The novel coronavirus (COVID-19) pandemic that has hit across the globe has caused significant changes in people’s lives. A Nielsen investigation has identified six thresholds that track trends in consumer behavior around the world as markets have been impacted by the virus. While Indonesia was one of the last countries in Asia to confirm a COVID-19 infection at the beginning of March, cases have since climbed, and Indonesia has joined many other markets around the world at level 5, Restricted Living. Due to concerns around the virus and living restrictions, Indonesians are adapting their media and consumer habits.

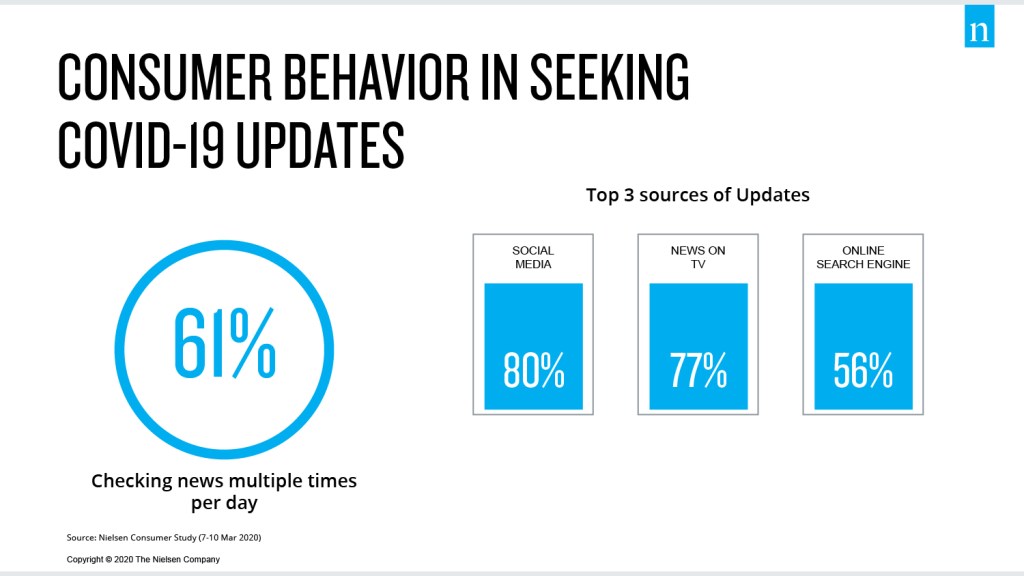

In a recent Nielsen study, 82% of respondents—mostly Upper Class—said that they were aware of COVID-19 in early February 2020. Following President Joko Widodo’s announcement on the first COVID-19 cases on March 2, 61% of respondents checked COVID-19-related news several times every day through various media channels.

The study found that social media (80%), TV news (77%) and online search engines (56%) were the most accessed sources of information for consumers to get updates on COVID-19.

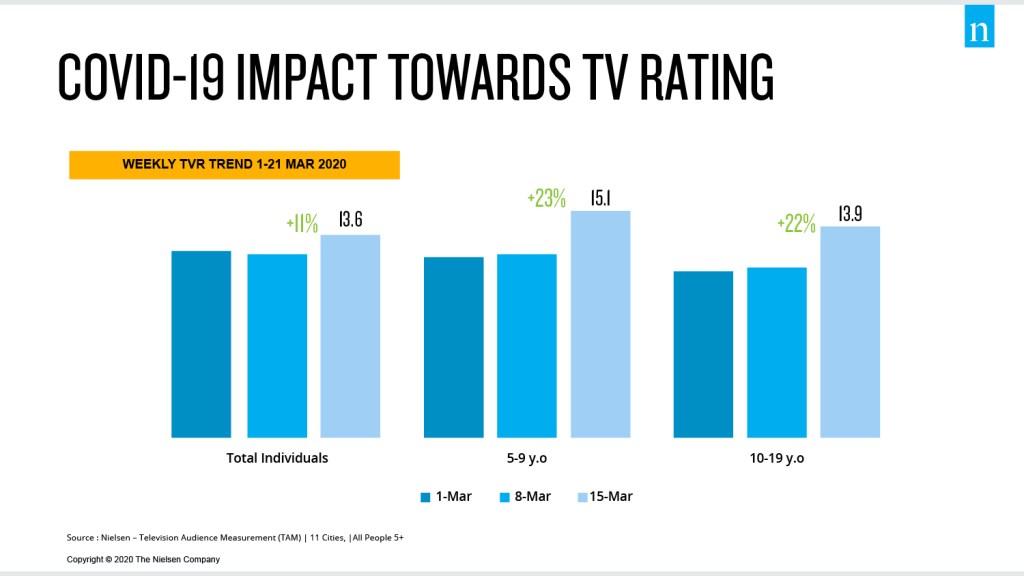

Following the country’s stay-at-home policy to prevent the spread of COVID-19, 30% of respondents planned to shop online more often. It also affected TV viewing, with ratings growing from 2.6% on March 8 to 13.6% on March 15. The highest increase was seen in younger audiences, with ratings increasing 23% for 5-9 year olds increasing and 22% for 15-19 year olds.

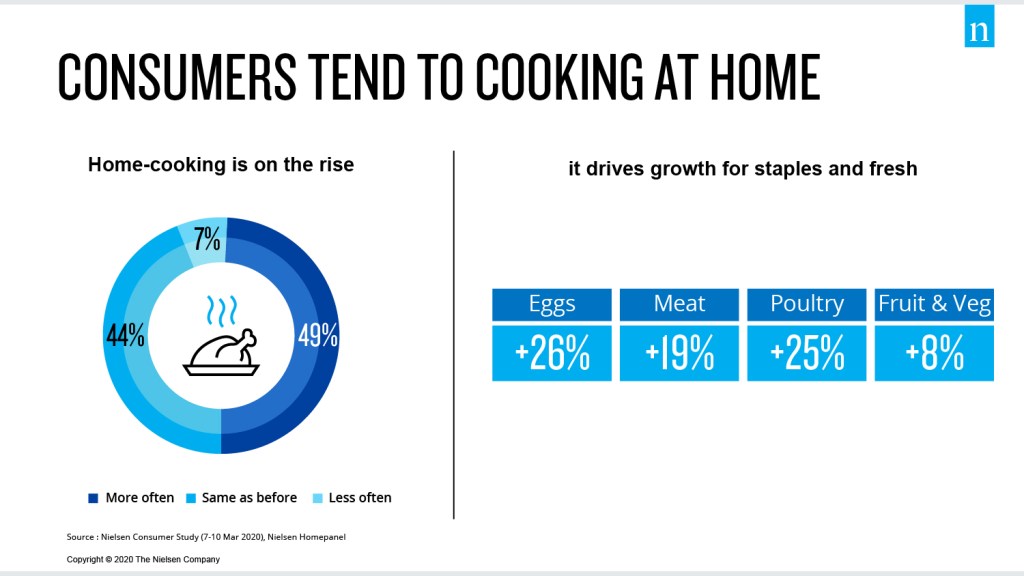

Across other countries in Asia, we’ve seen the rise of the “homebody economy” as consumers stay home due to concerns about the virus and shift their spending to serve this new lifestyle. In Indonesia, 50% of consumers have reduced out-of-home entertainment, and 46% have reduced eating out. On the other hand, 49% of consumers cooked at home more often, and this has driven the sales growth of staples and fresh products, such as eggs (+26), meat (+19%), poultry (+25%) and fruit and vegetables (+8%).

To prepare for stay at home measures, consumers around the world have been purchasing similar products as part of their pantry preparation. In Indonesia, many shoppers turned to Modern Trade outlets for much of their pantry prep, though there were some differences across consumer segments and regions. On the national scale, Upper Class consumers shopped more at Hypermarkets/Supermarkets than other consumers. Meanwhile, the trend in JakartaGreater is different, where not only Upper Class, but also Middle and Lower Class consumers shopped more at Hypermarkets/Supermarkets.

In addition to stocking up on pantry goods, health and hygiene have become major concerns for consumers amid the current pandemic. And early studies from China show that health will likely continue to be key concerns as infection rates slow and Indonesia enters a new normal. As many as 44% of respondents claimed that they consume health products more often, and 37% who claimed they consume vitamin drinks more often. Industry players for vitamins and pharmacies seized this opportunity and increased their advertising budgets on TV. Vitamin ad spending increased 14% and reached more than IDR90 Billion, while cough medicine ad spending increased 22%, reaching more than IDR30 Billion.

For retailers, the current situation can create an opportunity to keep their business going and at the same time to help provide what consumers’ needs during the stay at home period. Supermarket and hypermarket have the opportunity especially from Upper and some Middle SES consumers, who might look for sufficient stock and more product alternatives in the absence of their usually preferred items. Meanwhile, Minimarket is the preferred choice across SES for its proximity, which helps consumers to avoid large crowds and from using public transportations.

The most important thing that retailers need to do is to monitor their stock allocation as there are risks to the distribution line. Delivery services with simple ordering methods and easy access to consumers, and utilizing omnichannel communication, including TV, internet, social media, messaging and chat apps, will help businesses to fulfill consumers’ needs.

Read in Bahasa Indonesia.

Methodology

Sources include Nielsen Consumer Study (7-10 Mar 2020), Nielsen Scantrack (Jan-Mar 2020 vs Jan-Mar 2019), Nielsen Home Panel (Jan-Mar 2020 vs Jan-Mar 2019), Nielsen TV Audience Measurement (1-18 Mar 2020), Nielsen Ad Intelligence (1-18 Mar 2020).

Learn more from our complete COVID-19 coverage.