Market mix modelling (MMM) is widely used to review and optimise media spend, using sophisticated mathematical models of the past to predict the future – but if the findings and recommendations aren’t translated and implemented into your media planning and buying strategy, nobody wins and these powerful analytics projects become a sophisticated, but shelved, ‘nice to know’.

Mondelēz, Carat and Nielsen set out to change this during a recent project with the Cadbury brand. The three players came together to flip the equation and put the consumer at the heart of the analysis with impressive results.

Market Mix Models as an enabler rather than a capability

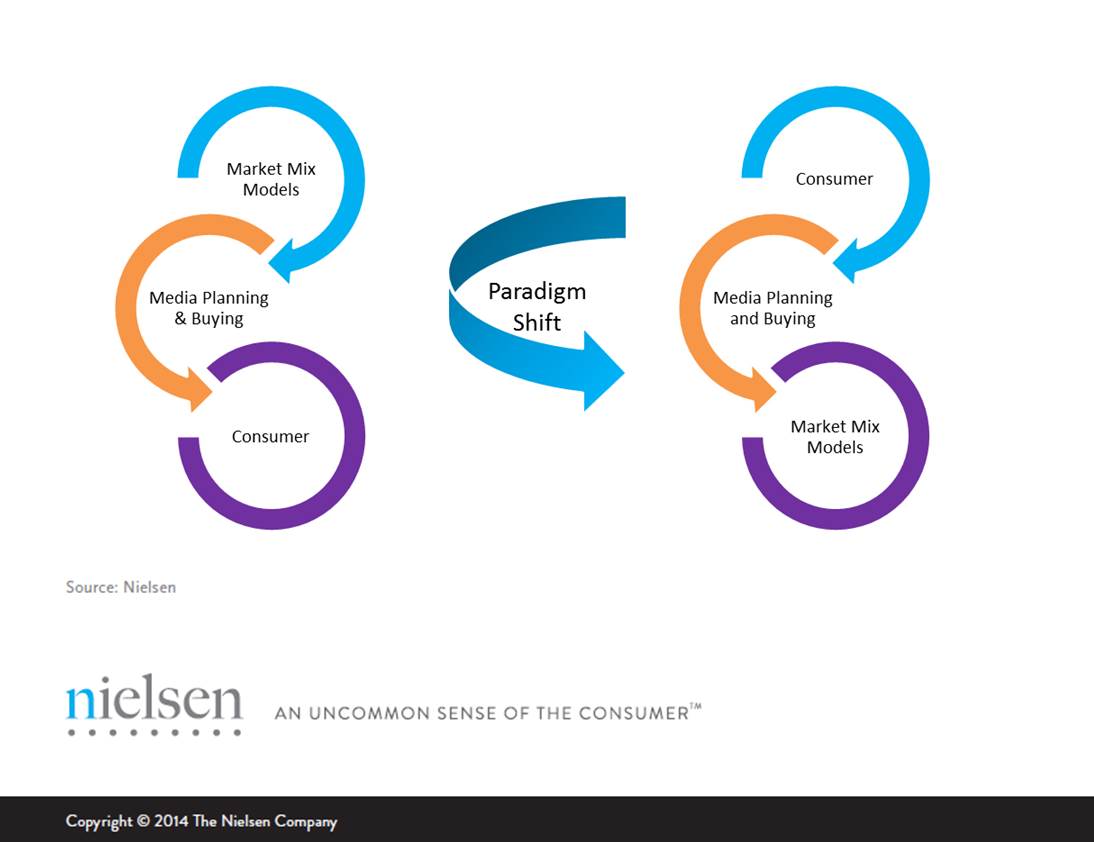

With a goal to optimise and execute media spend using the consumer as the start; we decided to do things differently to the usual MMM process. We started with the end goal in mind and figured out how to run our models to enable that end goal rather than dictate the end goal, a paradigm shift in the MMM world.

We set out to understand the individual drivers of media response in order to increase the effectiveness of Cadbury’s advertising program without needing an increased media budget; we simply wanted to find a smarter way of planning Cadbury’s existing media spend that would more effectively and efficiently, resonate with their consumers.

Cadbury is already a well-known brand and has strong equity in the market. Instead of focusing predominantly on TARPs as the central TV buying measure, we examined the buying behaviours of Australian chocolate consumers and established the need to plan using reach and frequency goals that were appropriate for this much loved brand.

We looked at many different variables in order to understand what components (and by how much) each of them elicited a sales response in our chocolate consumer; day-part of media airings, media vehicle, TV copy durations, flighting strategies, unique reach and frequency, as well as in-store activity over the past three years were just some of the variables under the microscope.

The new approach however, required a rethink from all parties as to how the measures are used and applied:

- Mondelēz and the Cadbury brand team needed to rethink the use of internal MMM and guidelines, as well as the conversations their brand teams had on a global level

- Carat needed to rethink the conversation it had with the Mondelēz marketing team and how the media strategy was developed, as well as the traditional principles of media buying

- Nielsen needed to rethink traditional ways of running MMM to ensure we could accurately measure optimum reach and frequency cap thresholds, amongst other variables

Key learnings from this process

1. Collaboration is the key to successToo often MMM is done in isolation and the powerful learnings that can be identified in these projects aren’t directly applied or implemented. By getting the media strategists, marketing and sales managers and researchers all in one room, collaborating, the results were staggering.

2. Consumer insights need to be placed at the heart of research. By starting with the end goal in mind and putting the need to understand consumer behaviour and response at the centre of our analysis, we were able to focus on learning what was best for this particular brand and the people who buy it. Media return on investment was impressively increased and the marketing campaign was optimised with no additional budget.

The result was incredibly satisfying for all parties; not only did it teach all of us new understandings and ways to look at media analytics, planning and buying, it also showed us what can truly be achieved when all stakeholders collaborate with one goal in mind.

Optimising media spend by putting the consumer first

These insights were presented live on stage at Nielsen’s Consumer 360 conference (July 31 – Aug 1, Fairmont Resort, Blue Mountains). Multinational food manufacturing giant, Mondelēz, and leading Australian media agency, Carat, discussed how a truly holistic and collaborative approach for one of Australia’s most loved brands, Cadbury Dairy Milk, created a winning media plan. The 2014 plan culminated in efficient, but also realistic reach and frequency goals, true continuity on air and efficient use of 15 second copies. The result was a high return on media investment and a measurably strong sales result.