In 2018 the insurance sector spent nearly $79 million in New Zealand on advertising to reach potential insurance buyers. Whether it is car, contents, house, life, medical, travel or other insurance, 2,861,000 New Zealanders aged 20+ hold at least one insurance policy (approximately 81% of the total population). In addition, we have increased our purchase of insurance policies online by 30% compared to 2016, with nearly 345,000 purchasing an insurance policy online in 2018.

Car insurance is the most common policy to hold with close to two-thirds of Kiwis having car insurance, followed by contents and house insurance policies.

SPOTLIGHT ON THE TRAVEL INSURANCE OPPORTUNITY

413,000 (29% of overseas travelers) did not take up insurance on their last trip which means there is a real opportunity to grow this sector. We estimate that if Kiwi travelers going to the top five holiday destinations (Australia, China, Pacific Islands, UK/Europe and Japan) paid for a basic travel insurance policy for the duration of one week, this would be worth approximately $12.8 million additional value to the market.

29% of New Zealanders that traveled overseas did not take up insurance on their last trip

KIWIS DO FLY:

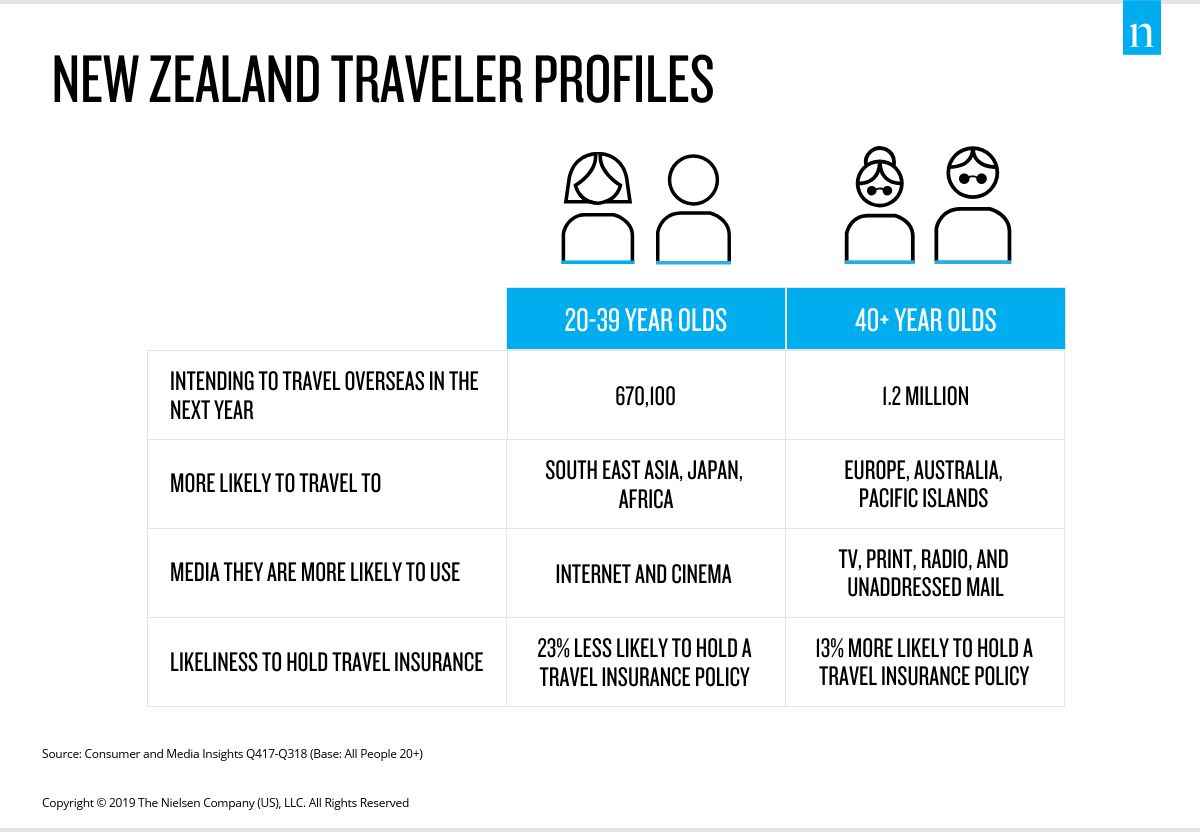

Almost 1.5 million Kiwis travelled overseas in the last year (an increase of 120,000 from 2016). People living in these households spend approximately $2.8 billion on travel during the year. However, not all travelers are the same, making it important for travel insurance companies or other brands/companies within the travel-industry to have a deeper understanding of their target customers. For example, the infographic below highlights that 20-39 year olds are more likely to travel to destinations like South East Asia, Japan and Africa and are also less likely to be insured during their travels.

CATCHING UP WITH THE ELUSIVE KIWI

With changing travel tastes, more Kiwis travelling than ever before, and the increasing proportion of online-purchased insurance policies, travel and tourism and travel insurance companies need to understand:

- “Which travel destinations have the most appeal to New Zealanders?”

- “Which experiences are modern travelers looking for?”

- “What media mix is required to reach these customers?”

- “How well covered are Kiwis when they go abroad?”

Source: Consumer and Media Insights (CMI), Q417-Q318, (Base: All People 20+).

Source: Nielsen Ad Intel, Jan-Dec 2016, Jan-Dec 2018.

Methodology

ABOUT NIELSEN CONSUMER AND MEDIA INSIGHTS (CMI)

In this environment, breadth of understanding of consumer attitudes, media consumption and their day to day behaviours is essential. Nielsen Consumer and Media Insights provides views of consumers you want to identify, understand and then reach. Meaning you don’t rely on too narrow a view of a customer. The data is gathered via an independently audited survey of 11,000 New Zealanders aged 10+. It uses mixed methodology and is weighted to Statistics NZ population data for national representation.

ABOUT NIELSEN AD INTEL

In New Zealand, advertising spend is a $3.5 billion industry spanning across TV, print, online display, radio, out-of-home, unaddressed direct mail and cinema advertising. Nielsen’s Ad Intel solution provides Advertisers with an understanding of who has advertised, on which medium, and how much was spent – delivering competitive ad spend intelligence at a granular level (i.e. category, advertiser, product and/or media type).