As audiences continue to increase their streaming consumption, sports are ready to join the ranks of hit programs like Stranger Things, Only Murders in the Building and Obi-Wan Kenobi. And with new streaming-exclusive deals involving the NFL and MLS in play, fans are ready, as more than one-third of U.S. homes now access TV programming strictly through an internet connection1.

While more than 90% of the homes in the U.S. have access to the internet, the growing abundance of video streaming services and content—both live and on-demand—provides audiences with ample choice outside of traditional TV options. And select sports leagues are transitioning as well. This year, the NFL’s Thursday Night Football (TNF) became exclusive to Amazon Prime Video; and starting next season, MLS matches will be exclusive to a new streaming service within the Apple TV app.

These two rights deals signal the shift that has been building as emerging digital platforms have progressively increased their stakes in sports rights. While some deals will continue to involve a mix of linear and streaming, such as the new Big Ten Conference deal, recent viewership trends illustrate how comfortable fans are in accessing sports content without traditional broadcast and cable access.

According to Nielsen Fan Insights, 80% of sports fans, 76% of NFL fans and 89% of soccer fans have regularly or sometimes watched sports on any streaming or online channel this year.

From a sheer viewing perspective, audiences appear far more engaged with streaming NFL games on Amazon than they are with watching them on premium cable. Nielsen TV viewership data shows that the first three TNF games on Amazon Prime Video this year attracted significantly more viewers (13 million, 11 million and 11.7 million, respectively) than each of the seven Thursday games from last year that aired only on the NFL Network.

This viewership data highlights how much has changed since Twitter first streamed 10 TNF games during the 2016-17 NFL season alongside the traditional broadcasts, and homes that get their TV content through an internet connection are ready.

These homes, dubbed broadband-only homes2, spend an oversized amount of time with sports programming, along with local and national news. Across the top 56 U.S. local markets where Nielsen measures TV audiences, BBO households are 36% more likely to watch sports events than the average TV household. In some markets, they are twice as likely to view sports events3.

As a genre, sports has been slower to migrate to streaming platforms, but audiences’ appetite for over-the-top content continues to grow. In August 2022, streaming captured 35% of total TV time, capping six consecutive months of viewership highs. Access preference is even clearer when we look at the decline in the number of TV households that receive their content solely from a cable or satellite provider.

Not surprisingly, the makeup of BBO households has broadened as the percentage of these homes has increased over time. While people 25-34 are the most likely to live in a BBO home (58.7%), internet connectivity, access to it and content availability have inspired adoption among much wider audiences. For example, more than 51% of kids 2-11 live in a BBO home, as do nearly one-quarter of adults 50-64. Just five years ago, only 2.1% of adults 50-64 lived in a BBO home.

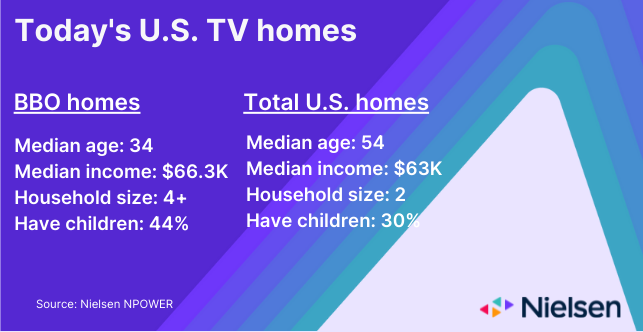

Even with the broadening makeup of BBO homes, the majority are younger, are larger in size and earn more than the average U.S. household. And not surprisingly, the highest concentrations of BBO homes are in major metro areas, simply due to infrastructure access.

In the years ahead, we expect the composition of BBO homes and their geographic concentrations to broaden, largely because of the many initiatives being introduced to provide affordable, reliable high-speed internet access to under-served areas.

On Sept. 22, 2022, for example, the Biden-Harris administration announced $502 million in loans and grants in the third funding round of the USDA’s ReConnect Program to provide rural residents and businesses in 20 states with high-speed internet access. In total, Biden’s Bipartisan Infrastructure Law provides $65 billion to expand affordable, high-speed internet to all communities across the U.S. And at a more local level, an array of counties, cities and towns are making similar commitments to deliver and expand broadband infrastructure, such as Kenosha, Wis., rural North Carolina and Whiteside County, Ill.

The increasing focus on new broadband infrastructure, coupled with Americans’ plans to increase their streaming usage in the coming year, serves as additional evidence that audiences will continue gravitating to over-the-top, digital content options, including sports—one of two genres that remains a fixture within traditional linear TV programming. Given the strong appetite for sports and news among BBO homes, combined with the significant audience engagement with the first TNF game on Amazon, it’s likely that streaming services will continue to expand by offering different genres that BBO viewers are clamoring for.

Notes

- Nielsen NPOWER

- Broadband-only homes received their TV programming through a high-speed internet connection

- Nielsen Local TV measurement July, 2022

A version of this article originally appeared on Streaming Media.