Card or cash? Not anymore. ‘Buy now, pay later’ options have been rapidly embraced by Australians since 2015—completely disrupting the online retail and finance sectors. And with near universal awareness of buy now, pay later services among Australians (91%), the upside for businesses is at an all-time high.

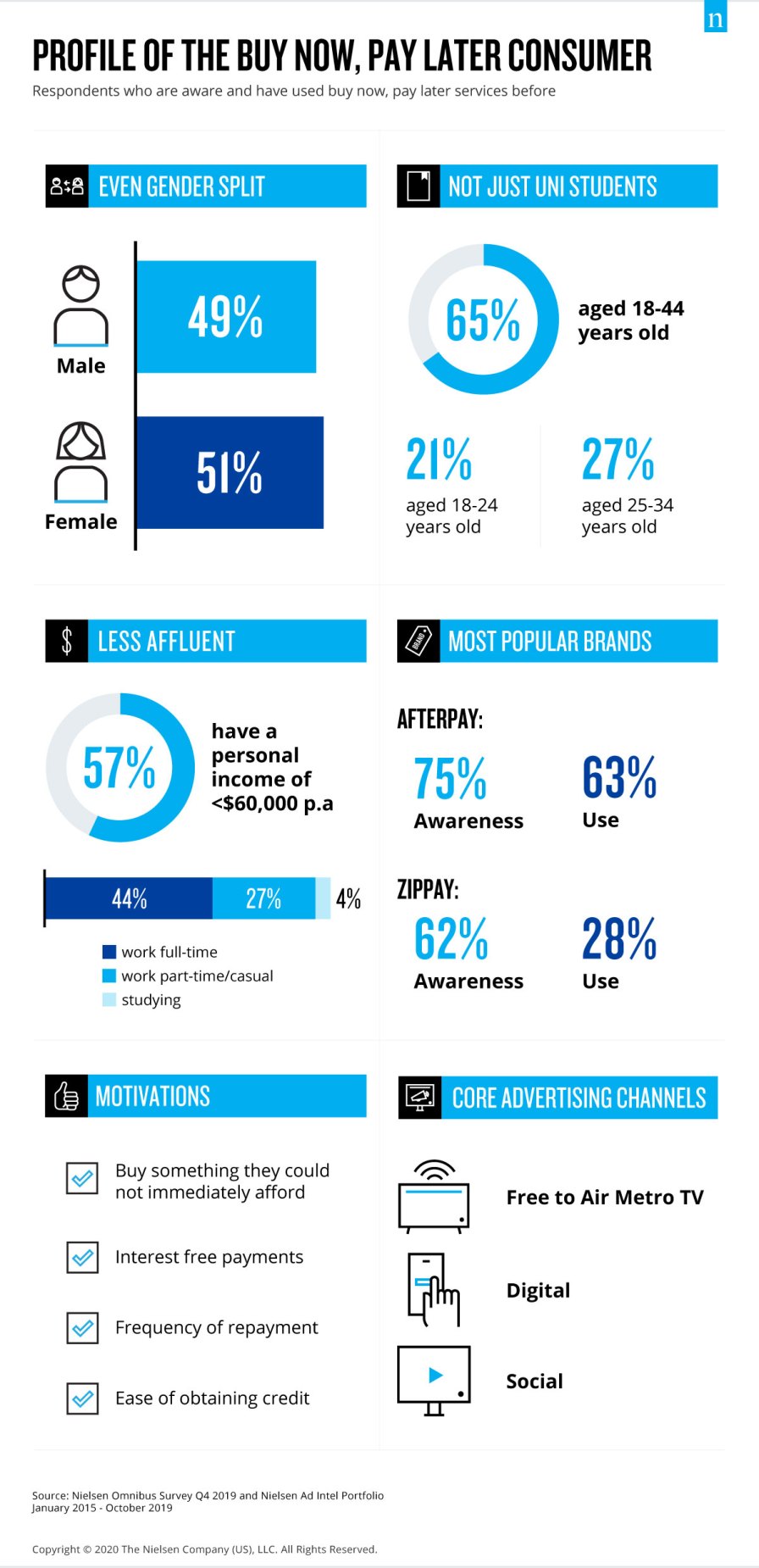

Buy now, pay later platforms have mass appeal among Australian consumers and retailers. Cash-strapped consumers get their purchases instantly, with the full amount paid off in regular, interest-free instalments within a couple of months. No saving and waiting, no applying for credit cards, no additional fees and no interest. For retailers, buy now, pay later platforms provide the opportunity to benefit from more immediate sales—both online and in-store. Specifically, it increases the chances of growing a customer base, and it incentivises customers to spend more than they initially intended. Nielsen research shows that 65% of Australians who have used buy now, pay later payment methods are aged 18-44, 27% are 25-34, and 21% are 18-24.

Since launch, the two most popular buy now, pay later brands in Australia—AfterPay and ZipPay—have used advertising to successfully connect with these consumer groups, as well as drive awareness and promote the benefits of their services. Nielsen Ad Intel Portfolio shows that most of the advertising spend for these brands has been on free-to-air metro television, with a slight skew toward Sydney (27%) and Brisbane (28%) between 2015 and 2019. Advertising from these providers has, however, declined by 27% between 2018 and 2019—with brands increasing their concentration on search and social advertising.

The rise of buy now, pay later platforms highlight how digital and social advertising can be a cost-effective way of reaching your target audience, particularly for online shoppers. At the same time, the impact of maintaining above-the-line media channels as part of the media mix shouldn’t be underestimated. Affiliate TV advertising could be a smart way to drive usage, awareness and site traffic for both retailers and buy now, pay later brands.

Despite its exponential success since launch, buy now, pay later platforms have recently come under scrutiny. There are questions around whether these services encourage consumers to live beyond their means, potentially sending them spiralling into personal debt. Nielsen research shows that more than seven-in-10 have used these services to buy a product they needed but could not afford to make a full payment for immediately; and most say interest free payments is the most important benefit followed by frequency of repayment and ease of obtaining credit.

These concerns have prompted a review by the Reserve Bank of Australia who will decide later this year whether buy now, pay later providers should prevent merchants from passing costs on to customers.