Auckland, March 20, 2025 – Nielsen Ad Intel’s latest data shows advertising expenditure across New Zealand’s Investment, Finance, and Banking sector jumped by 4.1% year-on-year, topping $295.3 million between February 2024 and January 2025.

Top Investment, Finance and Banking ad categories

Banks remained the sector’s largest advertisers, investing $179.5 million – an increase of 2.9%, YoY. However, finance and investment companies showed the most significant growth, up 18% to $91.6 million, followed by credit cards ($20.3 million), miscellaneous financial services ($3 million), and building societies ($365,000).

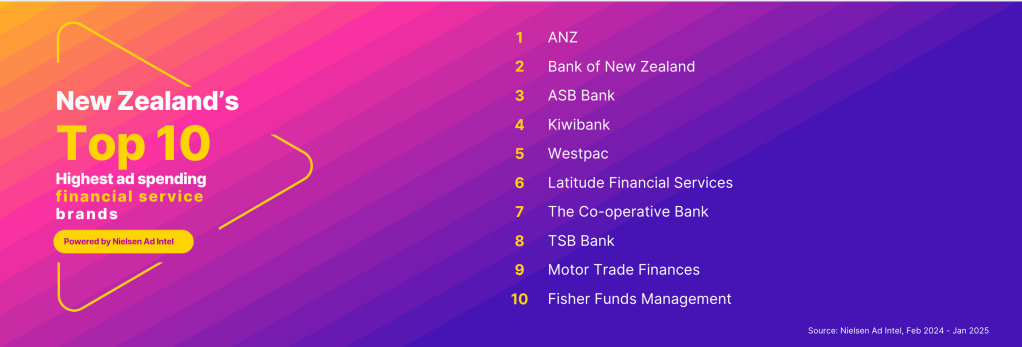

Top Investment, Finance and Banking sector advertisers

Leading advertisers over the past year included ANZ, Bank of New Zealand, ASB Bank, Kiwibank, and Westpac, with Latitude Financial Services notably leaping from 32nd place to 6th.

Additionally, Nielsen Consumer Media Insights (CMI) found that despite steady satisfaction with financial providers (73% of New Zealanders remain satisfied or very satisfied with their primary bank) consumer financial pressures continue to mount. The percentage of people reporting they have “no spare money and are going backwards” rose from 10.7% to 12.7%, highlighting growing cost-of-living concerns.

Additionally, more New Zealanders are taking proactive financial measures, with nearly half (47.4%) planning to reduce expenses and more than one-third (36%) planning to increase their savings over the next three months.

Nielsen Ad Intel’s Pacific Commercial Lead, Rose Lopreiato, said: “This data reflects how financial institutions are responding to an increasingly pressured consumer landscape. Understanding the complex New Zealand advertising market is crucial for financial brands aiming to effectively connect with a wide range of consumers, from those building and managing wealth, to those facing financial pressures, and the many millions in between.”

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences – now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

About Nielsen Ad Intel

Ad Intel provides the most complete source of cross-platform advertising intelligence available today. With intuitive software, review-and-compare ad activity across media, company, category or brand, plus historical data.

About Nielsen CMI (CMI)

Consumer Media Insights is an essential tool for understanding the constantly evolving consumer landscape. With rich demographic and lifestyle data, and information on purchasing behaviours and intentions alongside extensive media habit reporting, Consumer & Media Insights helps you shape successful brand, advertising and marketing strategies.

Note: Nielsen monitors gross advertising expenditure in major media at published rate card values. While discounts are made available from some media owners, rates are not openly available. Please also note that the category and brand/product groupings figures are grouped at Nielsen’s discretion.

Press Contact

Dan Chapman

dan.chapman@nielsen.com

+61 4040884