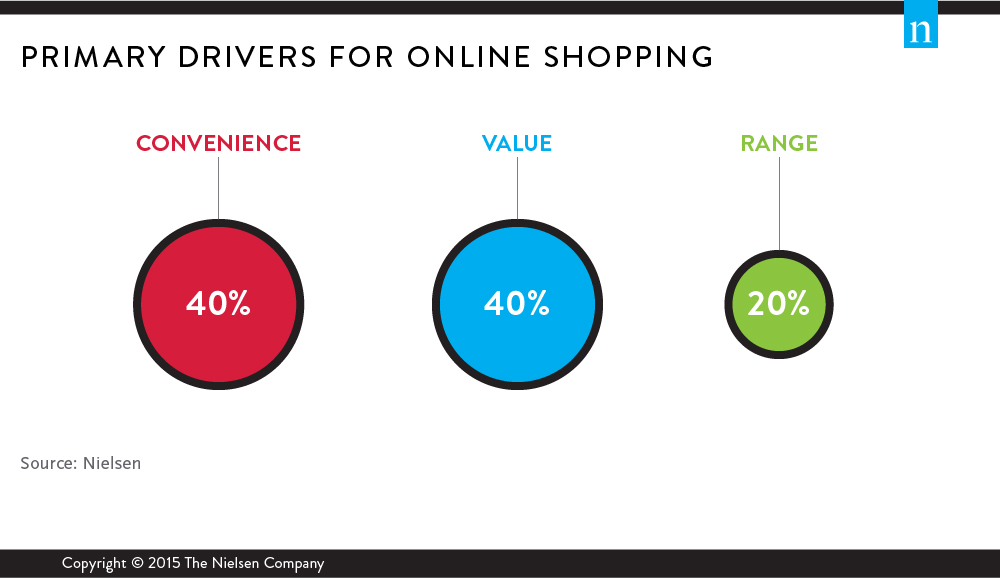

With nearly 2 million New Zealanders shopping online, what’s making Kiwi consumers click? Latest research reveals a 40:40:20 rule at play. The primary drivers of e-commerce are comprised of 40% convenience, 40% price and value and 20% range.

Convenience is important – saving time and effort with retailers at consumers’ fingertips. Forty percent of online shoppers cite saving time or effort as their main reason for shopping on the internet. Mobile devices are paving the way for consumers to shop online at different locations, it is convenient and immediate. Nearly a quarter (23%) of online shoppers buy via smartphones while nearly one-in-five (19%) do the same on their tablet.

Price competition and value for money is another key driver as stated by 40% of online shoppers; consumers everywhere want a good product at a good price. E-retailers have an advantage where they can pass real estate cost savings onto their customers to undercut the bricks and mortar businesses. Additionally digital can be used as a promotional tool to sell excess stock without wasting prime shelf space.

The ability to buy unique items, or to source items either not available in local stores, is also a draw to the online retail space. Twenty percent of online shoppers primarily shop online because of the range available including items they want that are not available in their local area. The seemingly limitless options available in a virtual environment provide new opportunities for both merchants and consumers.

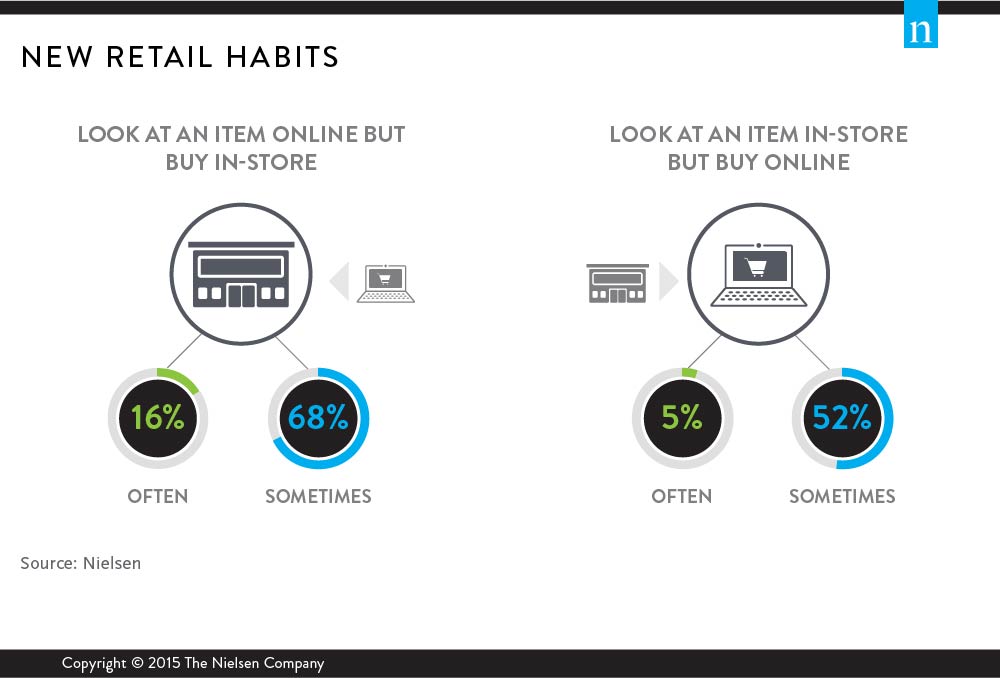

NEW RETAIL HABITS

Retail is converging and we see online browsing convert to both online and in-store purchasing. Show-rooming does occur, with 57% of online shoppers having looked at a product in-store and then bought online (often to secure a cheaper price), yet only 5% do this regularly. On the other hand, we now see New Zealanders web-rooming. More than eight-in-10 (84%) online New Zealanders have been prompted to go in-store to purchase an item following browsing online.

Now is the time to create omni-channel experiences for consumers who are actively using both digital and physical platforms to research and purchase, as increasingly, they don’t make a distinction between the two.

ABOUT THE NIELSEN ONLINE RETAIL REPORT 2015

Nielsen’s Online Retail Report provides New Zealand’s only in-depth information on the nation’s online retailing. It is an annual measure of e-commerce activity and shopping patterns. The research methodology combines an Online Panel Survey of 1,100 New Zealanders with Nielsen’s Consumer and Media Insights service and Nielsen Online Ratings. The report is now available to purchase.