Disney Achieves Largest Monthly Share Increase, Followed by FOX and Paramount, with Each Clocking 7% Monthly Growth

NFL Games, MLB Postseason and Revitalized Broadcast Schedule Boost Disney, FOX, Paramount and Warner Bros. Discovery in Nielsen’s Media Distributor Gauge

Hallmark Watch-Time Jumps 11% vs. September as Movie Viewing Builds

NEW YORK – November 24, 2025 – The October television landscape was energized by the convergence of fall sports and the traction of a new broadcast season, according to Nielsen’s Media Distributor Gauge. Coverage of NFL and college football, alongside the MLB Postseason and a revitalized broadcast schedule, fueled substantial gains for traditional media powerhouses and a reshuffling of the media distributor rankings.

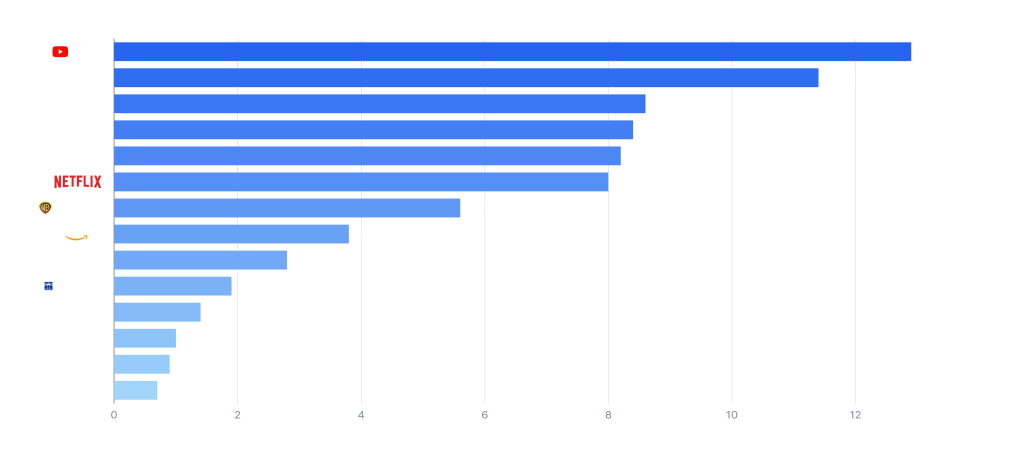

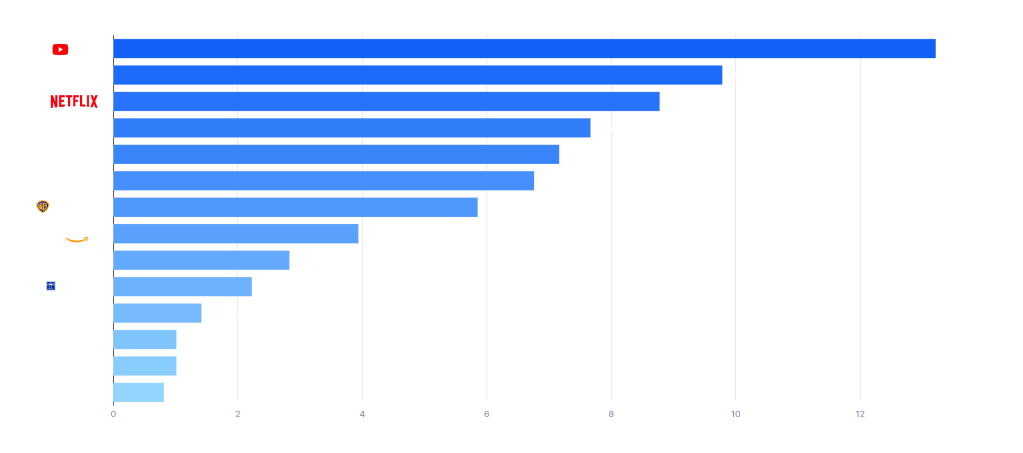

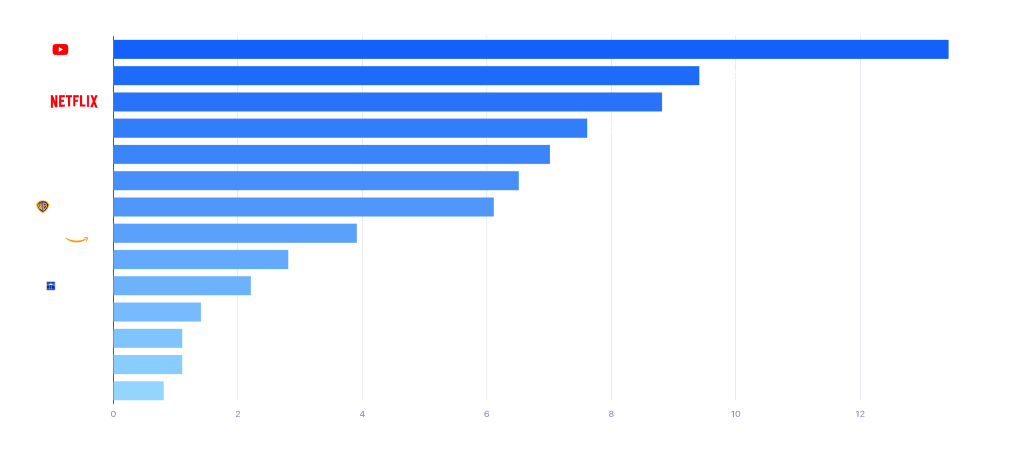

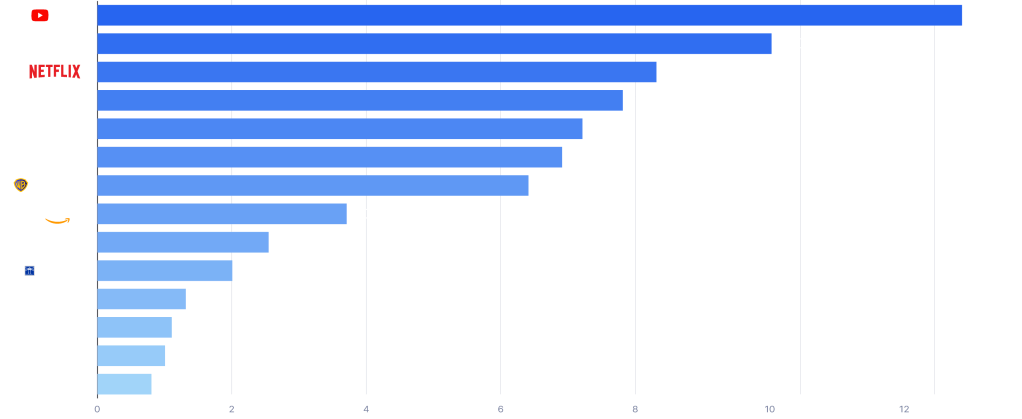

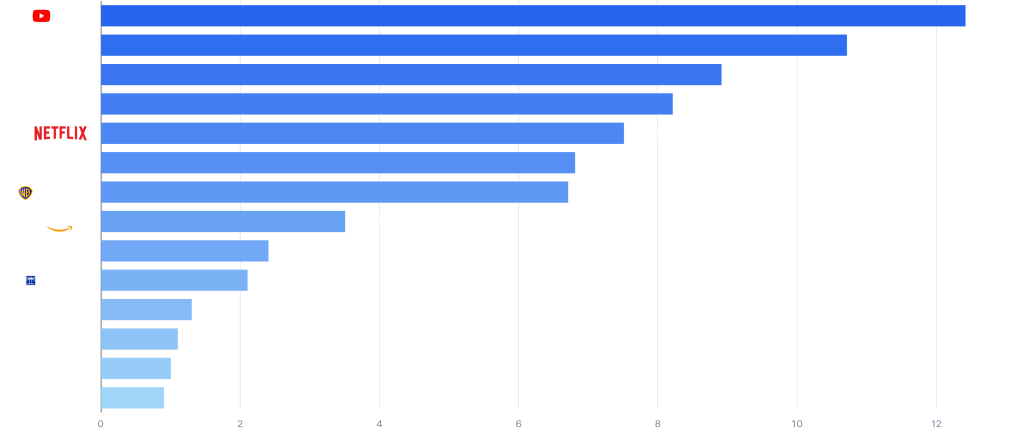

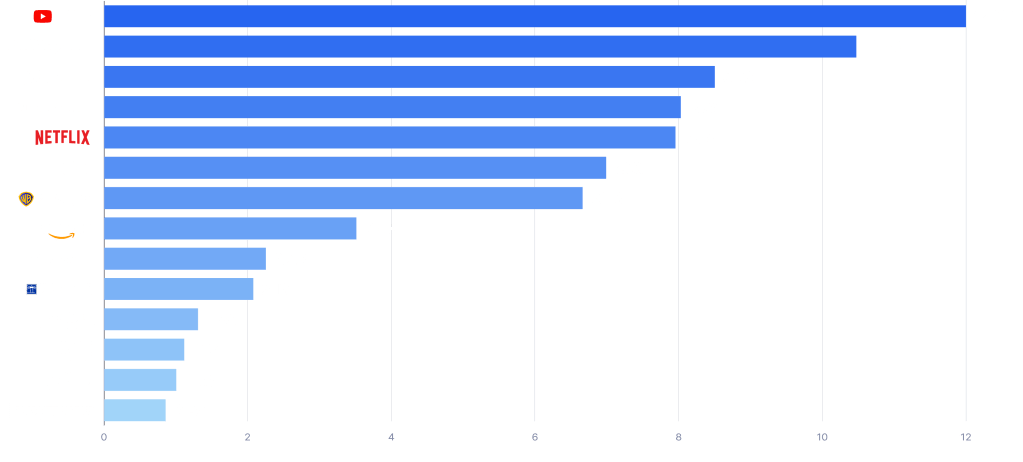

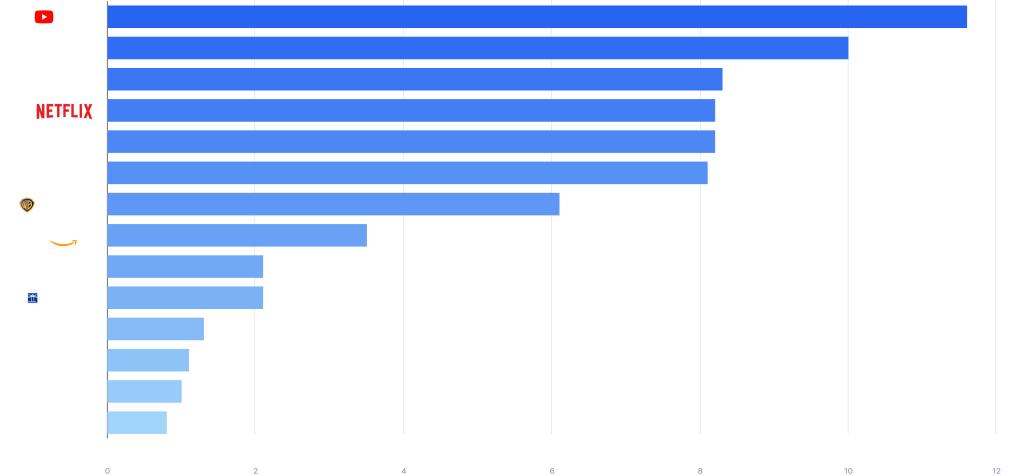

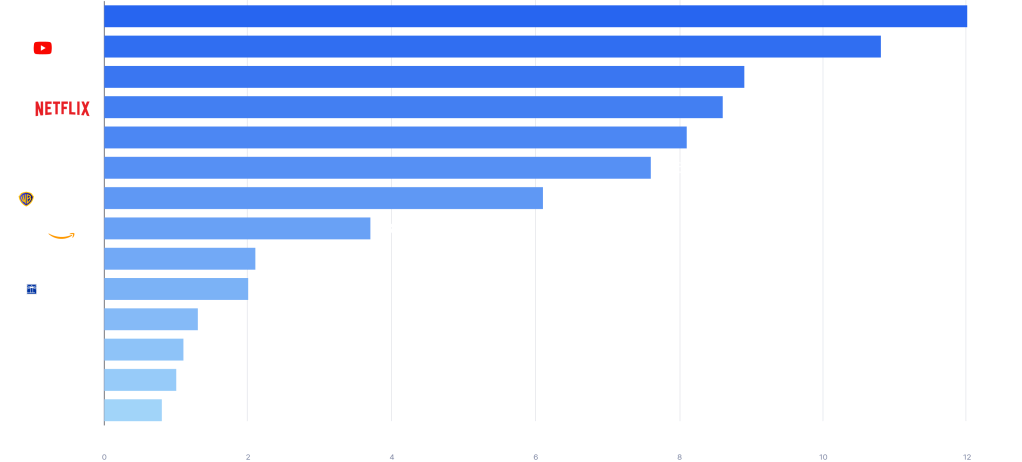

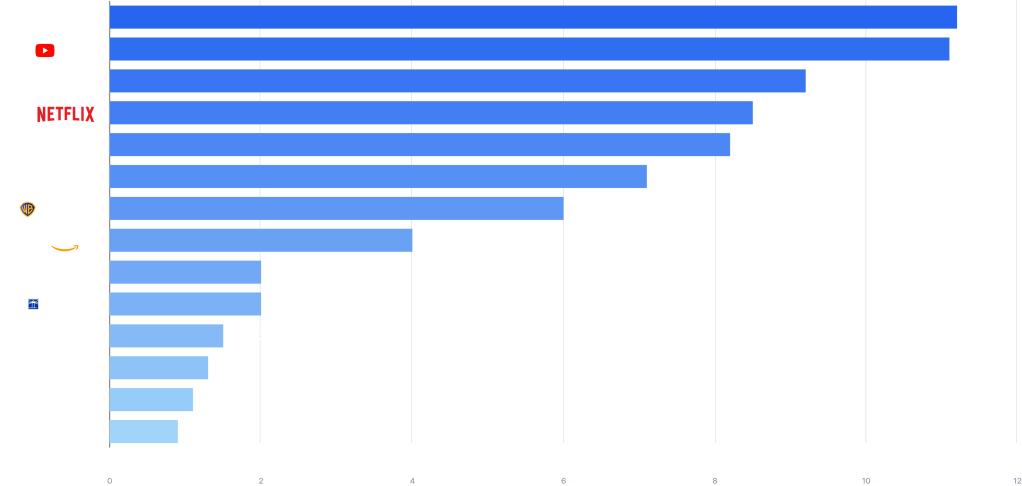

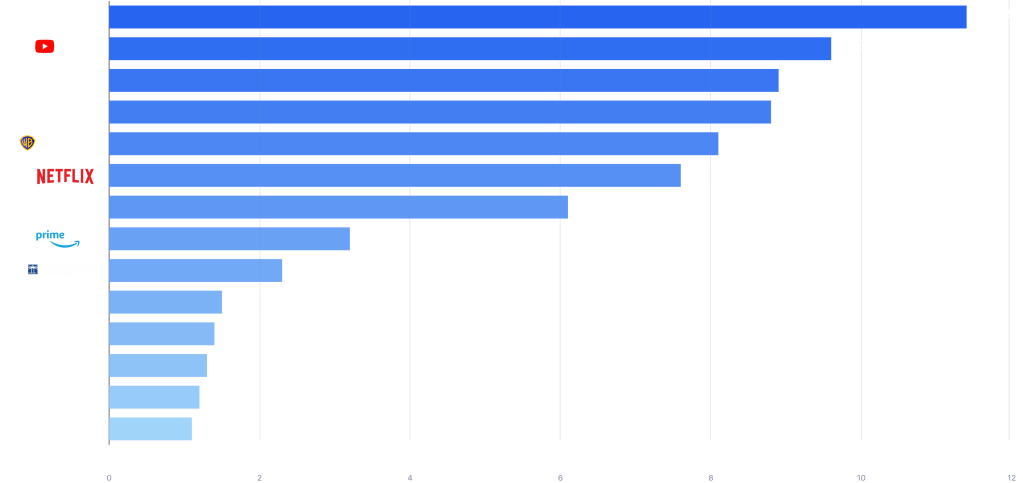

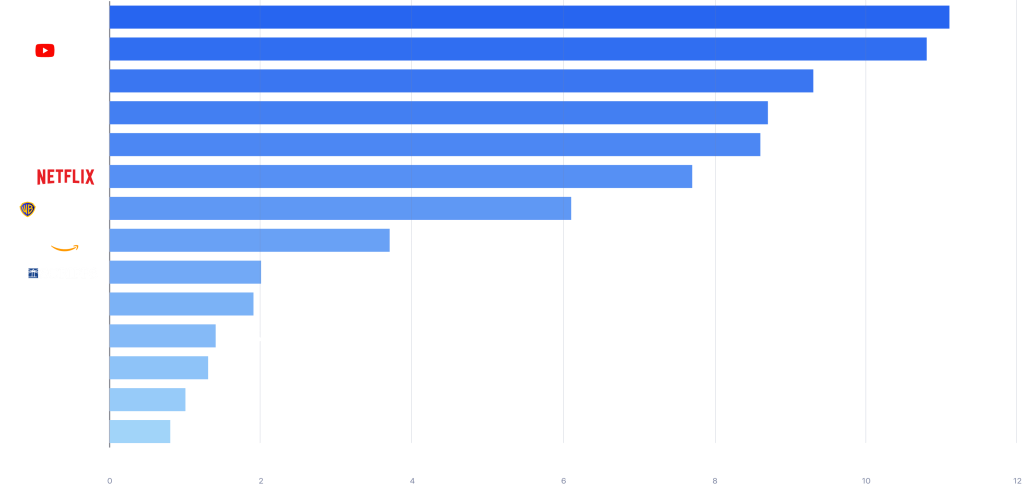

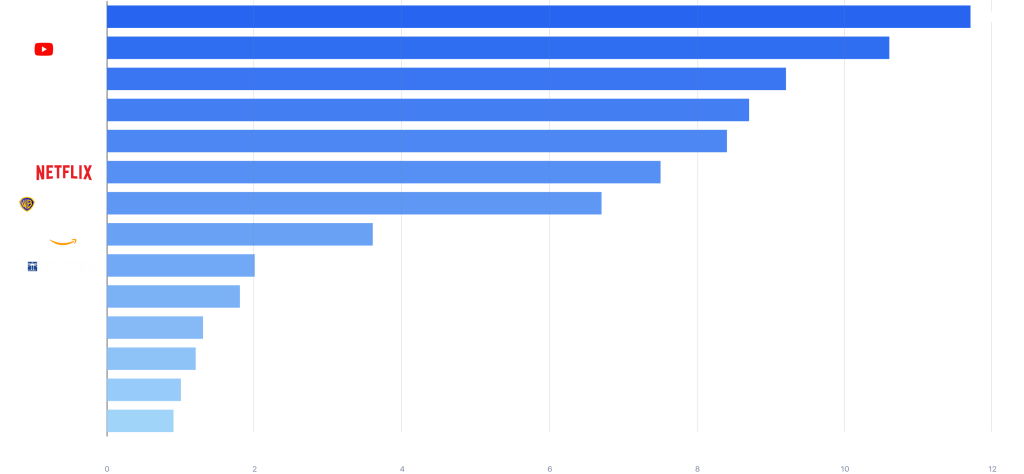

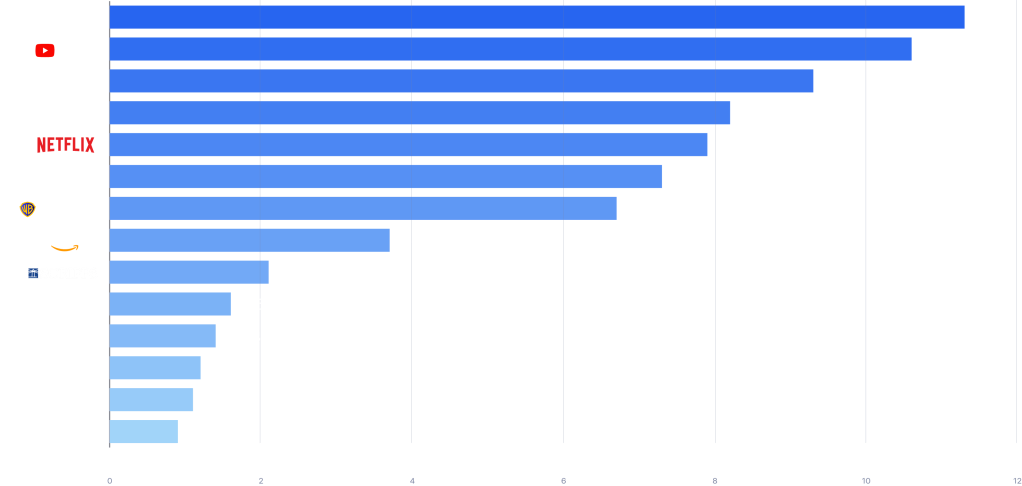

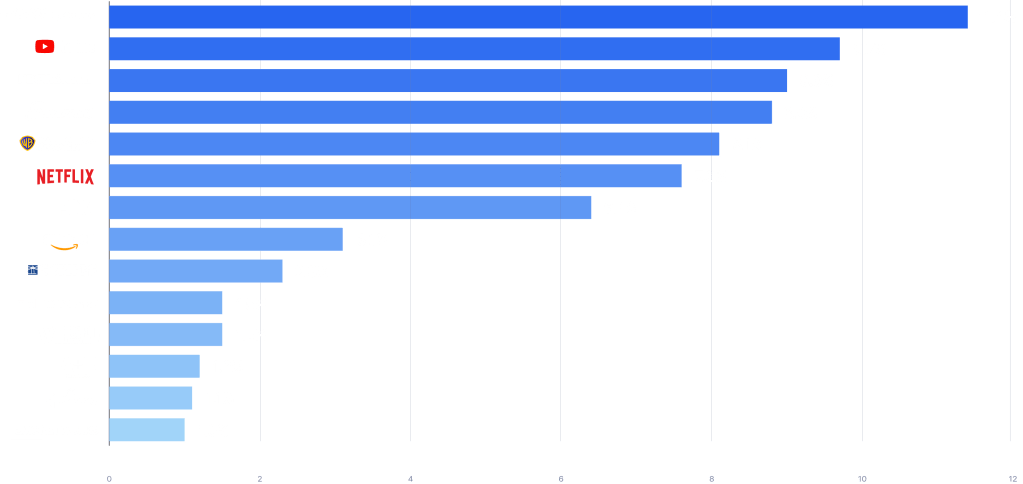

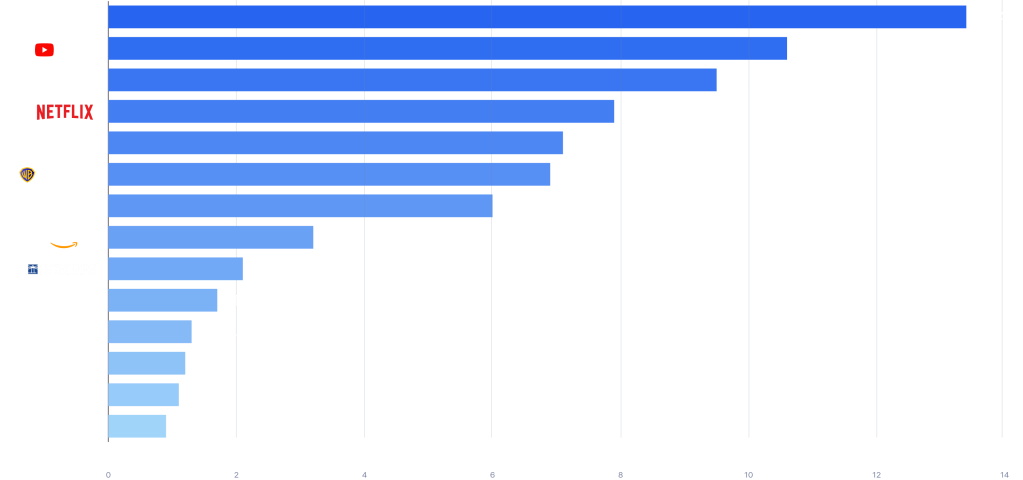

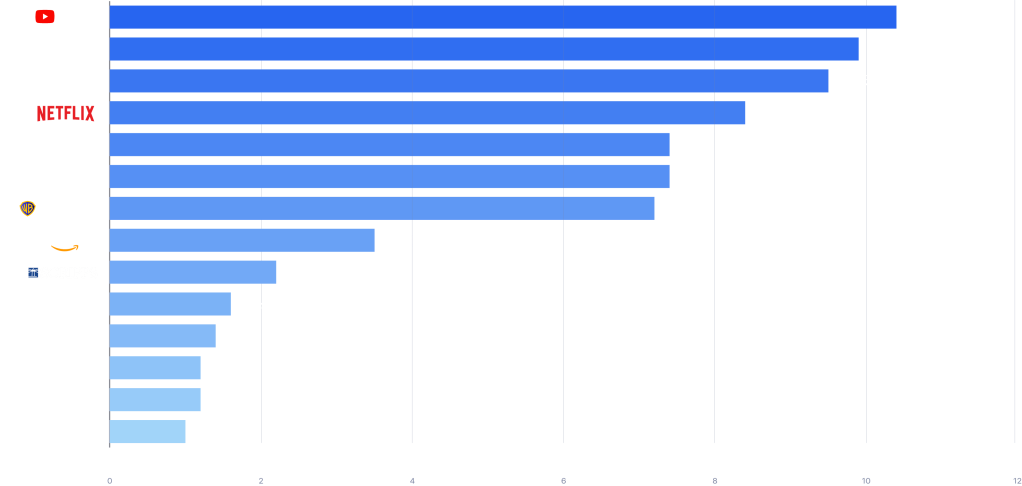

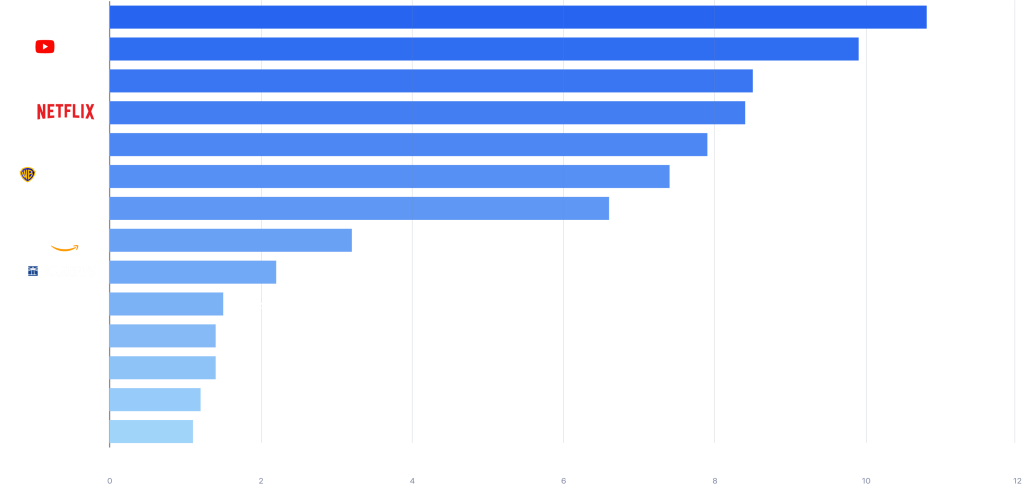

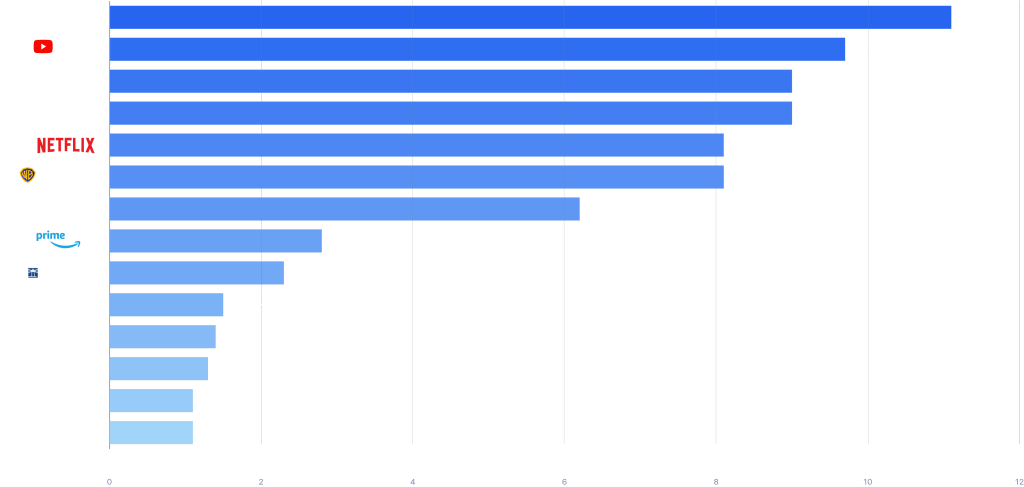

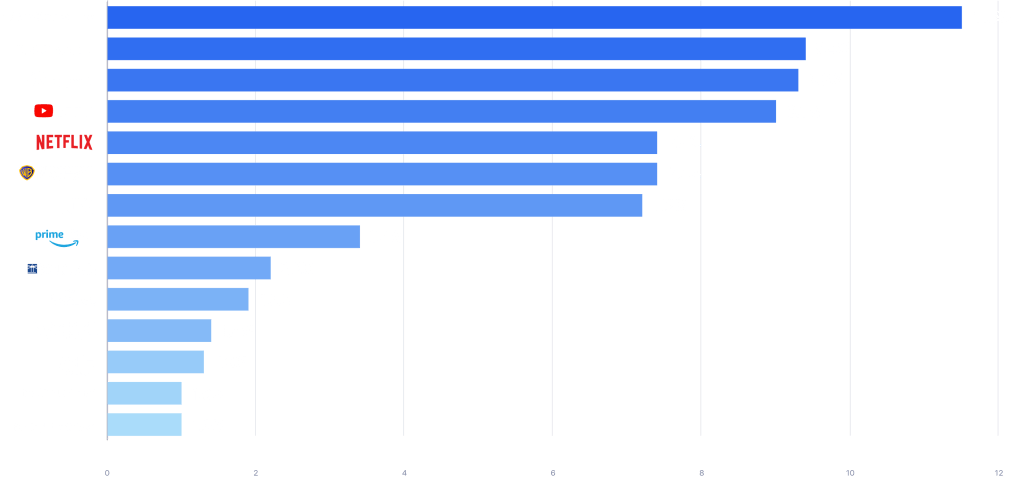

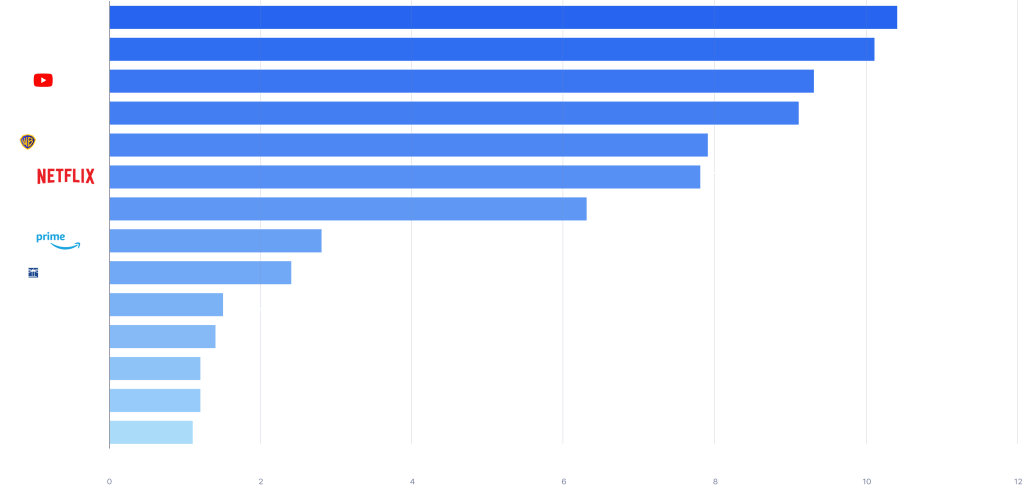

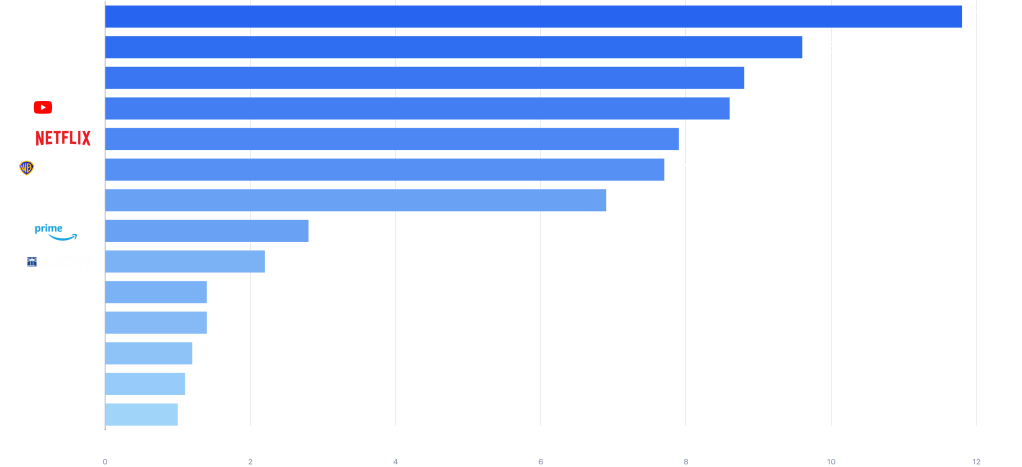

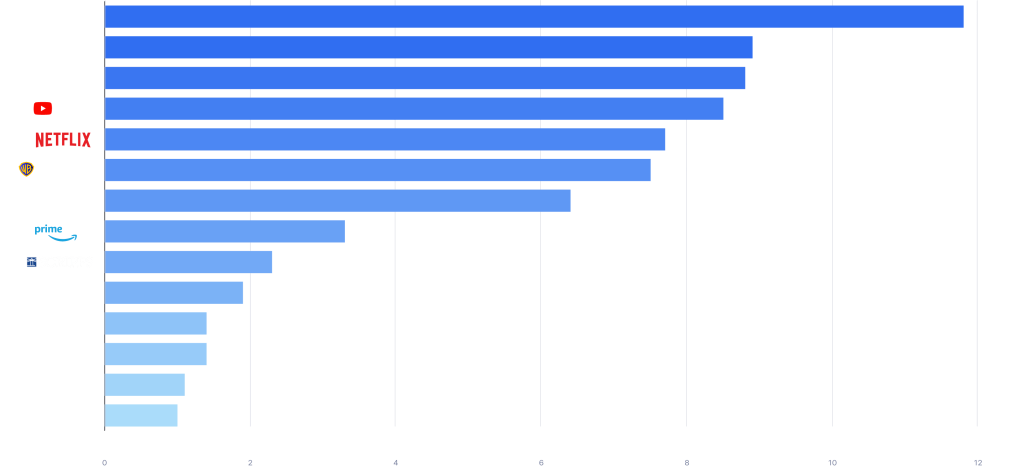

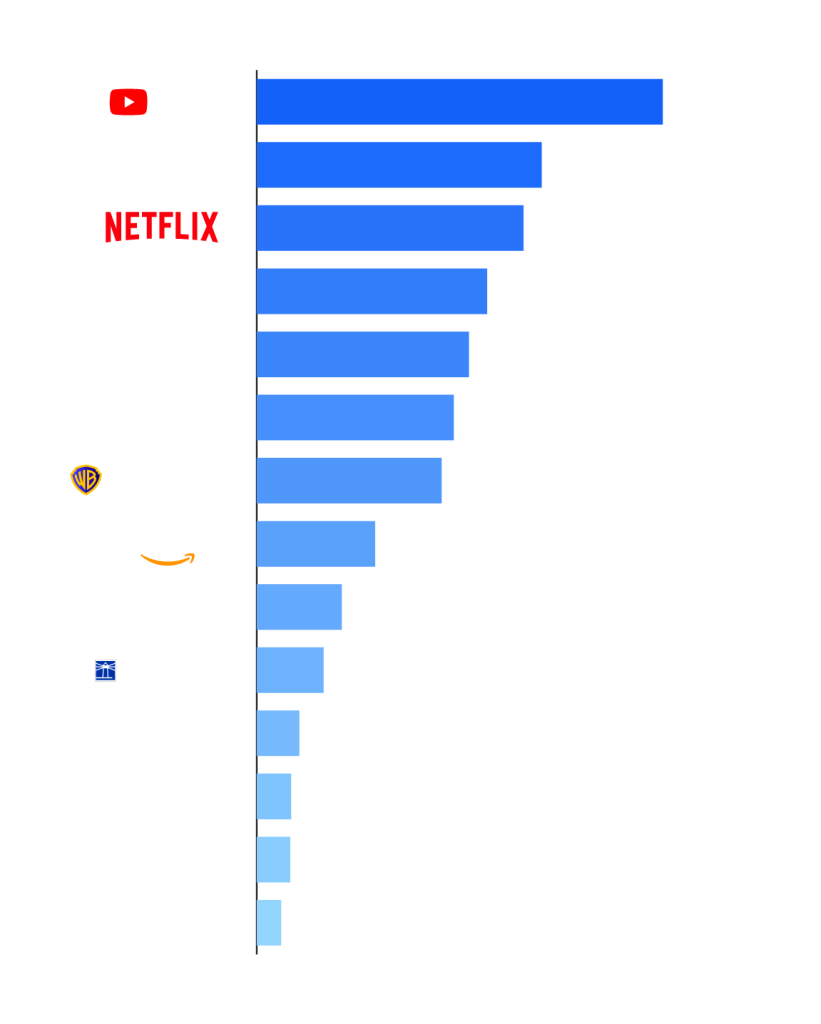

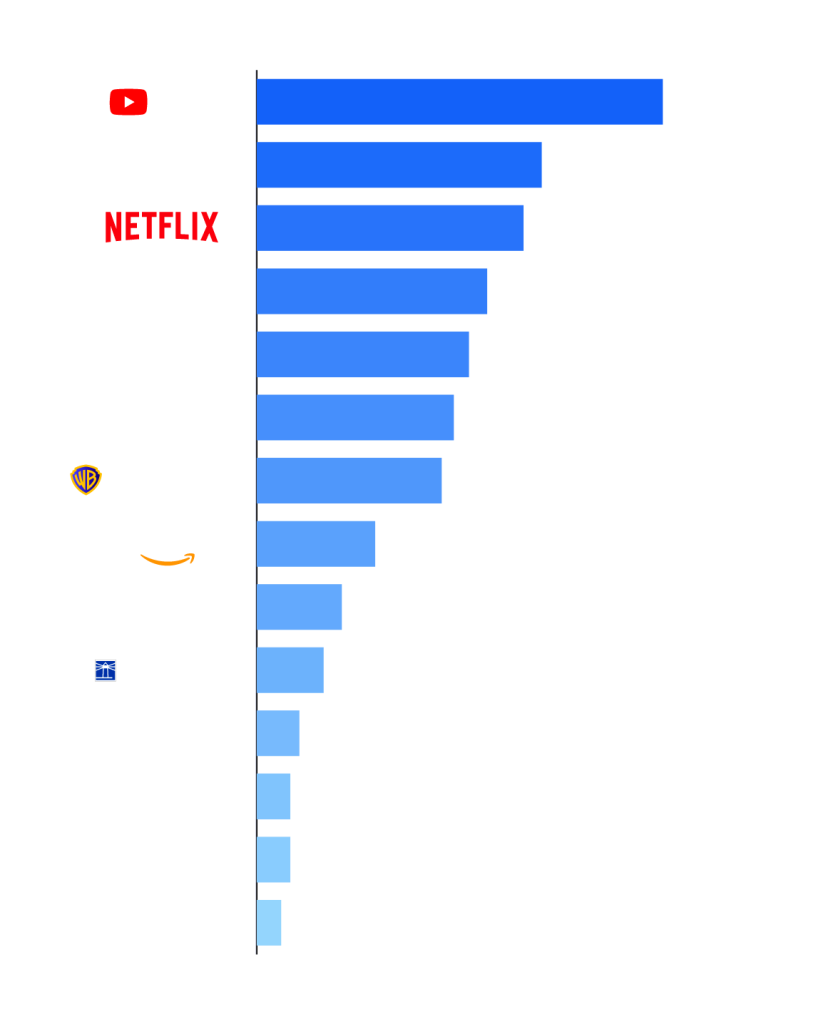

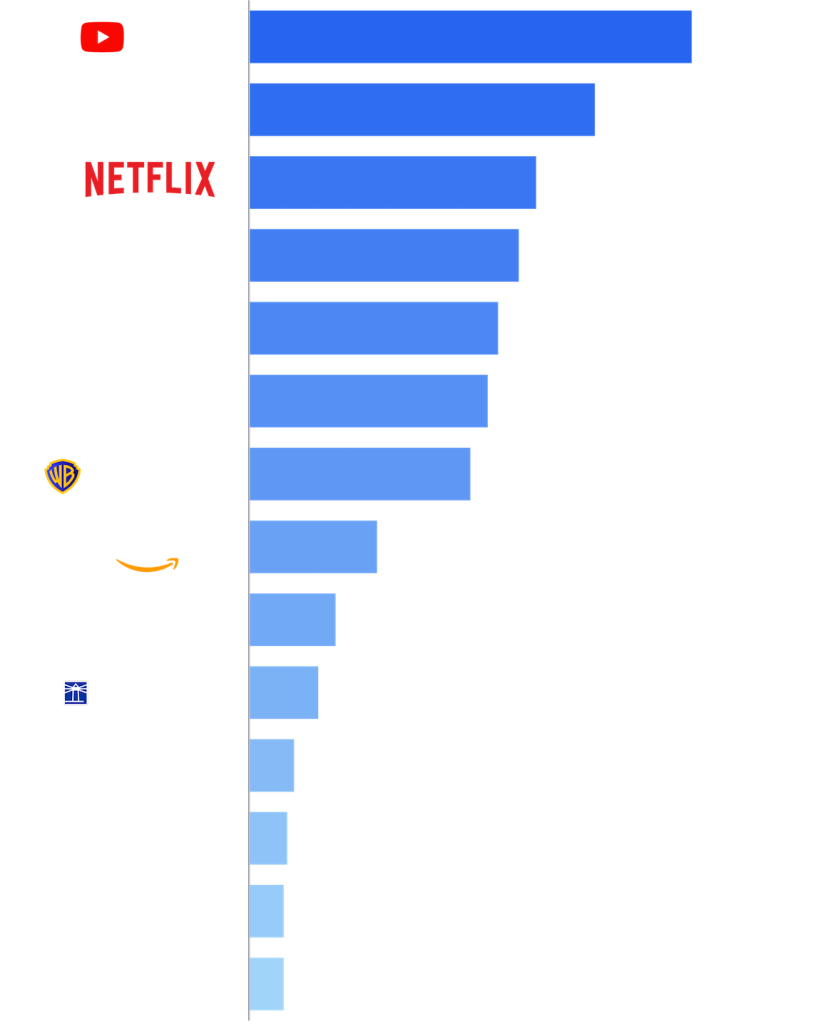

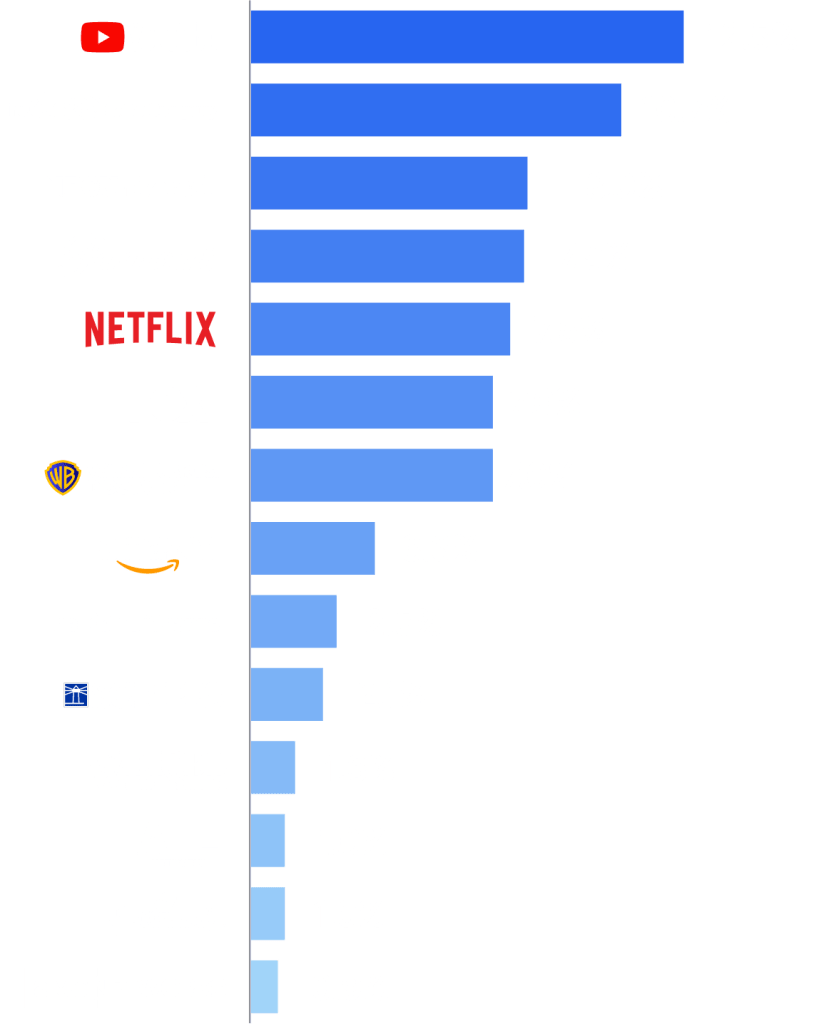

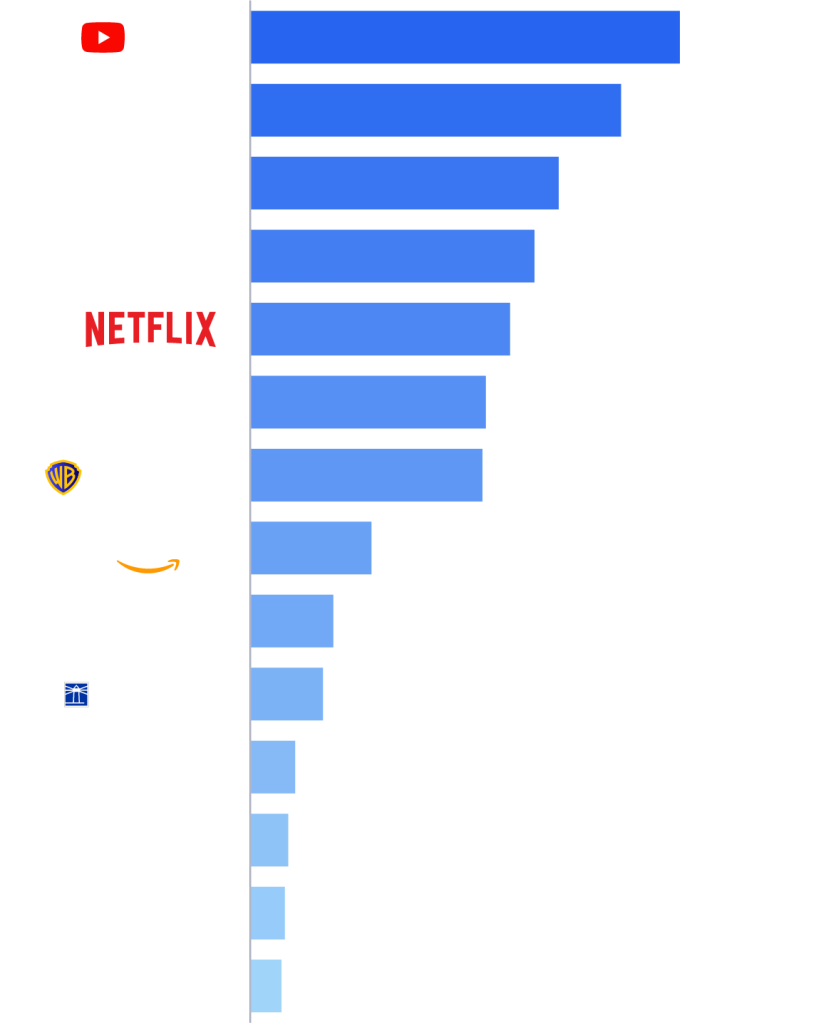

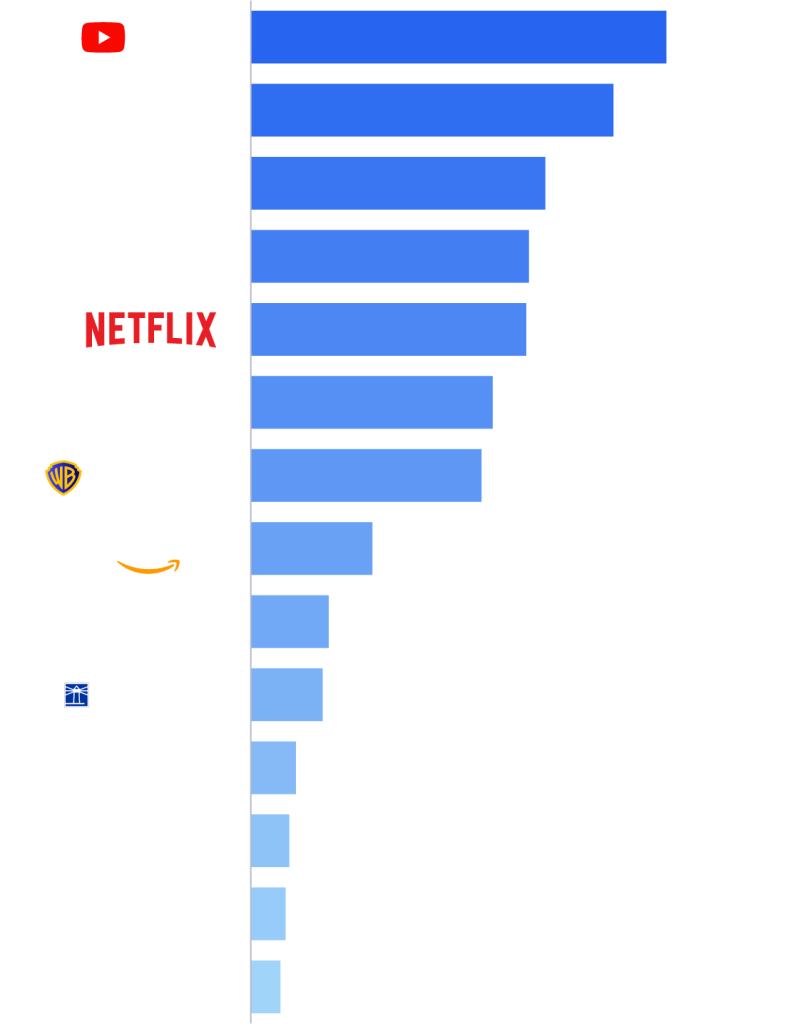

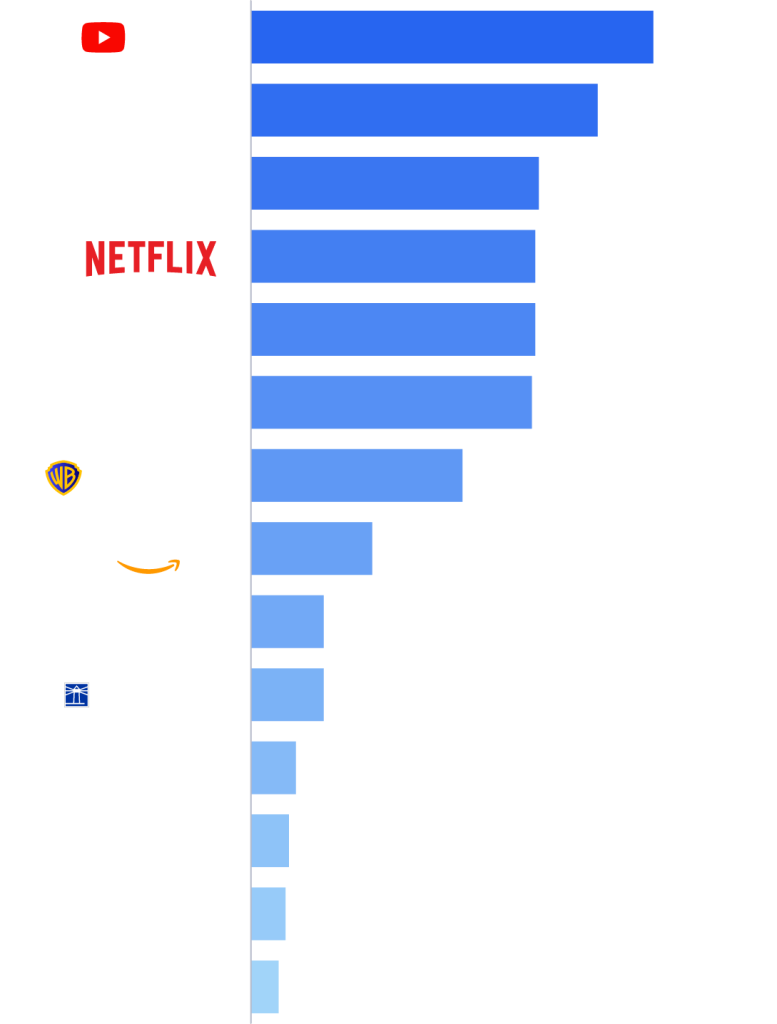

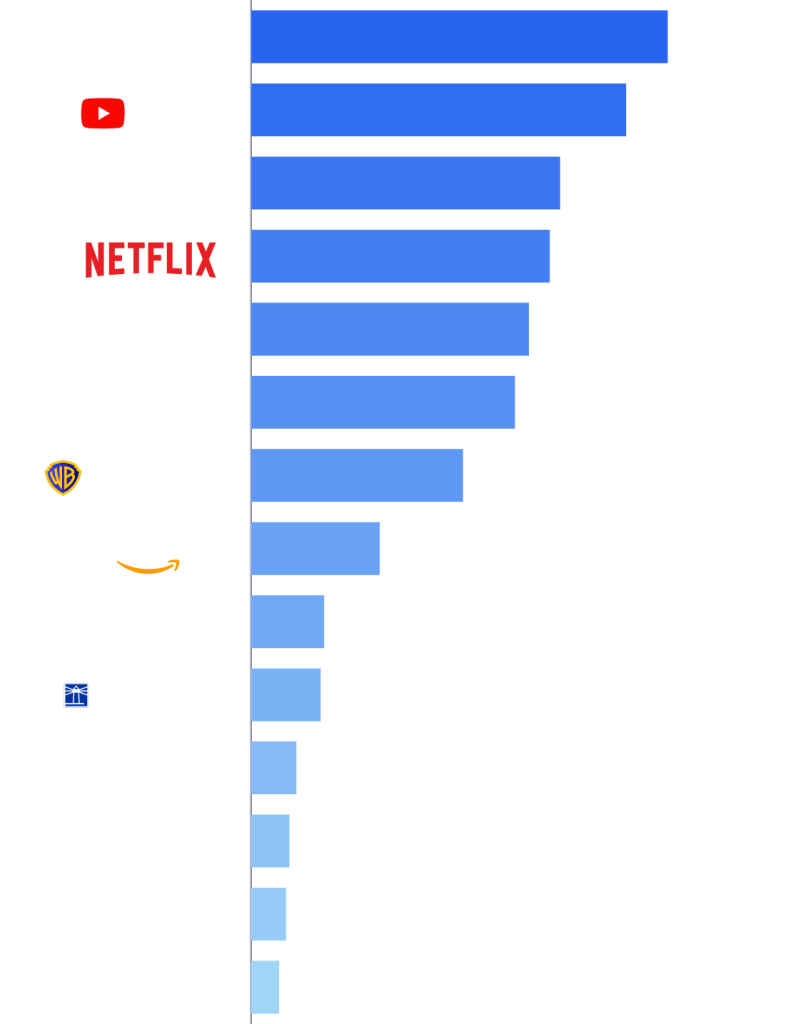

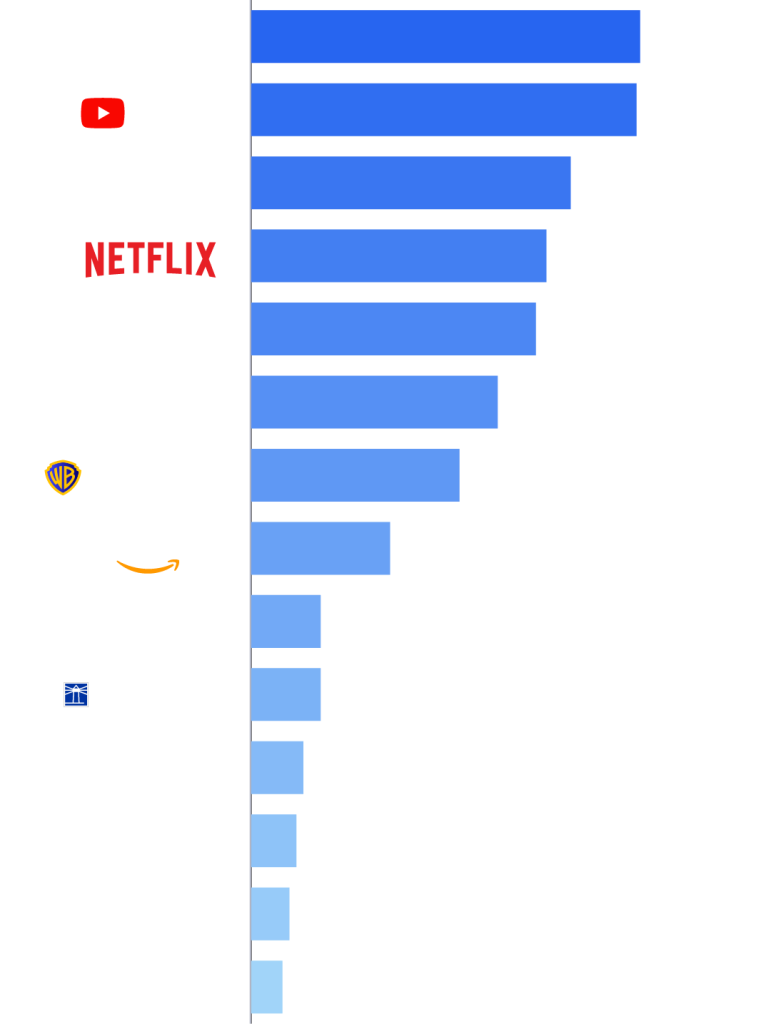

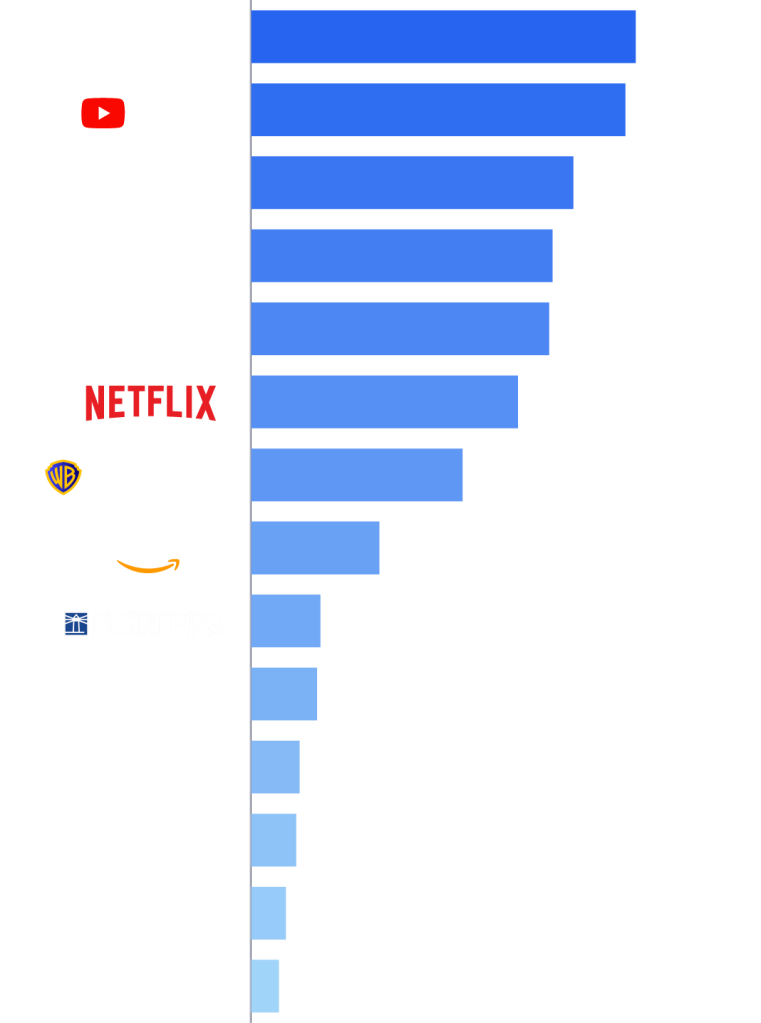

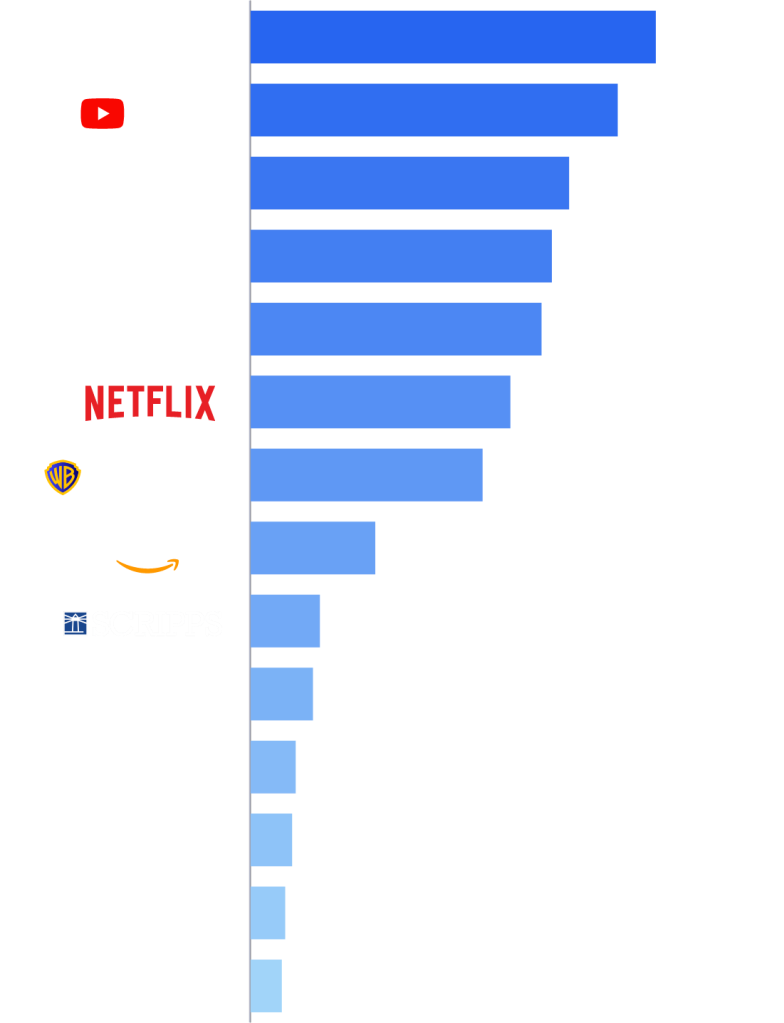

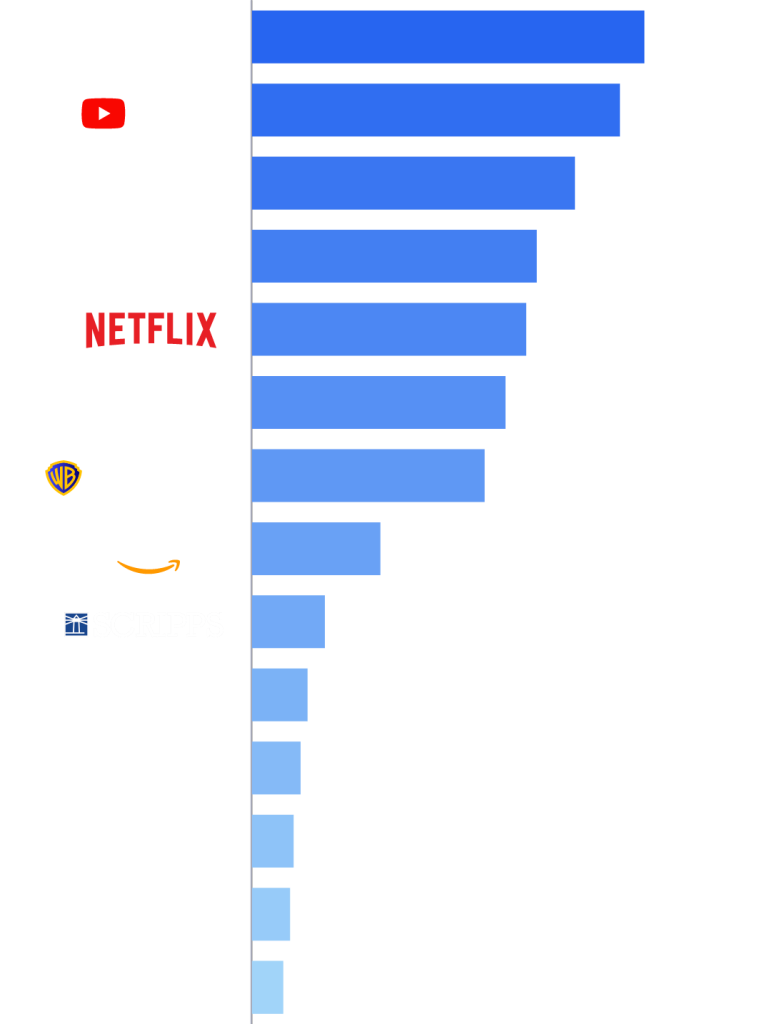

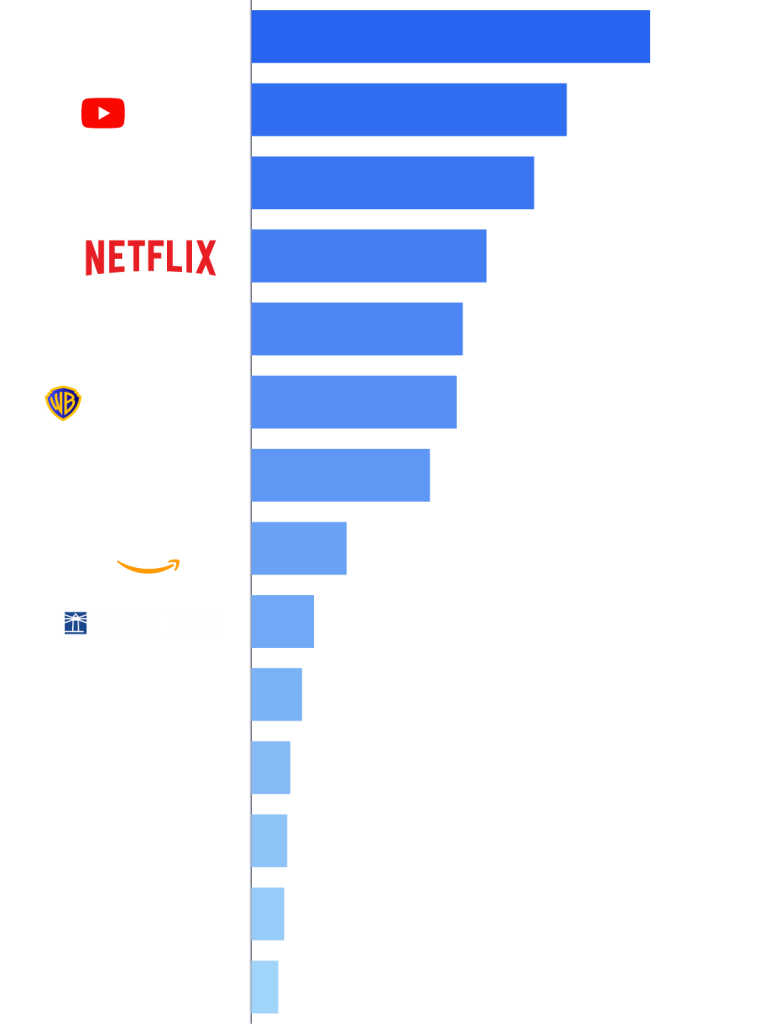

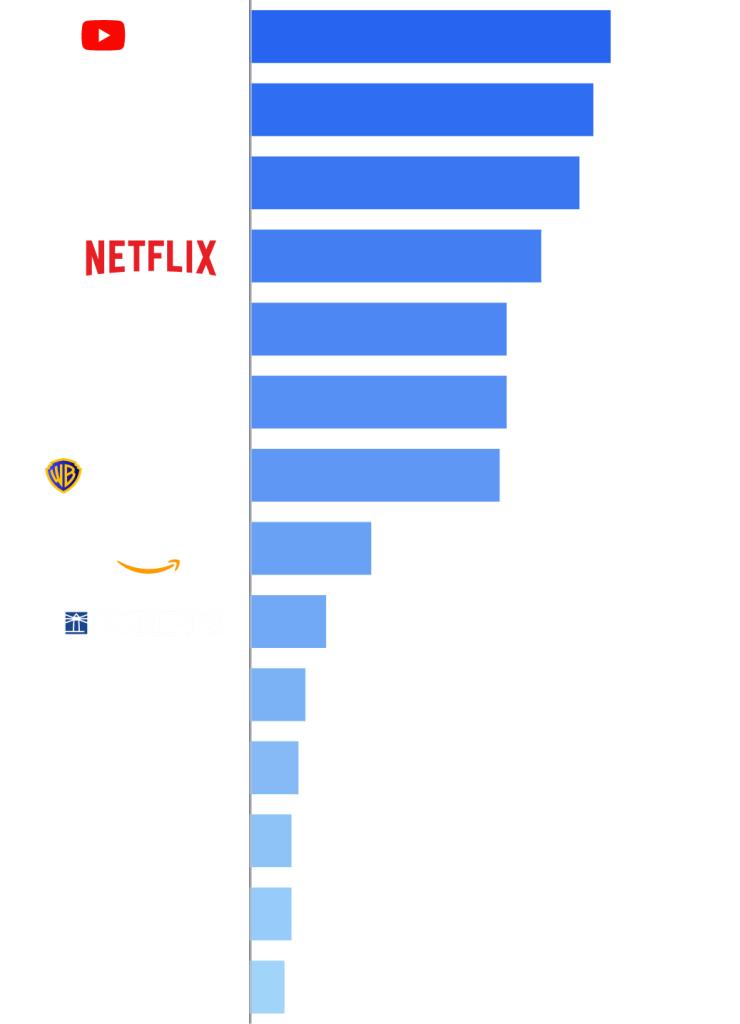

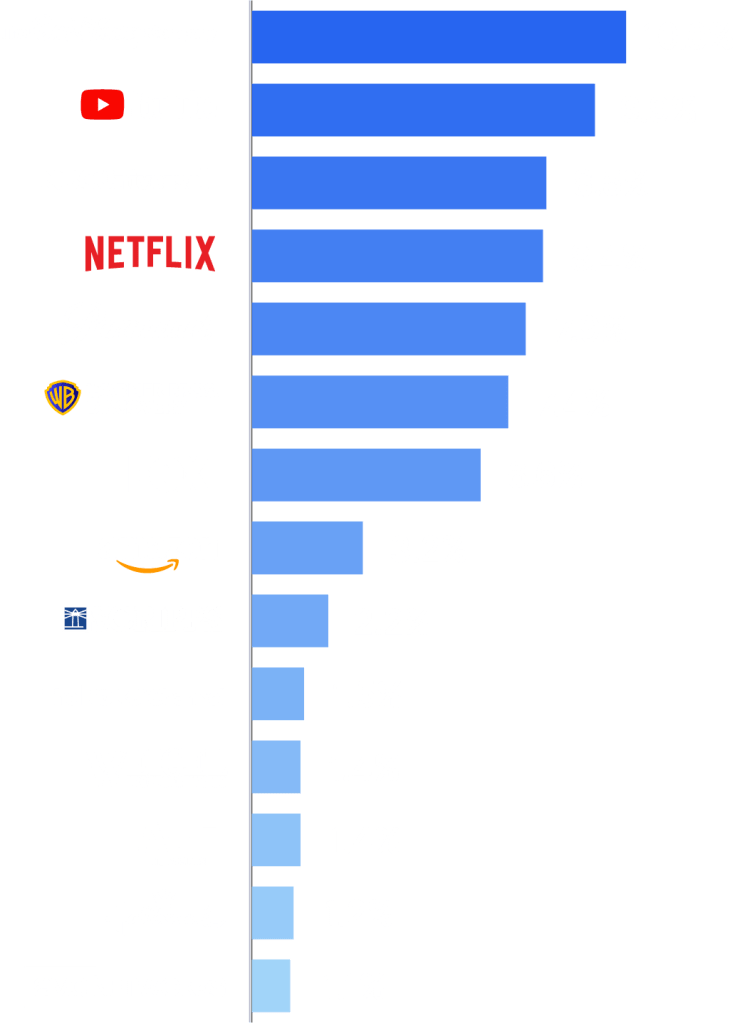

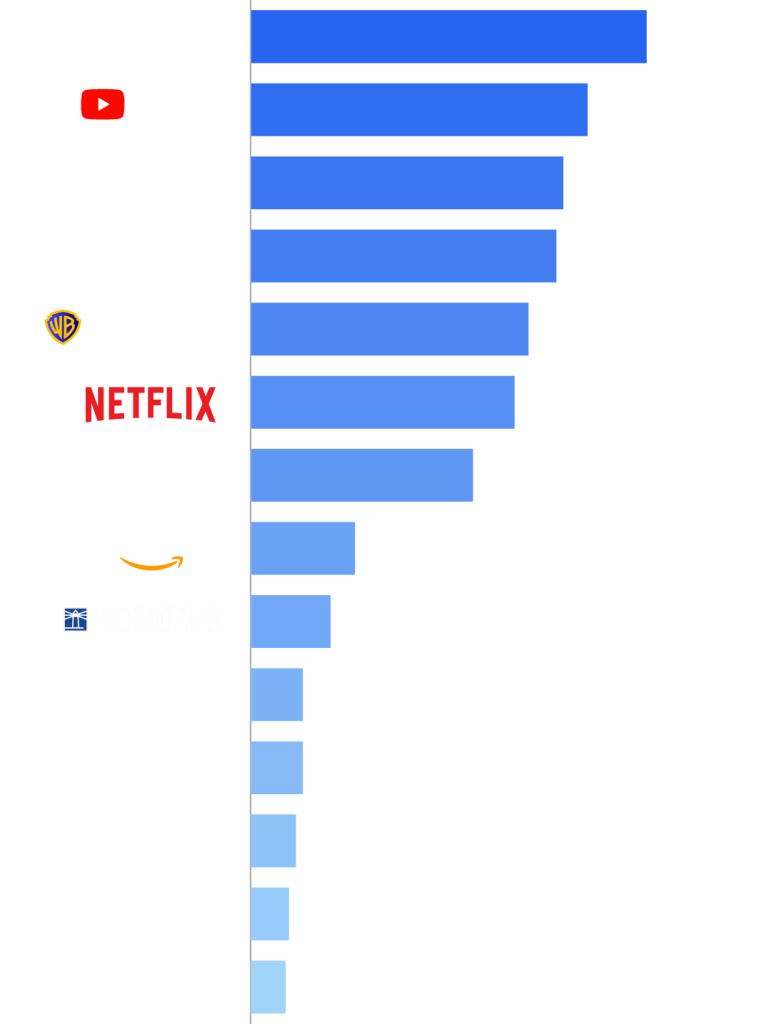

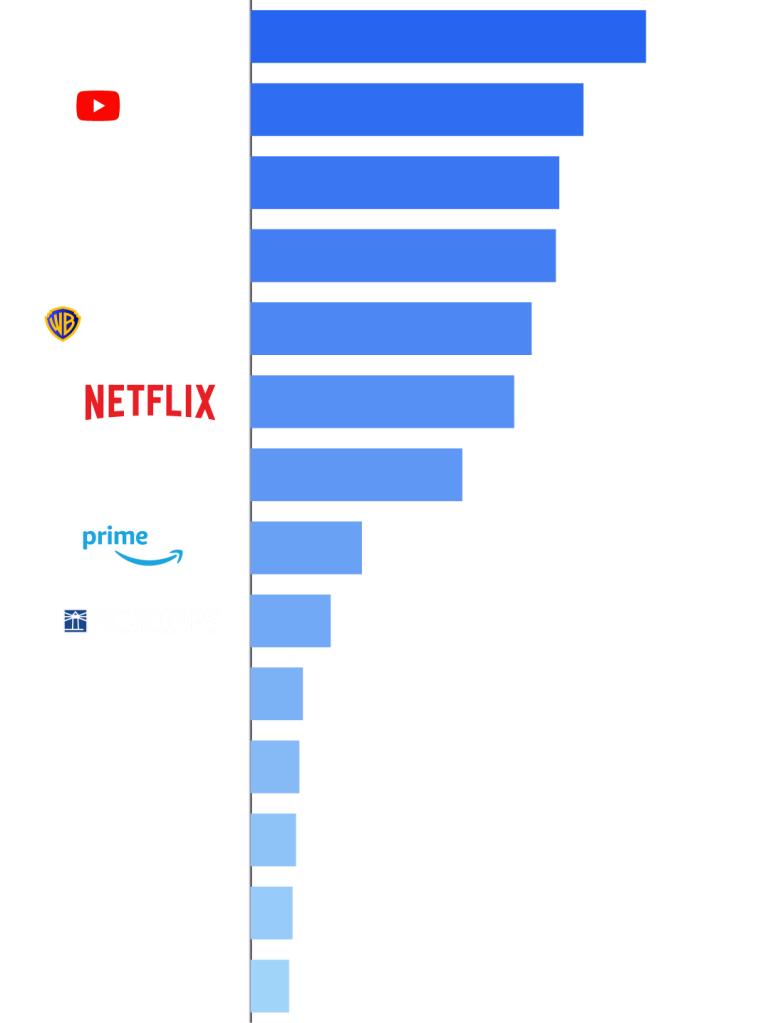

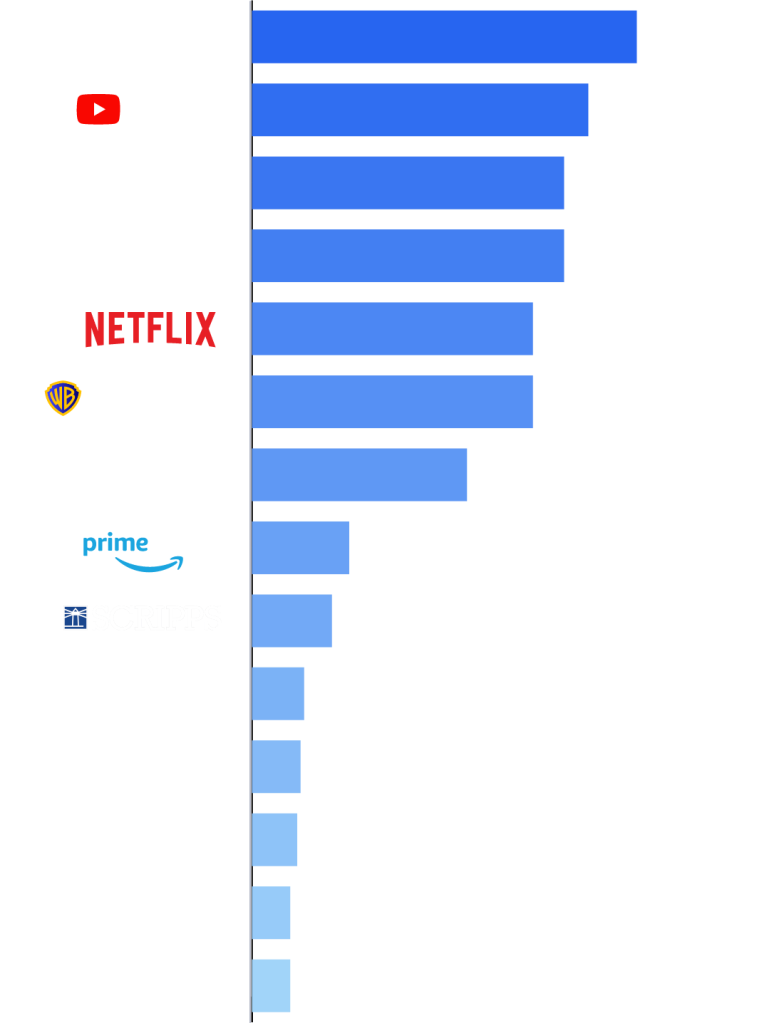

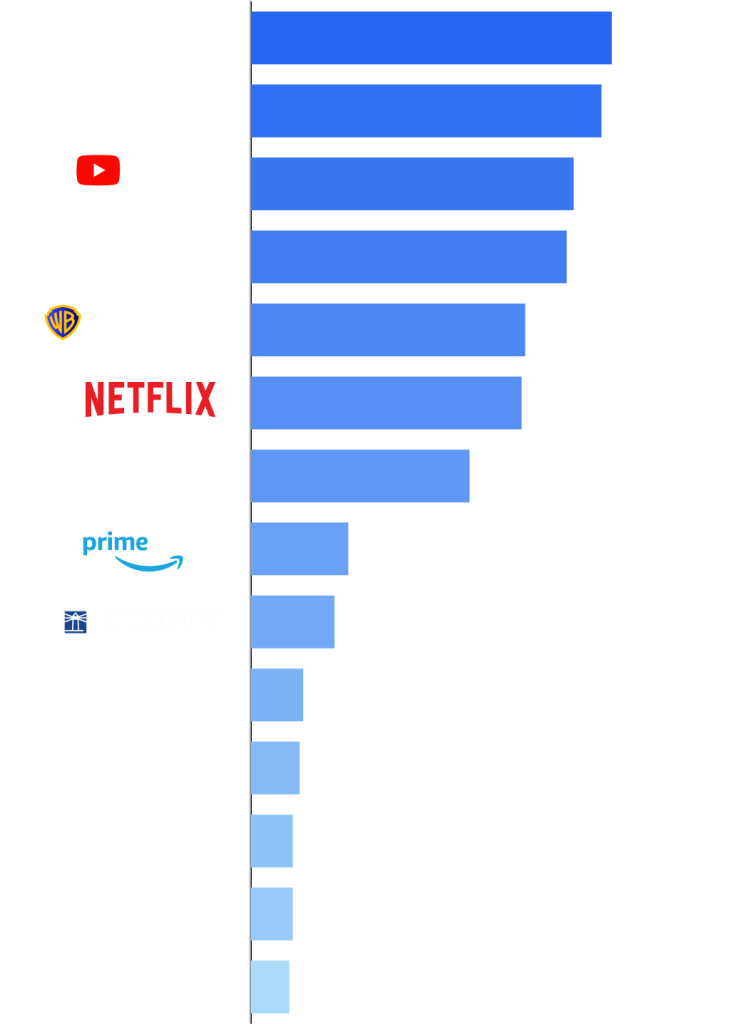

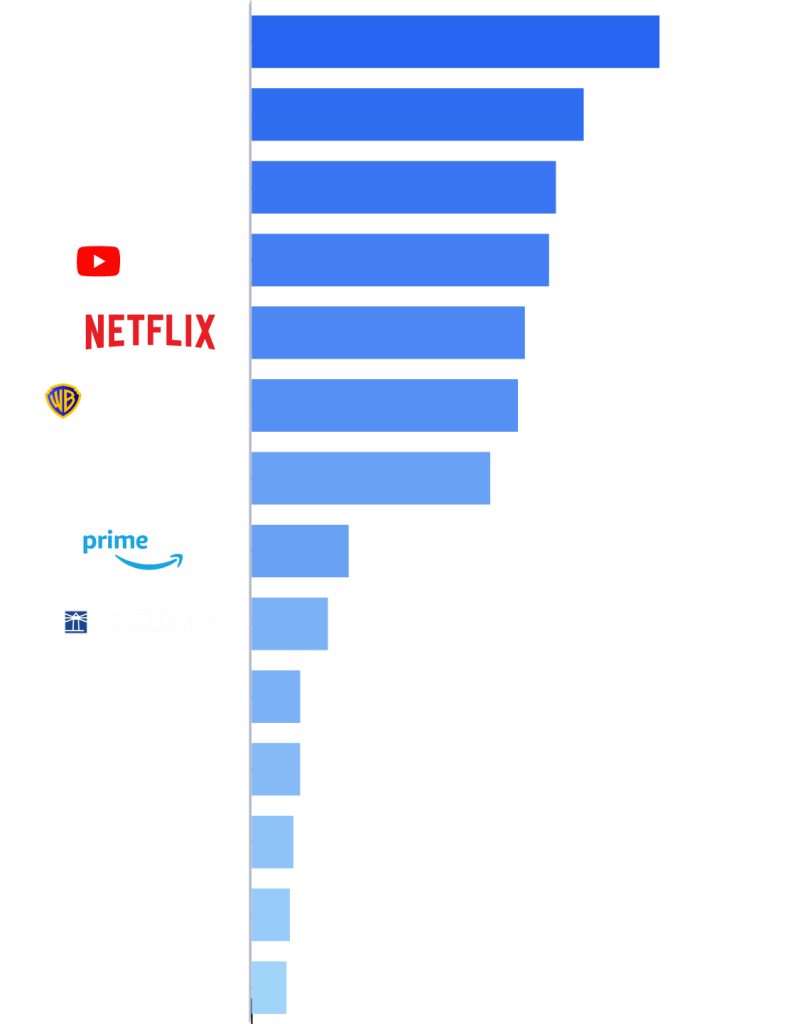

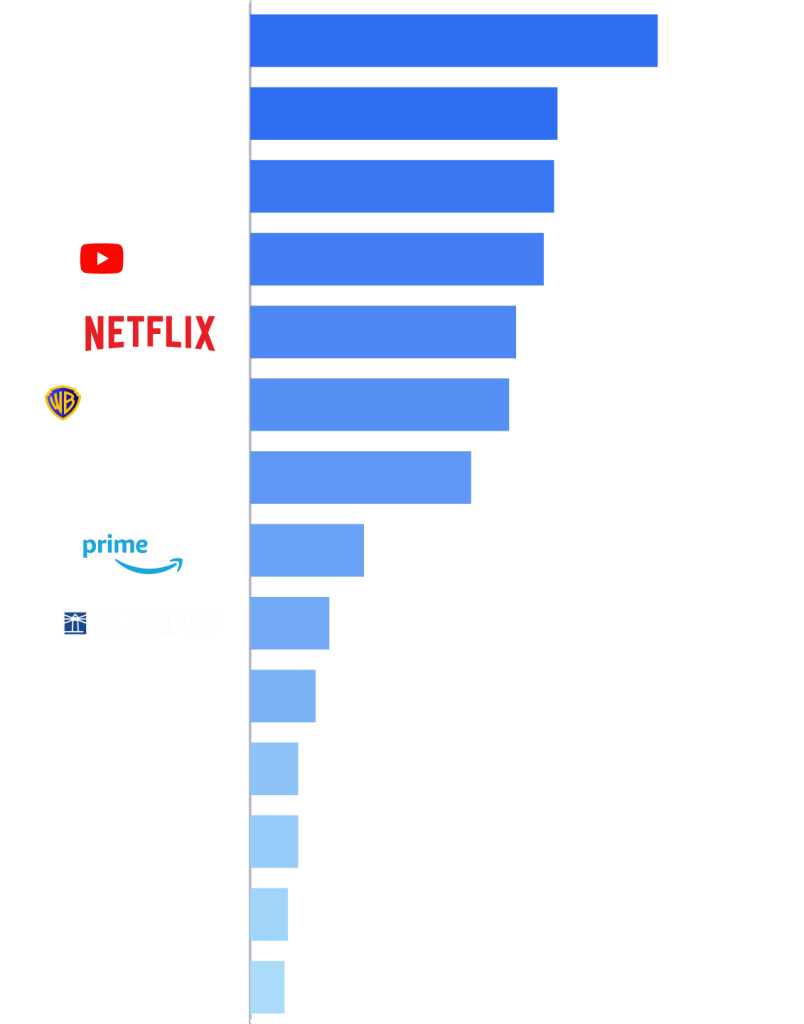

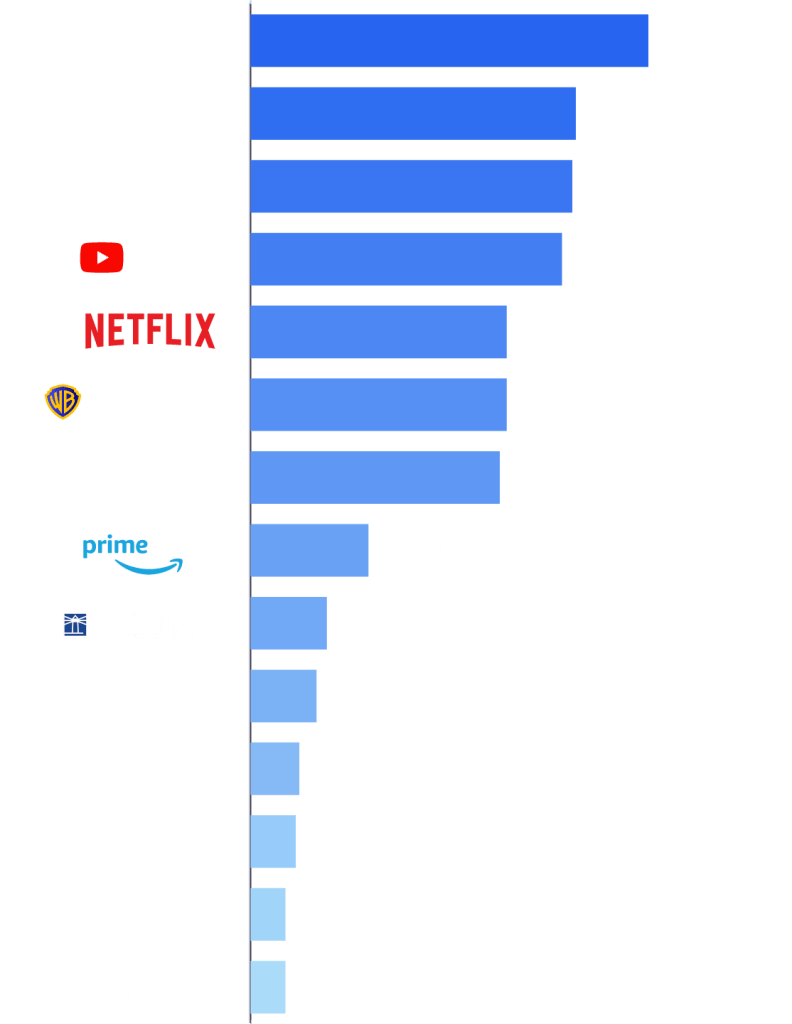

The top three media companies remained unchanged from September to October, as the rankings were led by YouTube with 12.9% of total TV, Disney with 11.4%, and NBCUniversal with 8.6%. Time spent watching YouTube was up 4% this month (+0.3 share points), driven by double-digit growth among kids and teens as many schools across various parts of the U.S. experienced fall breaks.

Disney achieved the largest share increase in October and added 0.7 share points as its overall viewership climbed 7% month-over-month. Disney’s success was characterized by balanced growth across linear and streaming platforms: ESPN and ABC affiliates each saw a 9% viewing increase, while Disney Streaming (Disney+, Hulu and ESPN+) contributed a 7% bump. ABC affiliates and Disney Streaming represented the largest share growth contributions, however, each adding 0.3 share points to the distributor’s total.

Hallmark posted the largest percentage increase in watch-time in October as viewership surged 11% compared to September. Hallmark’s growth was powered by an uptick in movie viewership, which led to a gain of 0.1 point to represent 1.0% of TV this month. Hallmark climbed from 13th to 12th in the distributor rankings.

The influence of live sports and linear programming caused movement elsewhere on the chart: FOX and Paramount mirrored Disney’s 7% monthly growth and each climbed one spot in the distributor rankings, finishing with 8.4% and 8.2% of TV, respectively. FOX was propelled by the MLB playoffs, with significant lifts from FOX Sports 1 (FS1) and FOX broadcast affiliates. FS1 recorded a massive 285% viewing bump on the strength of ALCS coverage, and contributed 0.4 points to FOX’s 0.5-point increase, while FOX affiliates rose 12% driven by the start of the World Series (Games 1 and 2), college football’s Big Noon Saturday, and NFL games on Sundays.

Similar to Disney, Paramount’s October growth was powered by increases across both linear and streaming, with CBS affiliates up 13% and Paramount+ up 8.3%. Although NFL games represented CBS’ the top three programs this month, the network notably owned the top three non-sports programs across the entire broadcast category, with Tracker, 60 Minutes and Matlock.

Warner Bros. Discovery also benefited from the MLB Playoffs in October, adding 0.2 points month-over-month to capture 5.6% of total TV watch-time. Exclusive coverage of the Dodgers-Brewers four-game NLCS drove a 93% viewing increase on TBS.

The October 2025 interval spanned four weeks, from 09/29/2025 through 10/26/2025. Nielsen reporting follows the broadcast calendar, with weekly intervals beginning on Monday.

About The Gauge™

The Gauge™ is Nielsen’s monthly snapshot of total broadcast, cable and streaming consumption that occurs through a television screen, providing the industry with a holistic look at what audiences are watching. The Gauge was expanded in April 2024 to include The Media Distributor Gauge, which reflects total viewing by media distributor across these categories. Read more about The Gauge methodology and FAQs.

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences—now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

Press Contact

Lauren Pabst