarity. In addition, a recent Nielsen analysis of 100 sponsorships between 2020 and 2021 in seven markets across 20 industries found that the sponsorships drove an average 10% lift in purchase intent among the exposed fanbase.

During this year’s World Cup, nearly two-thirds of those who watched or intended to watch live World Cup matches in our World Cup Viewing Habits Survey said they recalled the ads they saw during the matches they watched. And not surprisingly, food, snack and alcoholic beverage brands benefited the most, gaining the best recall among audiences.

The World Cup, like the Olympics, presents a unique opportunity for brands and agencies to attract audiences who might not otherwise be inspired to watch. With an average 4.7 million4 people watching the 2022 men’s World Cup live on cable and broadcast—higher than the average primetime programming we saw this year—advertisers would be wise to consider global tentpole sporting events in their marketing mix.

From a soccer perspective, they won’t have long to wait to score a golden goal, as the 2023 FIFA Women’s World Cup is just around the corner. The opportunity therein speaks for itself; the 2015 final between the U.S. and Japan was the most watched World Cup match (men and women) of all time.

Notes

- ABC, CBS, NBC, FOX

- Sept. 20-Oct. 17, 2022

- Nielsen World Cup Viewing Habits Survey, Nov. 27-Dec. 1, 2022

- Nielsen National TV Panel