Deborah Sumner, VP, Financial Services Practice Lead

The mobile banking consumer carries a higher balance than the average banking consumer and has a greater net worth. While still only representing a small percentage of banking households, that number is increasing. Understanding the unique needs of this lucrative segment could mean winning and retaining valuable customers. To get into the mindset of the mobile banking consumer, Nielsen profiles five segments of consumers and offers strategies on how to reach them.

Consumer confidence and comfort levels for mobile transactions are at an all time high. For financial institutions, mobile banking creates efficiencies, cost savings, drives customer loyalty, engages new segments and offers real-time solutions. For consumers, mobile banking offers a consistent experience, improved speed of information and empowerment. But to truly understand the needs of the mobile banking user, banks must go beyond basic mobile services and learn how consumers interact with financial institutions.

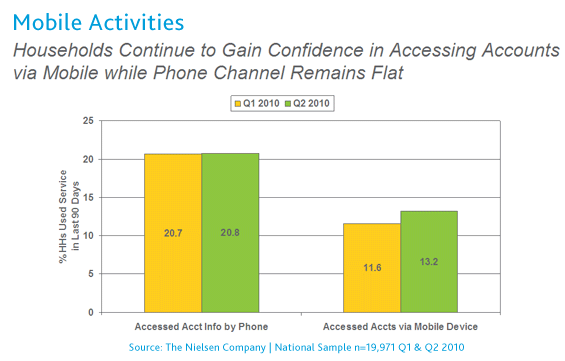

Nielsen examined the mobile banking user and found that 13.2 percent of households accessed their bank account via a mobile device in second quarter 2010 versus 20.8 percent who accessed their account via the bank’s customer service call center. While mobile access penetration is lower than other channels, it has grown from 11.6 percent in first quarter and call center access has remained relatively flat quarter-over-quarter.

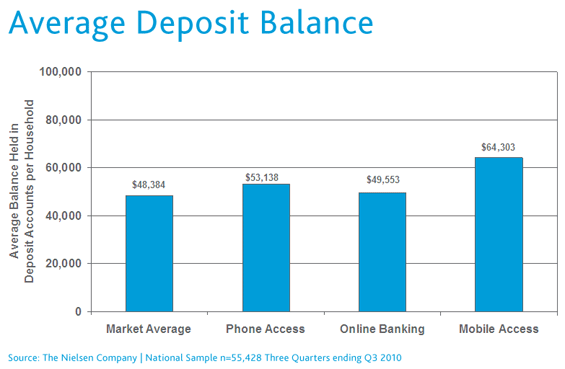

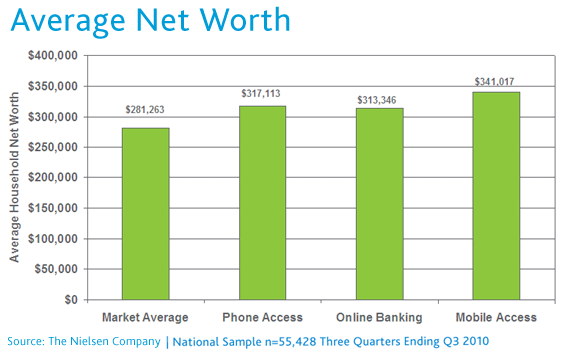

Mobile banking users also bring greater value to an institution by maintaining higher average balances ($64,303) versus ($48,384) for the average customer and greater net worth ($341,017) versus their online banking counterparts ($313,346) or the market average ($281,263).

Who is the Mobile Banker?

Unlike other channel strategies, mobile banking defies specific demographic categories such as age and income. Nielsen identified distinct characteristics of the mobile banker and grouped them into five segments, each with a specific mobile mindset. In order to deliver true customer value and a unique customer experience, it is necessary to know what drives the mobile banking consumer.

Mobile Office Workers

Representing 14.8 percent of mobile bankers and 9 percent of the U.S. population, this group of image-conscious, brand-centric, career-minded multi-taskers likes to stand out in the crowd.

Mobile Office Workers are younger to middle age (35-54) and are more likely to engage in mobile banking than any of the other groups. They rank highest for smartphone ownership and they stay connected by consuming information such as news, sports and finance. Their friends are a big part of their lives—even more important than their families.

- Social TextersComprising one out of five mobile bankers and 14.3 percent of the population, this segment of racially-diverse, techno-adopter, social butterfly millennials believes money is a measure of success. Social Texters are the youngest mobile group (18-24) and are generally still in college. They are most are likely getting financial support from their parents and are more likely to have a prepaid feature phone. They index high on checking their balances—or more likely checking for deposits from parents.

- Country Club CommunicatorsMaking up 12.8% of mobile bankers and 11.6 percent of the population, this group of older, educated, wealthy empty nesters appreciates the finer things in life. Country Club Communicators are the oldest (45-64), wealthiest and most educated of the mobile mindsets. They index high for Smartphone ownership and they have adapted to mobile technology to keep in touch with their children (see Social Texters) and therefore have a higher propensity to use SMS text messaging. They are loyal to their bank and use a variety of banking services and products.

- Mobile BasicsCovering 11.3 percent of mobile bankers and 10.8 percent of the population, this segment of practical, family oriented, small town, blue collar workers are interested in the no frills option.

- In Touch, On the GoIncluding 6.8 percent of mobile bankers and 7 percent of the population, these suburban soccer moms and dads tend to buy on impulse.

Both Mobile Basics and In Touch, On the Go are middle age (35-54) and are more likely to own a feature phone. They have a lower propensity to mobile bank and use their phones for the most basic needs of communicating with family and checking balances. Both groups use a variety of credit to manage their cash flow and they are generally not savers except for retirement or their children’s college.

Cashing in on Opportunities

Mobile banking provides rewarding opportunities to financial institutions who know how to connect with the right consumer groups:

- Drives loyalty – Mobile banking creates an ongoing uniform, consistent dialogue with the customer. Banks should look to Mobile Office Worker’s friends to help market the benefits of mobile banking, as they are an important part of their life. Tell-a-friend and word-of-mouth programs are ways to engage with this group.

- Engages new segments – Mobile banking opens up new groups previously underserved; unbanked, younger or out-of-footprint. Even though Country Club Communicators are not as sophisticated as their Mobile Office Worker counterparts, they have adapted in order to remain connected with their children and have a higher propensity to use SMS text messaging. Banks should create family plans that parents and children can equally take advantage of; these plans should be communicated by Country Club’s personal banker or trusted financial advisor.

- Empowers – Mobile banking provides customers with control of their finances with real-time interaction. Mobile Basics and In Touch, On the Go tend to be at the opposite end of the mobile banking spectrum, however they still have a need to be in charge of their finances. They rank high in checking their balances and using credit to manage their cash flow. Banks should create marketing messages that stress control and offer simple SMS text message alerts for overdrafts, potential fraud and payment due dates.

- Offers solutions, not a product push – Mobile banking creates a vehicle for offering products that customers want and need at the exact moment when they need them. Real-time response isn’t easily replicated in most other channels. Regardless of the consumer mindset, this creates a positive customer experience and can be used across all groups to broaden the mobile universe.

It’s hard to deny the ubiquity of the mobile phone and mobile banking is the perfect complement, which offers something for every degree of technology adoption and comfort level. SMS, mobile web and downloadable applications provide a variety of simple functionality to a higher level of sophistication that is core to delivering unique customer engagements. It’s important for banks to be able to connect the banking behavior to the face and mindset of the mobile consumer to deliver a relevant and valuable user experience.