Watching TV is Canadians’ favorite leisure activity, but the very definition of TV is changing. Given the expanding array of screens, viewing platforms and content options, how are Canadian viewers consuming TV today?

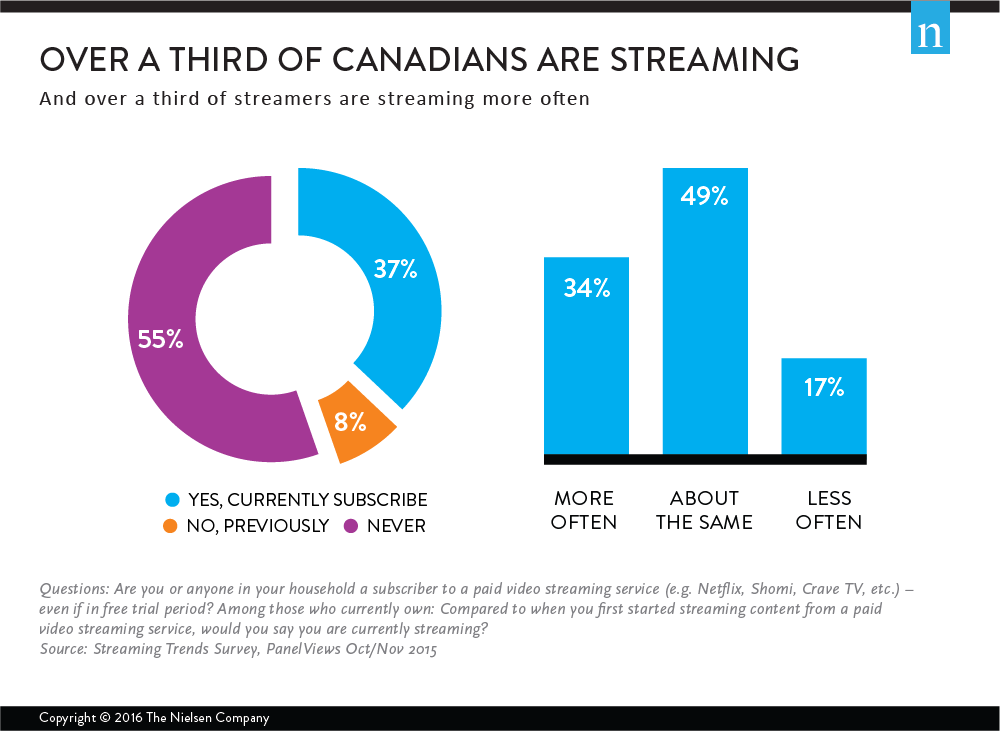

According to a new survey of Canadians who participate in Nielsen’s HomeScan panel, more than one-third of Canadian viewers (37%) access TV content using subscription video-on-demand (SVOD) services, such as Netflix, Shomi or Crave TV. A further one-in-10 (8%) are lapsed users of a paid streaming service, meaning that almost half of all viewers in Canada have watched TV content via SVOD.

While current streaming in Canada is at a lower level than in the U.S. (where penetration of SVOD is now 46%, up from 40% in 2014), usage among families with children, those under 35 years of age, and among Canada’s South Asian community are much higher. Penetration of streaming services increases with income, and usage among the English-speaking population is much higher than among the French-speaking population (44% vs. 13%), a strong suggestion that the availability of language-appropriate content is a big driver of usage.

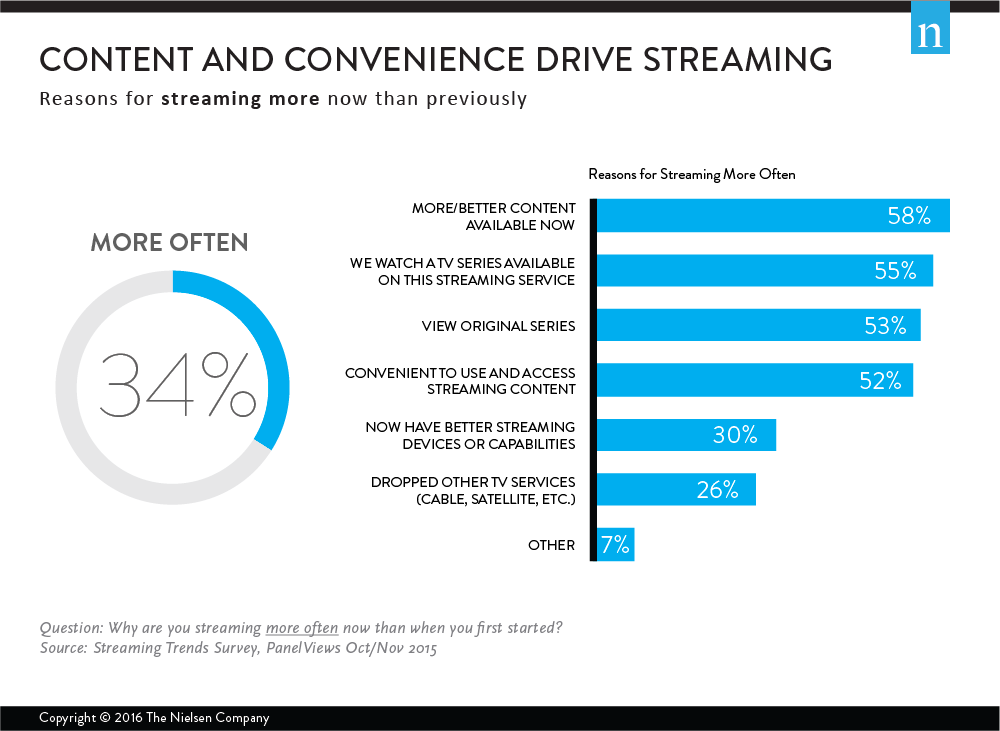

Most viewers use streaming to watch both TV series and movies (60%), with fewer people being TV dominant (19%) or movie dominant (21%) in their usage. While half of subscribers are streaming about the same amount as when they first subscribed, one-third are streaming more often. However, the amount of time they devote to watching is still less than traditional TV. While traditional TV viewing averages about 20 hours a week, viewing averages less than 6 hours per week through SVOD, and the vast majority of Canadians (83%) stream less than 12 hours of content per week.

Viewers cited several reasons for the increase in streaming—including the greater quality and quantity of content available now, the exclusivity of original content on certain platforms or loyalty to a particular show on a streaming service. While content is crucial, convenience is also a major driver of growing usage of SVOD for more than half of users, as is the improved technology for 30%.

And content choice is a lesser factor for some. Among the minority of users streaming less content today (17%), lack of time is the primary reason. Compare this to the small group of viewers who have let their membership lapse, and we found cost is the primary reason for cancelling a subscription service—one third of them didn’t watch enough to justify the subscription, and a further third only used it while access was free.

How are Canadians watching this content? Audiences prefer larger screens for the SVOD viewing experience. Content is more likely to be accessed through a PC/laptop than any other device (43%), with tablets (33%) also much more popular than smartphones (22%). For families with children, tablet viewership is highest, at 46%. One-third also access directly through a smart TV, and one-quarter watch through a dedicated streaming device like Chromecast or Apple TV.

Among those with an SVOD service, 75% have also retained their TV service. Media and industry attention has focused a lot on cord cutting, but most viewers who stream continue to subscribe to their regular TV service too. Cord cutters, where they exist, skew younger and lower income. The most common reason to retain TV is to have access to live news and events. SVOD content also traditionally lags regular TV broadcasts, and many still prefer to watch shows on regular TV before they become available on paid streaming services. They are not prepared to wait. Nor are they prepared to give up the variety that regular TV provides—in Canada, more so than in the U.S., viewers believe that they can’t the full breadth of content through SVOD services.

Content providers will need to balance the quality and quantity of programming on offer, both on regular TV and on streaming platforms, as well as the cost/benefit to viewers, as new patterns of media consumption continue to emerge. Viewers have unprecedented choice in what, when and where to view, and they will continue to expect greater ‘remote control’ over their viewing behavior. This will have long-term impact for advertising, pricing and competition for viewership.

Methodology

Data for this study came from an online HomeScan survey fielded between Oct. 19, 2015, and Nov. 8, 2015, to the heads of household from our Homescan Household Panel. There were 6,448 Canadian respondents aged 18 and older.