Despite falling into one generation, Millennials are not a uniform, homogeneous group with a common set of beliefs, interests and behaviors. Their lives are in rapid transition: They’re joining the workforce, moving into their own homes and starting families. And these changes influence their media consumption habits, including how and when they listen to the radio.

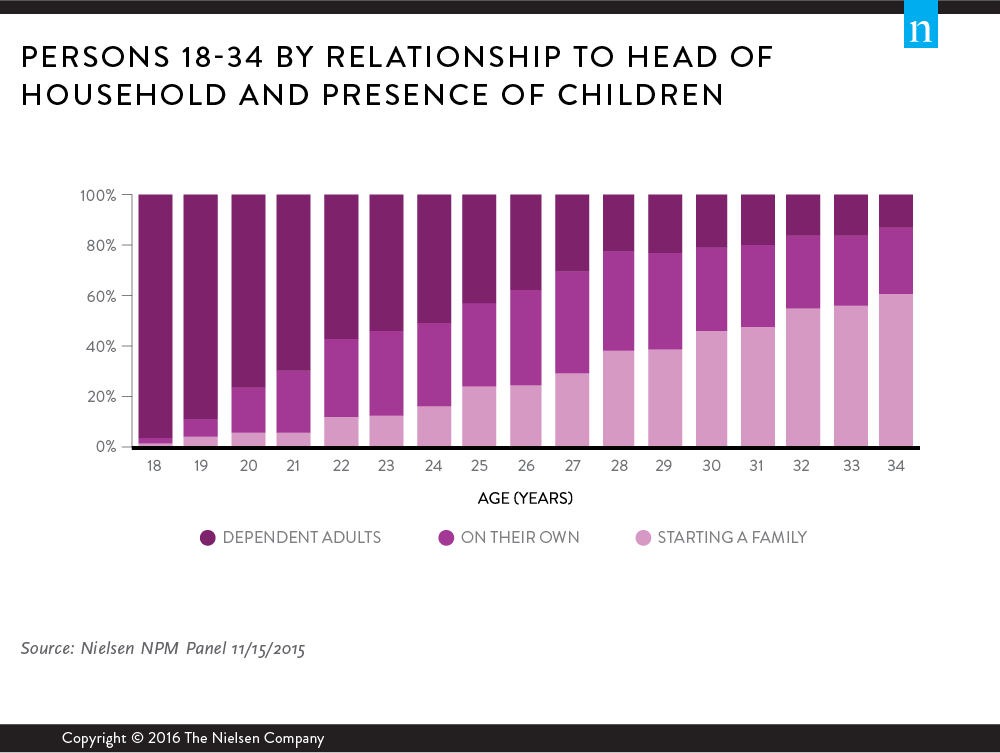

To better understand the media habits of the different sub-groups within the overall Millennial generation, Nielsen’s fourth-quarter 2015 Total Audience Report separated the 18-34 crowd into three different groups: Dependent Adults (those living in someone else’s home), On Their Own Millennials (those living in their own home without children), and Starting a Family Millennials (those living in their own home with children). The data showed that 97% of 18-year-olds live in someone else’s home, primarily a parent’s or parents’; by their mid-30s, 90% of Millennials live in their own home, and more than half have children. Interestingly, one-third of 26-27 year olds falls into each of the three life stages.

Radio’s Reach Among Millennials

For Millennials, radio is an important part of their lives, and they listen in many ways as they are moving through different life stages. Getting insight into their radio listening habits is critical for advertisers, agencies and radio broadcasters as they need to know when and how to reach these different groups of Millennials.

In the average week, radio reaches about 90% of Dependent Adult Millennials and 89% of On Their Own Millennials. But that number rises to 92% among Millennials who are Starting a Family. This group also contains a higher percentage of Hispanics, who tend to be heavy radio listeners.

On average, radio reaches nine out of 10 Millennials across all three life stages each week.

Millennials’ Top Formats

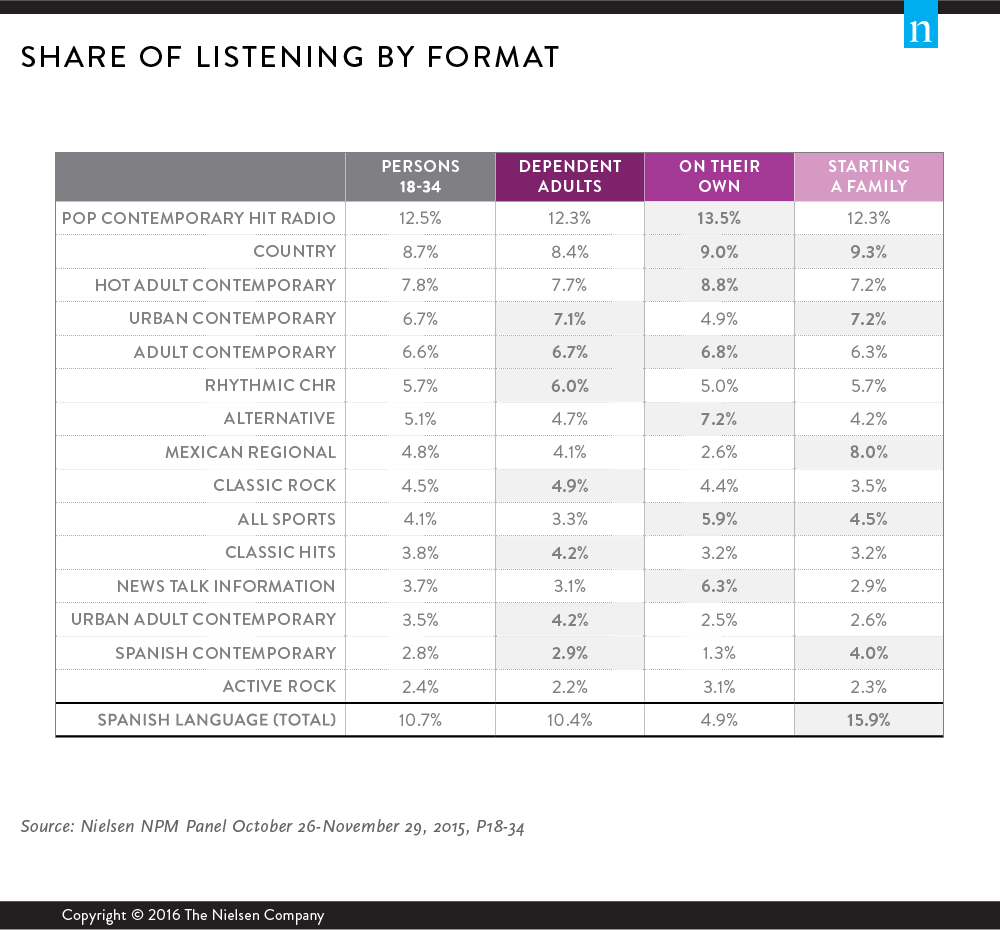

What Millennials listen to is also greatly driven by life stage. Although Pop Contemporary Hit Radio is the No. 1 format for all three groups, other format preferences within these groups vary by life stage experience.

Dependent Adult Millennials, who tend to live at home with their parents or another adult, listen to more Classic Rock, Classic Hits and Urban Adult Contemporary than the overall Millennial group. According to the recent Total Audience report, Dependent Adult Millennials listen to these formats because they’re exposed to them by older adults in the home.

On Their Own Millennials are the least ethnically diverse group and show a preference for non-ethnic formats like Hot Adult Contemporary and Alternative. They also listen to sports stations more than the other two Millennial groups.

On average, radio reaches 97% of all Hispanics each week. Starting a Family Millennials include the highest percent of Hispanic and Spanish-speaking listeners. In this group, Mexican Regional has the third-highest share of listening time. Overall, 16% of this group’s listening is spent tuned in to Spanish language formats – more than triple the amount of On Their Own Millennials. Comparatively, radio reaches 90% of all African-Americans 18-34 each week. Urban Adult Contemporary is the No. 1 format among this group.

Radio Effectively Reaches Millennials

With 265 million Americans 6 and older listening to the radio each week, the medium reaches more people each week than any other platform. Despite the proliferation, many advertisers perceive Millennials as unreachable by radio because of the abundance of media options available to them.

The reality, however, is that Millennials account for 66.5 million radio users each week. And no matter which life stage Millennials are in, nine out of 10 listen to radio weekly. That’s where ungrouping them can help advertisers, agencies and radio stations understand each group more closely so they can develop meaningful radio advertising that appeals to this large and varied group of young consumers.