Across the region, for every ad featuring strong women and girls, there’s the inexplicable product that was marketed specifically to women—but didn’t have to be. From household cleaners to snacks, some brands are creating unnecessarily gendered versions of products and often charging women more for it.

But that doesn’t mean there aren’t opportunities for brands to market to women. In fact, some new brands are stealing the spotlight with solutions to women’s real life challenges. Female consumers are finding value in or make up brands that source and support local women community enterprises or endorse women entrepreneurs.

There are decades of cultural, political and religious inequities that either prevent women from working outright, restrict the types of jobs they can perform, the hours they work, or access to their finances. Within the region, there are vast differences in women’s participation in the labour force. In Middle East and North Africa (MENA), only 21% of women are in the formal labour force compared with 61% in Sub-Saharan Africa (SSA).1

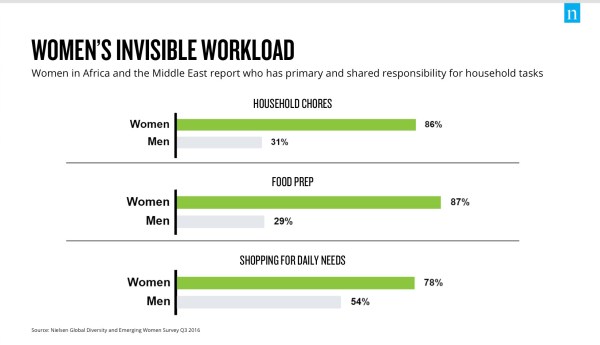

For brands to succeed today, they need to find ways to address the problems women face. Making up half of the population, women are the key influencers across the region. In reality, women still shoulder most of the household responsibilities. On average, 84% of women in AME say they have shared or primary responsibility for household chores and food prep. AME women are also significantly more likely to take on the primary care-taking role for children/elderly parents and extended families compared to global counterparts. Taking on this second, sometimes third job means that women have additional demands each week and less time to meet them. This makes women one of the largest opportunities for convenience-led technologies, products and services.

But convenience isn’t the only opportunity to make a significant difference in the lives of women. While almost half of AME women (48%) believe their financial situation is better than it was five years ago, it is not growing equally to men’s (54%). In fact, one in two AME women (50%) still believe they only have enough money for the basic necessities of life (compared with 42% of men).

There is growing evidence that the gender equality agenda is progressing in countries such as Saudi Arabia, UAE and Egypt. Governments have taken an interest in policies related to the protection of women’s economic and professional growth. Despite many challenges, including societal pressure on women to stay at home, a digital gender gap, and structural disadvantages in fund-raising and investments, this region has also become a hotbed for female entrepreneurs who are finding new and creative ways to enter the workforce.

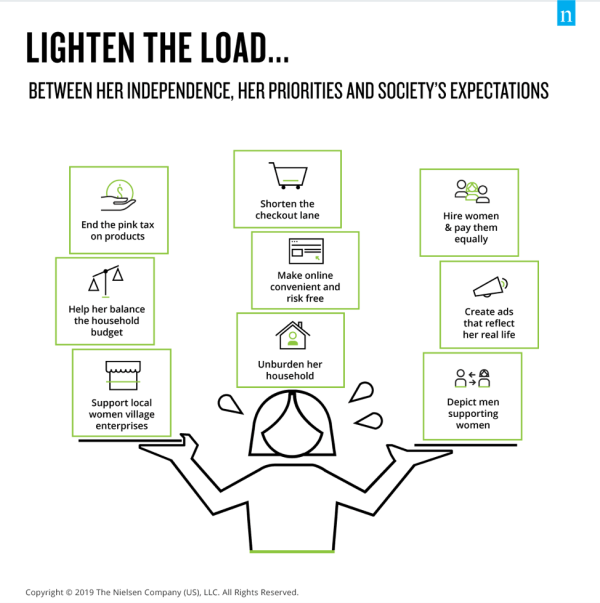

So how do we push for progress? Women must often balance traditional expectations of society and expectations of progress. Companies can become champions for women by addressing inequalities in hiring and employment opportunities, lowering the barriers to entry of formal employment; balancing inequalities in pay and recognition, establishing flexible hours or supporting women entrepreneurs.

Outside of the workplace, women are looking for ways to get back what they value most—time, which often means reducing hours spent completing daily chores. Brands can help women via product innovation and enhanced service delivery that simplify their daily routines (i.e., more transparent product labeling,meal kits). Brands also have an important role to play by removing gender stereotypes in their marketing and advertising materials. For example, instead of only featuring women doing the laundry, portray the benefits of sharing the responsibility.

Across AME, 61% of women say that a convenient store location is a highly influential factor when deciding where to shop, compared with 52% of men. The prevalence of traditional trade formats is testament to AME women’s ongoing need for proximity but they are also increasingly looking to more modern formats which offer ways to maximize efficiency, preferring stores that are easy to get in and out of, have organized layouts or those that offer time-saving, value-added services.

Women in across AME have significantly less access to mobile technology than men, compared to other regions in the world. In MENA, 80% women have access to a mobile phone2 compared with 69% in SSA, 9% and 15%, less than men, respectively. This lower access to technology adversely affects how they can access employment opportunities, finances, communicate or shop.

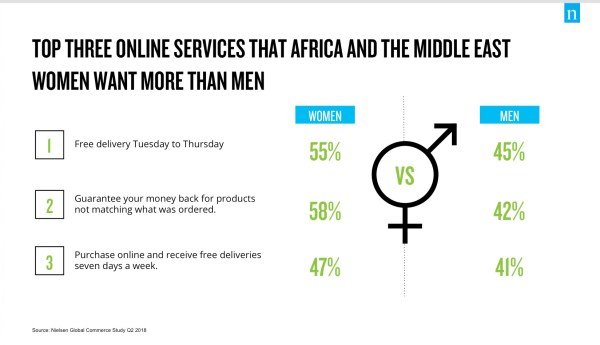

While the overall e-commerce industry in AME has exploded over the past few years, the contribution of fast-moving consumer goods (FMCG) to these sales is still relatively small. Less than 15% of women with internet access have ever purchased FMCG products online, but among those that have are encouraged by risk-free guarantees and convenience.

AME women also care about their health and their environment. Ninety-one percent of AME women are actively looking to change their diets, compared with 86% of men. How do women interpret what’s healthy for them and their world? AME women are more likely than men to scrutinize the items on the shelf than men to determine if a product is healthy or meets their cultural dietary requirements. They’re looking for transparent labels to help them make informed choices and they want companies to be open about where their products come from—as well as how they’re produced.

AME women are also more likely to buy products that are environmentally friendly (50% women vs. 43% men) or buy from companies that actively support environmental (47%) and social causes (40%) compared to men (43% vs. 35%) and to an even greater extent than their global counterparts (40% and 36%, respectively).

Brands can win hearts by being transparent about their practices, where their ingredients come from and by prioritizing quality. AME women are more likely than men to associate premium products with the quality of their ingredients and care about where their products come from and how they are produced.

There is an enormous opportunity for manufacturers and retailers to create more products and solutions that address these needs, whether that’s more healthy prepared halal meals or clean and simple ingredient listings.

So what does this mean for manufacturers and retailers?

It means that cultural gender norms are swiftly changing, even in the most conservative societies and AME women are fighting for change. Almost four in five women (79%) believe that men have a responsibility to help with household chores, compared with 68% of men.

Yet, gender bias remains commonplace in current-day advertising, and both men and women are noticing. Stereotypes that might have been acceptable a few years ago now discourage women and men from purchasing or using a product. Brands can play an important role in women’s empowerment and equality journey, normalising the involvement of men in daily tasks, be that sharing the load in the home or encouraging and defending inclusivity in the workplace.

Brands that are getting it right, whether through social responsibility, sustainability, health or convenience, will continue to win wallets. Those that don’t change fast enough won’t. Patronage is contingent on a true understanding of a woman’s needs and reflects her reality on screen, on the shelf and in the store.

Companies that want to succeed won’t only donate to women’s causes. They will actively hire women, ensure women are paid equally and be offered flexible working arrangements. Companies that step away from media headlines and roll up their sleeves to make sure their policies help women both as employees and as people living in the community, will be contributing and growing a powerful group that holds considerable sway over household spending.

In short, brands and retailers that focus more on how they can lessen the load off women’s shoulders and less on the color of their packaging will earn more dollars.

Methodology

The insights in this article were derived from the following sources:

- (1) International Labour Organisation A quantum leap for gender equality: For a better future of work for all

- 2GSMA Connected Women – The Mobile Gender Gap Report 2019

- The Conference Board® Global Consumer Confidence Survey is conducted in collaboration with Nielsen Q1 2019.

- The Nielsen Q1 2019 Loyalty Survey

- Nielsen Global Premiumization Survey Q2 2018

- Nielsen Global Commerce Study Q2 2018

- Nielsen Global Ingredient and Dining-Out Trends Report Aug 2016

- Nielsen Global Health and Wellness Q3 2016