Can you believe the new school year is just around the corner? And while some parents may be ready for the break that comes when they can send their kids back to the classroom, others with older children may be saddened by the prospect of sending their kids off to college. In preparation, consumers will fill their shopping carts with school supplies, clothing and an array of items to deck out dorm rooms. But binders, pens, backpacks, comforters and lamps won’t be the only items on Americans’ back-to-school shopping lists.

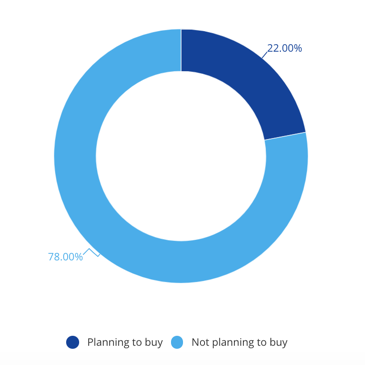

According to Nielsen Scarborough, one in five (22%) U.S. households with a child in college are also planning to buy a new or used vehicle during the upcoming year. That’s approximately 1.5 million households that potentially have a vehicle on their back-to-school shopping lists—and that’s a segment that auto manufacturers and dealers alike will need to understand and know how to reach. Luckily for them, digital can provide the answer.

“Back To School Auto Shoppers” are digital enthusiasts. Sixty percent identify themselves as a “Mobi-Essentialist,” someone who sees the internet as a lifestyle enabler and is rarely seen without their mobile device. These individuals are always eager for the latest news and information, and that even holds true when it comes to automobile buying. Back To School Auto Shoppers are 21% more likely than the average auto shopper to strongly agree that they research and compare as many vehicles as possible before making a final purchase.

And when it’s time to conduct that research, they’ll often turn to the internet. One in three (34%) Back To School Auto Shoppers say they’ve used the internet during the past year to gather automobile information. They’re also thorough in their information gathering, as they turn to a variety of online sources, including auto specific, traditional media and socially oriented websites. Back To School Auto Shoppers are 28% more likely than the average auto shopper to have used an auto dealership and/or auto manufacturer site/app, 16% more likely to have visited a radio website, 15% more likely to have visited a broadcast TV website and 10% more likely to have visited a newspaper website. Social networking also plays a major role in their quest for auto information, with 84% having engaged in the platform during the past 30 days, spending an average of one hour and 45 minutes there each day.

Understanding what will be on those automotive shopping lists will help guide dealers and manufacturers in developing digital creative and content that will resonate with this eager-to-buy audience. The majority, 66%, of Back to School Auto Shoppers plan to buy a used vehicle, while 39% will be in the market for a new one (and 5% plan to buy both a new and a used vehicle). Those buying used vehicles are more likely to have a midsize car on their list, while those buying new have their sights set on a sports utility vehicle. And both are likely to want to hear about all the bells and whistles, as they’re more likely than the average auto buyer to currently have vehicles with upgraded features.

So what’s going to drive auto buyers to pick a certain make or model? Don’t count on brand loyalty to bring home the sale, as only one in 10 say they completely agree that they’re loyal to vehicle brands and stick with them. Rather than brand, value and price will be the primary consideration among Back To School Auto Shoppers. About one quarter of new and used shoppers cited it as the No. 1 reason they used their last auto dealer.

But to be clear, that doesn’t mean Back To School Auto Shoppers aren’t willing to spend money. In fact, they plan to pay $2,000 more than the average auto shopper on both new and used vehicles. Selection of makes and models is also important to both new and used vehicle seekers, but those in the market for a new auto will also be looking for finance options through the dealer. Those in the used market, on the other hand, are more concerned with dealer reputation.

Across the many areas of consumers’ busy lives, digital is becoming an increasingly important way to get the information they need to make educated purchase decisions, and car buying is no exception. And that means dealers and manufacturers need to ensure that they’re part of the mix if they want their vehicles to be included in the back-to-school shopping opportunity.