Automotive demand is picking up pace around the world. So who are the car buyers of tomorrow, where do they live and what drives them along the path to purchase? Nielsen’s Global Survey of Automotive Demand polled more than 30,000 Internet respondents in 60 countries to find out. Here, we shine a spotlight on China.

Chinese Women Are in the Driver’s Seat

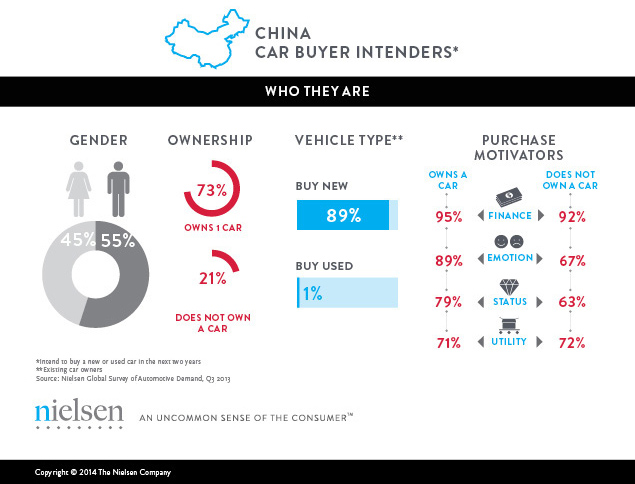

Move over men, Chinese women are an equal force to reckon with when it comes to buying a car. In the next two years, 45 percent of female Chinese respondents plan to buy, compared with 55 percent who will be male, making for a near-even split by gender.

For one-fifth (21%) of all Chinese respondents, this will be their first automotive purchase, compared with nearly three-fourths (73%) who already own a car. Among existing car owners, 89 percent plan to buy new, compared with only 1 percent who plan to buy used.

If you want to capture the purchase intent of Chinese car buyers, connect with their hearts. The strongest purchase motivator (aside from financial) is the love of driving (89%), followed by the need for status (79%) and utility (71%).

Online Sources Are Most Helpful

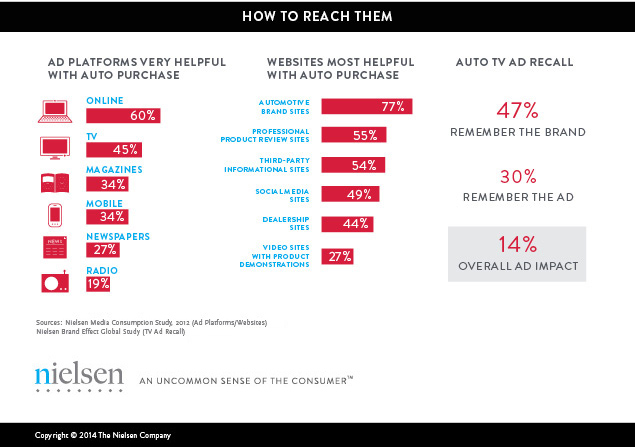

For six out of 10 (60%) Chinese respondents, online ad platforms are the most helpful in their paths to purchase, followed by TV (45%), magazines and mobile (both 34%). To measure the effectiveness of TV advertising in communicating to potential consumers, a recent Nielsen study analyzed a number of automotive brands and their ads to understand how real TV viewers remember the ads to which they were exposed. In China, 30 percent remembered the ad, and of them, 47 percent remembered the brand, for an overall ad impact of 14 percent.

Other findings include:

- Insight into who potential car buyers are, where they live, and how to appeal to them.

- Global trends in auto alternatives.

- Quick-reference country scorecards for: India, Brazil, Russia, Mexico, Indonesia, Turkey, the U.S. and Germany.

For more detail and insight, download Nielsen’s global survey of automotive purchase intent.

About the Nielsen Global Survey

The findings in this survey are based on respondents with online access across 60 countries. While an online survey methodology allows for tremendous scale and global reach, it provides a perspective only on the habits of existing Internet users, not total populations. In developing markets where online penetration has not reached majority potential, audiences may be younger and more affluent than the general population of that country. Additionally, survey responses are based on claimed behavior, rather than actual metered data.