Peacock, for the first time, grabs 1% of total streaming viewership

Despite the surge in television usage during the Thanksgiving holiday, total TV viewing managed to increase slightly in December (0.3%), amplified by two of the top 10 viewing days of the year. Total TV usage aside, engagement with content options continues to fragment as audiences gravitate to new titles and services.

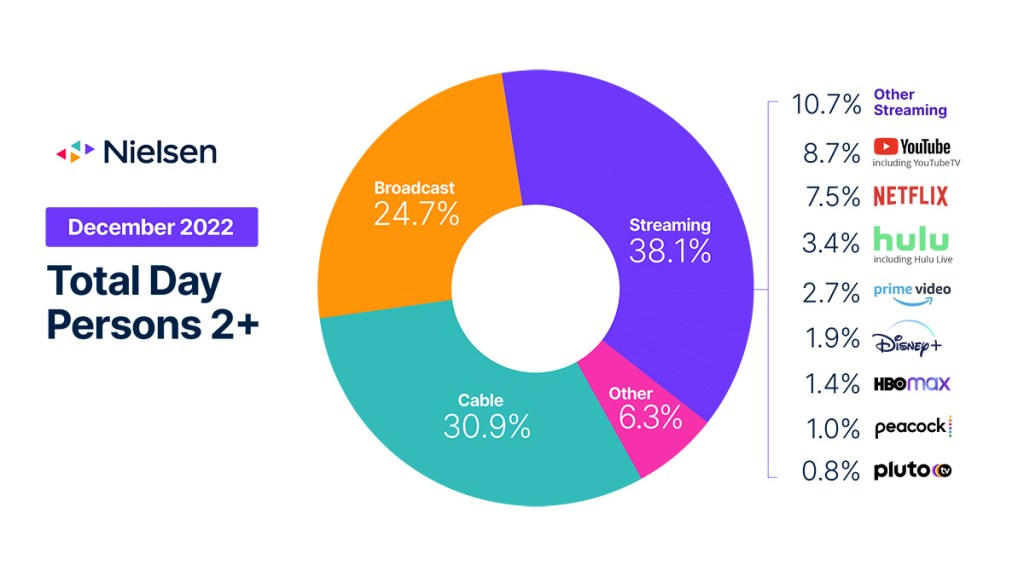

The competition for viewers in December led to losses of viewing share across broadcast, cable and streaming. The “other” category benefited, gaining 2 share points, driven in part by video game usage during holiday vacations and the gift-giving season. Within the streaming category, Peacock became the latest service to achieve a 1% share of TV usage, crossing the threshold to be broken out from the “other streaming” category.

Like we saw in November, December included five days that boasted more than 100 billion viewing minutes (including Christmas Day and Dec. 18). Streaming continued its reign as the top category, capturing 38.1% of total TV usage, down just 0.1% from November. Despite the slight loss of total TV usage share, time spent streaming actually increased 0.2% from November. Among the streaming services, HBO Max gained the most usage (18.1%), fueled by the second season of The White Lotus and the popularity of Friends and The Big Bang Theory. On a year-over-year basis, streaming usage in December was up 46.1%, resulting in a gain of 10.4 share points from a total TV usage perspective.

Broadcast and cable viewing declined (3.7% and 2.4%, respectively), reflecting less-robust offerings than were available in November and a post-election drop-off, which was most evident across cable. Even with the strength of World Cup viewing, sports viewing on broadcast slipped 12.3%, while drama viewing dropped 20%. Comparatively, feature film viewing increased 27% as the only genre to see increased engagement across broadcast. Cable benefited similarly, as a 4.9% jump in holiday movies helped the category capture 22.1% of cable viewing.

Fall TV viewing remains pivotal from a content perspective, and linear programming continues to draw large audiences, especially as the new TV season arrives each September. Amid the mix of must-see TV and sports, however, streaming remains the most popular option when compared with broadcast and cable among viewers.

Methodology and frequently asked questions

The Gauge provides a monthly macroanalysis of how consumers are accessing content across key television delivery platforms, including broadcast, streaming, cable and other sources. It also includes a breakdown of the major, individual streaming distributors. The chart itself shows the share by category and of total television usage by individual streaming distributors.

How is ‘The Gauge’ created?

The data for The Gauge is derived from two separately weighted panels and combined to create the graphic. Nielsen’s streaming data is derived from a subset of Streaming Meter-enabled TV households within the National TV panel. The linear TV sources (broadcast and cable), as well as total usage are based on viewing from Nielsen’s overall TV panel.

All the data is based on a time period for each viewing source. The data, representing a broadcast month, includes a combination of Live+7 viewing for the reporting interval (Note: Live+7 includes live television viewing plus viewing up to seven days later for linear content).

What is included in “Other”?

Within The Gauge, “other” includes all other TV. This primarily includes all other tuning (unmeasured sources), unmeasured video on demand (VOD), streaming through a cable set top box, gaming and other device (DVD playback) use. Because streaming via cable set top boxes does not credit respective streaming distributors, these are included in the “other” category. Crediting individual streaming distributors from cable set top boxes is something Nielsen continues to pursue as we enhance our Streaming Meter technology.

What is included in “other streaming”?

Streaming platforms listed as “other streaming” includes any high-bandwidth video streaming on television that is not individually broken out.

Where does linear streaming contribute?

Linear streaming (as defined by the aggregation of viewing to vMVPD/MVPD apps) are included in the streaming category and represented 5.3% of total television in December 2022. Broadcast and cable content viewed through these apps also credits to its respective category.

Do you include live streaming on Hulu and YouTube?

Yes, Hulu includes viewing on Hulu Live and YouTube includes viewing on YouTube TV.

Encoded Live TV, aka encoded linear streaming, is included in both the broadcast and cable groups (linear TV) as well as under streaming and other streaming e.g., Hulu Live, YouTube TV, Other Streaming MVPD/vMVPD apps. (Note: MVPD, or multichannel video programming distributor, is a service that provides multiple television channels. vMVPDs are distributors that aggregate linear (TV) content licensed from major programming networks and packaged together in a standalone subscription format and accessible on devices with a broadband connection.)