Most Asian-Americans believe beauty starts from the inside out—a sentiment reflected by grocery baskets that over-index with fresh meats, vegetables and fruits. But Asian-Americans take a holistic approach to beauty and spend more than average in the health and beauty department, too.

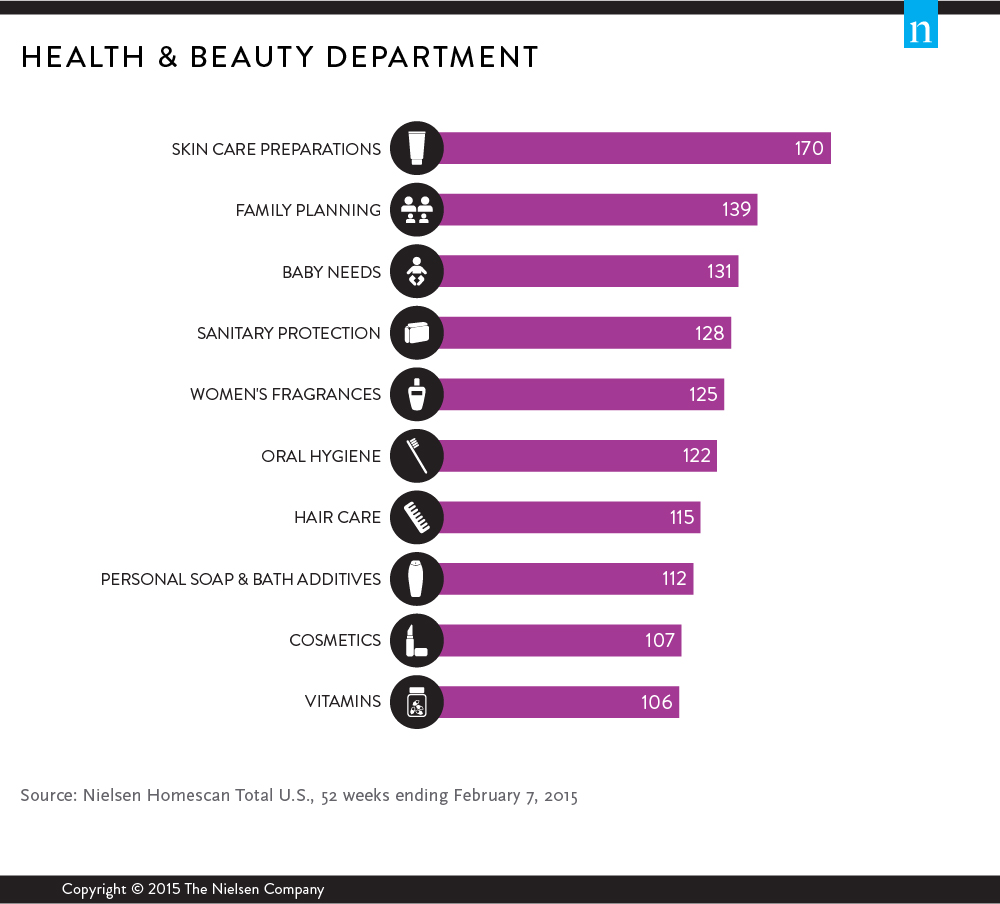

Nielsen’s latest report, Asian-Americans: Culturally Connected and Forging the Future shows that Asian-Americans spend 70% more than the average share of the U.S. population on skin-care preparation products, 25% more on fragrances, 15% more on hair care, 12% more on personal soap and bath and 7% more on cosmetics.

Personal care maintenance and the desire to live healthy lifestyles are also imperative to Asian-American shoppers. They spend 22% more on oral hygiene, 28% more on sanitary protection and 6% more on vitamins than average. With a median age of 35, Asian-Americans are younger than non-Hispanic whites (42), so they also spend more than average on family-planning (39% more) and baby-care (31% more) products.

MILLENNIAL ASIAN-AMERICAN WOMEN ARE DECISIVE SHOPPERS

Millennial Asian-American women (aged 18-34) who are heads of their households know what they want and demand the best quality. In fact, an extreme affinity for branded products makes them less likely than non-Asian-American Millennial woman to choose private-label brands. When asked about brand and private label preferences, Asian-American women are more likely to agree with the following statements:

- Name-brand products are worth the extra price.

- Private labels have non-appealing packaging, which deters me from buying.

- Private labels are not suitable where quality matters.

- I don’t know enough about private labels to try them.

- I don’t feel comfortable serving private label products to guests.

Millennial Asian-American women not only care deeply about their own appearances, they also shop for the men in their households. They purchase men’s toiletries 9% more frequently than non-Asian-American female heads of households and spend 20% more on average.

Marketers looking to reach Asian-Americans should consider offering cosmetic consultations and free product samples to increase trust and a willingness to try new items.

Other findings in the report include:

- Asian-American buying power equaled $770 billion in 2014 and is expected to reach $1 trillion by 2018.

- Asian-Americans are 31% more likely than average to buy organic foods and are 23% more likely to evaluate the nutrition of products.

- Eighty-eight percent of Asian Americans own credit cards, compared with 66% of the general population.

- Asian-Americans are leaders when it comes to technology, mobile and social media usage, and they watch and download more movies than any other ethnic segment.

For more detail and insight, download Nielsen’s Asian-Americans: Culturally Connected and Forging the Future Report.