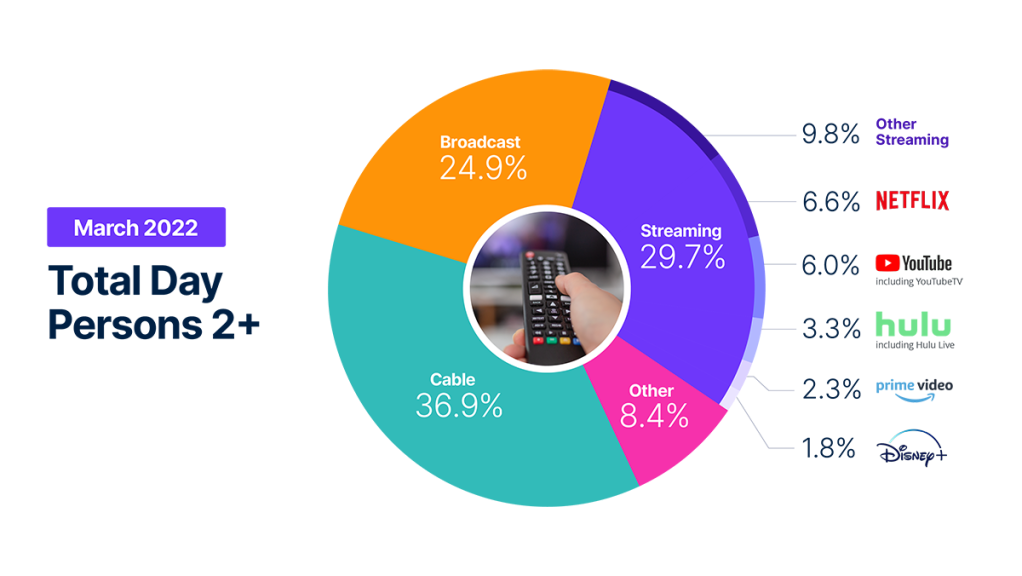

Total usage of TV down, but streaming accounted for nearly 30% of total time with TV

March marked a new milestone for streaming, as audiences spent nearly 30% of their total TV time watching over-the-top video content. Gaining a full share point over February, streaming services benefited from the transition away from the finale of professional football and the Olympics, which bolstered fall and winter TV viewing across broadcast networks.

Despite a slight 0.7% decrease in total streaming, viewing share across all of the streaming providers captured in The Gauge was either flat or gained slightly in March, with the “other streaming” category grabbing an additional 0.3% share as new services steadily gain traction in an ever-expanding field (“other streaming” includes any high-bandwidth video streaming on TV that is not individually broken out) .

The slight dip in streaming usage was much less than the 4.2% drop in total TV usage, which tracks with historical norms as consumers begin to ease into warmer weather. Despite the dip in total usage, audiences spent more TV time with cable, as the ongoing war in Ukraine fueled an increase of 1.6 share points on a slight increase in total volume.

Broadcast programming lost more than a full share point, with sports viewing down 53% on a month-over-month basis. NASCAR and the NCAA basketball tournaments helped satiate some viewers, but not enough to account for the draw of the Olympics and the Super Bowl, causing the “sports event programming” share of viewing to fall from almost 25% to 12% in March. Dramas provided some upside for broadcast, as a 17% increase in viewing helped it account for one-third of total broadcast viewing.

2022

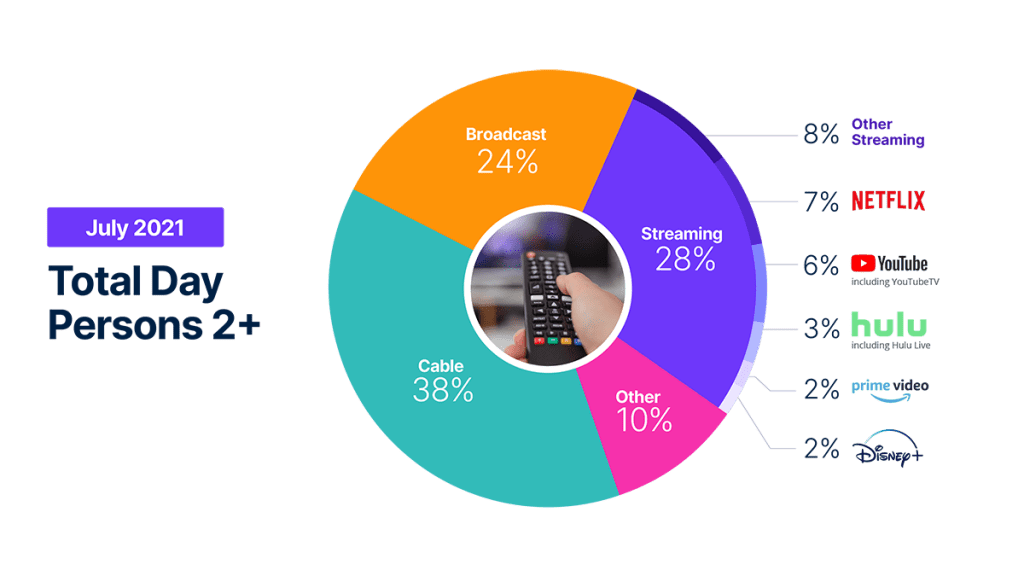

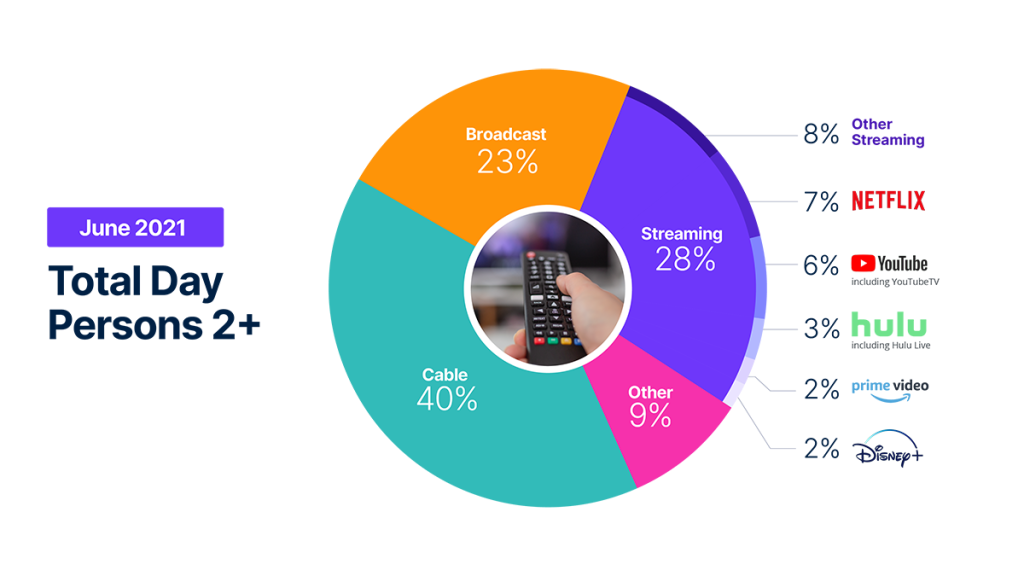

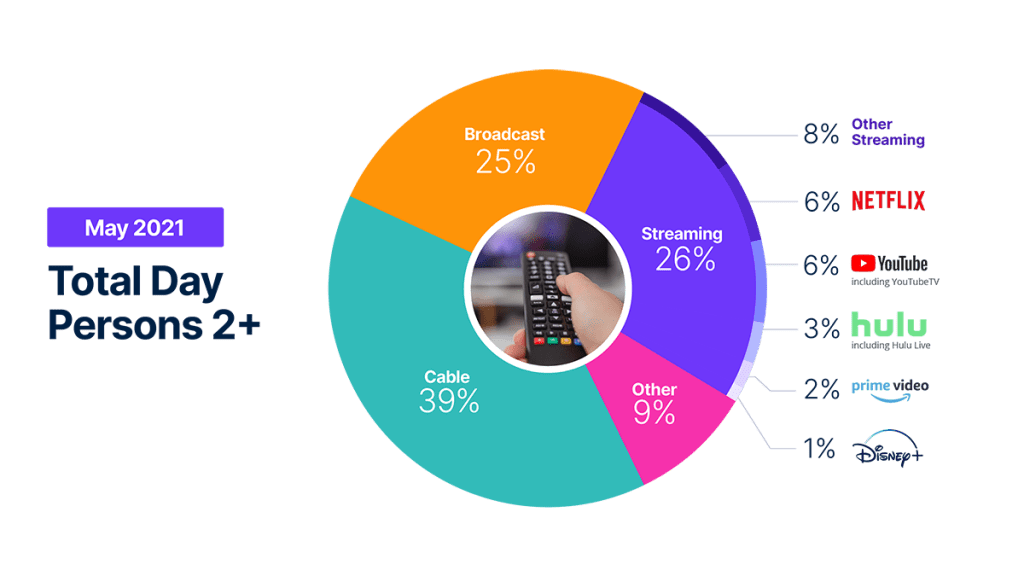

2021

Take me to the methodology details below.

Watch the video to hear Brian Fuhrer, SVP, Product Strategy at Nielsen provide a behind the scenes look at some of the viewing changes underpinning The Gauge.

METHODOLOGY AND FREQUENTLY ASKED QUESTIONS

The Gauge provides a monthly macroanalysis of how consumers are accessing content across key television delivery platforms, including Broadcast, Streaming, Cable and Other sources. It also includes a breakdown of the major, individual streaming distributors. The chart itself shows the share by category and of total television usage by individual streaming distributors.

The data for The Gauge is derived from two separately weighted panels and combined to create the graphic. Nielsen’s streaming data is derived from a subset of Streaming Meter-enabled TV households within the National TV panel. The linear TV sources (Broadcast and Cable), as well as total usage are based on viewing from Nielsen’s overall TV panel.

All the data is based on a specific time period for each viewing source. The data, representing a 5 week month, includes a combination of Live+7 for weeks 1 – 4 in the data time period. (Note: Live+7 includes live television viewing plus viewing up to seven days later. Live +3 includes television viewing plus viewing up to three days later.)

Within The Gauge, “Other” includes all other TV. This primarily includes all other tuning (unmeasured sources), unmeasured video on demand (VOD), streaming through a cable set top box, gaming, and other device (DVD playback) use. Because streaming via cable set top boxes does not credit respective streaming distributors, these are included in the “Other” category. Crediting individual streaming distributors from cable set top boxes is something Nielsen continues to pursue as we enhance our Streaming Meter technology.

Streaming platforms listed as “Other Streaming” includes any high-bandwidth video streaming on television that is not individually broken out.

Yes, Hulu includes viewing on Hulu Live and Youtube includes viewing on Youtube TV.

Encoded Live TV, aka encoded linear streaming, is included in both the Broadcast and Cable groups (linear TV) as well as under Streaming and other streaming e.g. Hulu Live, Youtube TV, Other Streaming MVPD/vMVPD apps. (Note: MVPD, or multichannel video programming distributor, is a service that provides multiple television channels. vMVPDs are distributors that aggregate linear (TV) content licensed from major programming networks and packaged together in a standalone subscription format and accessible on devices with a broadband connection.)