- India’s male grooming market to hit INR 5000 crores by 2016

- Personal and Professional image building is primary motivation for consumers

- Grooming perceptions stronger in metros than in smaller towns

At the time you are reading this featured insight, the global male grooming products segment will have generated more than $33 billion* in revenue!

This shouldn’t really come as a surprise, given that the global beauty industry is breaking new technological grounds nearly every day. Growth is largely driven by product innovation, an expanding middle class and an increasing interest in personal appearance, boosted by endorsements by celebrities and sports stars. And when it comes to specific areas of opportunity, the male grooming products market continues to drive expansion in the wider global cosmetics market.

In India too, fast-moving consumer goods (FMCG) companies are reaping the benefits of rising consumer sophistication. Higher incomes, exposure to international trends and concerns about aging, in addition to interest in personal appearance and grooming, have spawned whole product ranges catering to diverse needs and tastes. In fact, a market that was once was limited to shaving foam, deodorant and razors has made way for a dazzling array of products, spanning hair care, skin care and hygiene. As a result, male grooming is one of the fastest growing sectors in India’s personal care segment.

In order to gain some insight into the male grooming segment in India, we studied three sizeable product categories: fairness creams, face washes and deodorants.

Grooming Perceptions And Motivations

Contrary to popular belief, men don’t typically use grooming products only to increase their appeal to the opposite sex. Rather, most respondents said they felt the need to improve themselves—evolve their personal hygiene. Good grooming, they believe, is conducive to boosting self-confidence.

Not surprisingly, however, Nielsen research indicates that grooming perceptions are stronger in metros and urban towns than in non metros.

The ‘Super Groomers’

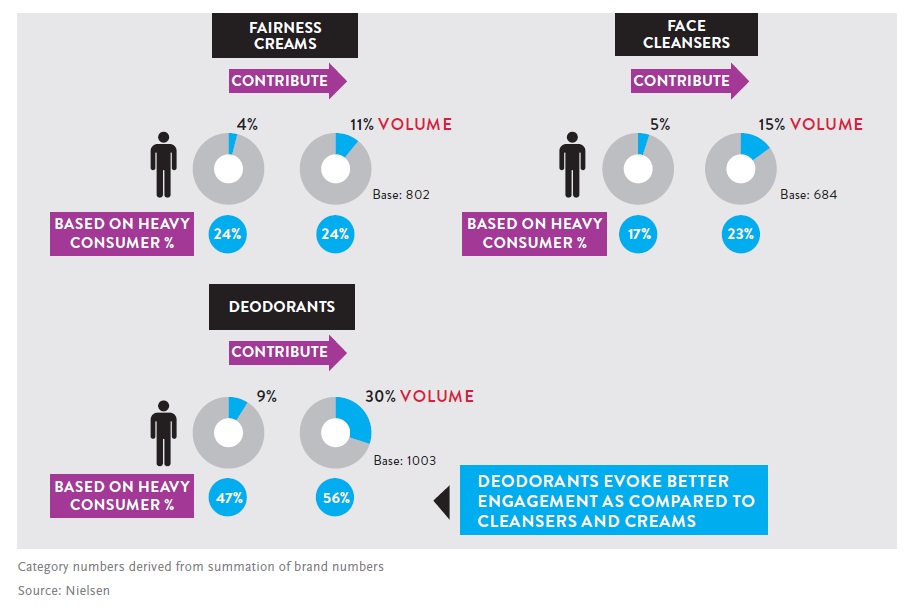

Depending on usage volume and frequency, we categorize consumers of male grooming products as heavy, medium and light users. The analysis was done at an individual brand level and then scores across brands were aggregated to arrive at a category view.

As the next step we looked at the engagement level among the heavy users. The parameter we used to gauge engagement levels was the Nielsen Brand Equity Index (BEI). Higher the brand equity index, higher the engagement.

Profiling Super Consumers

We then looked at the profile difference between the super consumers and the universe. An analysis of the fairness creams category showed that super consumers for this category are typically metro dwellers, affluent, upwardly mobile and sociable. Grooming is important to them and they understand its contribution to their professional and personal presence. They look for grooming products that are age and gender appropriate.

Super Consumers, Super Contributors

Surprisingly, there are fewer super consumers in the male grooming category than there are in other FMCG categories. From the chart below, you can see that out of the total consumers of fairness creams in the market, super consumers account for just 4%. However, they contribute 11% of sales – three times their size.

* According to research by Global Analysts Inc.

For more details download the full report (top right).