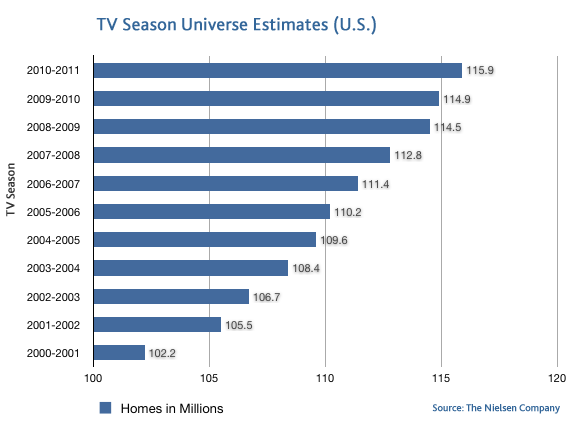

For the 2010-2011 broadcast season, Nielsen estimates the total number of TV households in the U.S. will climb to 115.9 million, an increase of one million homes from last year. Nielsen also estimates an increase of more than two million persons age two and older (P2+) in U.S. TV households, for a total of 294,650,000 people.

Top Local Markets

The rankings of the Top 10 local TV markets were unchanged, but in the Top 20, the Miami-Ft. Lauderdale area moved ahead of Denver. No new markets entered the top 100, however there were several changes within the ranks. Austin, TX had the largest spike within the top 100 ranks, moving from 48 to 44.

| Top 20 U.S. TV Markets (2010-11 Season Estimates) | ||

|---|---|---|

| 2010-11 Rank | 2009-10 Rank | Market |

| 1 | 1 | New York |

| 2 | 2 | Los Angeles |

| 3 | 3 | Chicago |

| 4 | 4 | Philadelphia |

| 5 | 5 | Dallas-Ft. Worth |

| 6 | 6 | San Francisco-Oak-San Jose |

| 7 | 7 | Boston (Manchester) |

| 8 | 8 | Atlanta |

| 9 | 9 | Washington, DC (Hagrstwn) |

| 10 | 10 | Houston |

| 11 | 11 | Detroit |

| 12 | 12 | Phoenix (Prescott) |

| 13 | 13 | Seattle-Tacoma |

| 14 | 14 | Tampa-St. Pete (Sarasota) |

| 15 | 15 | Minneapolis-St. Paul |

| 16 | 17 | Miami-Ft. Lauderdale |

| 17 | 16 | Denver |

| 18 | 18 | Cleveland-Akron (Canton) |

| 19 | 19 | Orlando-Daytona Bch-Melbrn |

| 20 | 20 | Sacramnto-Stkton-Modesto |

| Source: The Nielsen Company |

Other notable local market changes:

There were more changes in the rankings compared to last year, yet still not as many as previous years. It was a tie for the largest increase in TV households, with Odessa-Midland and Austin, both rising four spots. The decline in the overall number of rank changes the past few years reflects overall slower household growth in the U.S. and large declines in domestic migration, particularly to Sun Belt areas. Major metropolitan areas lost less population than usual partially attributable to Baby Boomers delaying retirement plans, individuals unable to sell their homes, and/or individuals unwilling to move away from job-heavy markets. However, the recent increase in rank changes for this year seems to imply some of these phenomena are relatively short term and/or heavily contingent upon economic conditions.

Similarly, while many Florida markets had dropped in rank in the latest estimate (Tampa, Miami, Ft. Myers, Tallahassee) partially as a result of the aforementioned phenomenon, there is evidence of some “bounce back” for markets such as Miami and Tallahassee. Further, previous “high growth” markets (e.g. Las Vegas, Florida markets) which showed diminished growth or even declines in the last two estimates seemed to “stabilize” (i.e. maintain rank) for the most recent estimate. For all these markets, the decreases and/or growths do not necessarily reflect a true decline in population or households. The estimates may also reflect an adjustment to align with the most recent information from the U.S. Census Bureau.

For the first time since the Hurricane Katrina recovery period, the New Orleans market rank has declined (from 51 to 52). Though population in the market has increased, recent trends in Persons Per Household (PPH) indicate that previous PPH assumptions were too conservative (i.e. assuming fewer people per household). To better reflect contemporary population dynamics in the area, the PPH ratio was increased for the recent estimate, based on recent U.S. Census Bureau data, resulting in a smaller than usual increase in the Total Household estimate for this year which allowed the Buffalo market to pass New Orleans.