The acceleration of digitization across global industries over the past year enabled businesses to continue operating in a world without face-to-face interactions. As impressive as it is to bring a business into a virtual experience, however, digitization is merely the starting point for brands seeking to cultivate active and healthy relationships with consumers.

This is particularly relevant for financial services companies that have historically maintained relatively passive relationships with consumers. That’s because staying operational doesn’t guarantee brand loyalty, especially as traditional banks continue to cite the need to improve their customer experiences. Awareness is key, as the recent Digital Banking Report acknowledges that consumer trust in traditional banks continues to recede. The pullback in ad spend last year is another factor reducing top-of-mind awareness among consumers.

The call to action for marketers in financial services is no different from other industries: connect with people and build meaningful relationships based on true needs. For some financial services companies, however, that will mean overcoming preconceived notions and offering more than virtual replications of existing experiences.

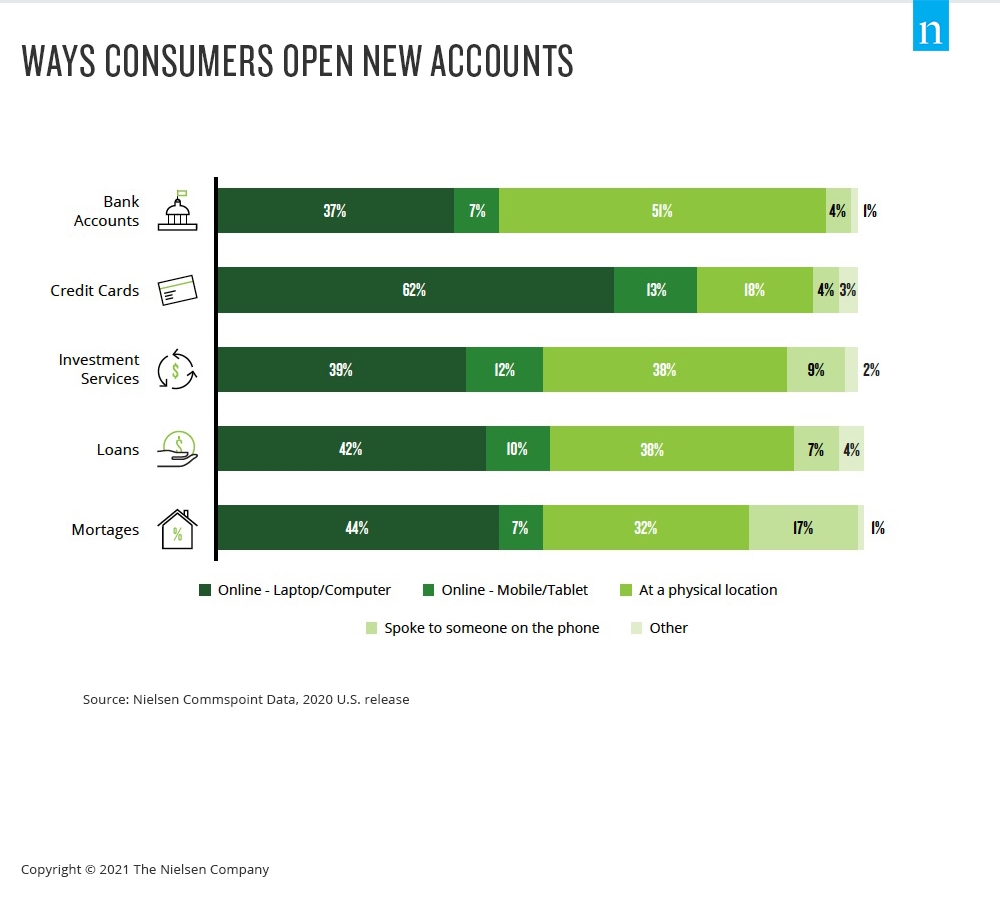

Even before the pandemic, 55% of Americans said they were using digital banking offerings, with an 11% increase in usage over the previous three years among consumers over 40. And Nielsen Commspoint data shows that online channels are becoming the dominant way consumers obtain most financial products, including credit cards and new bank accounts.

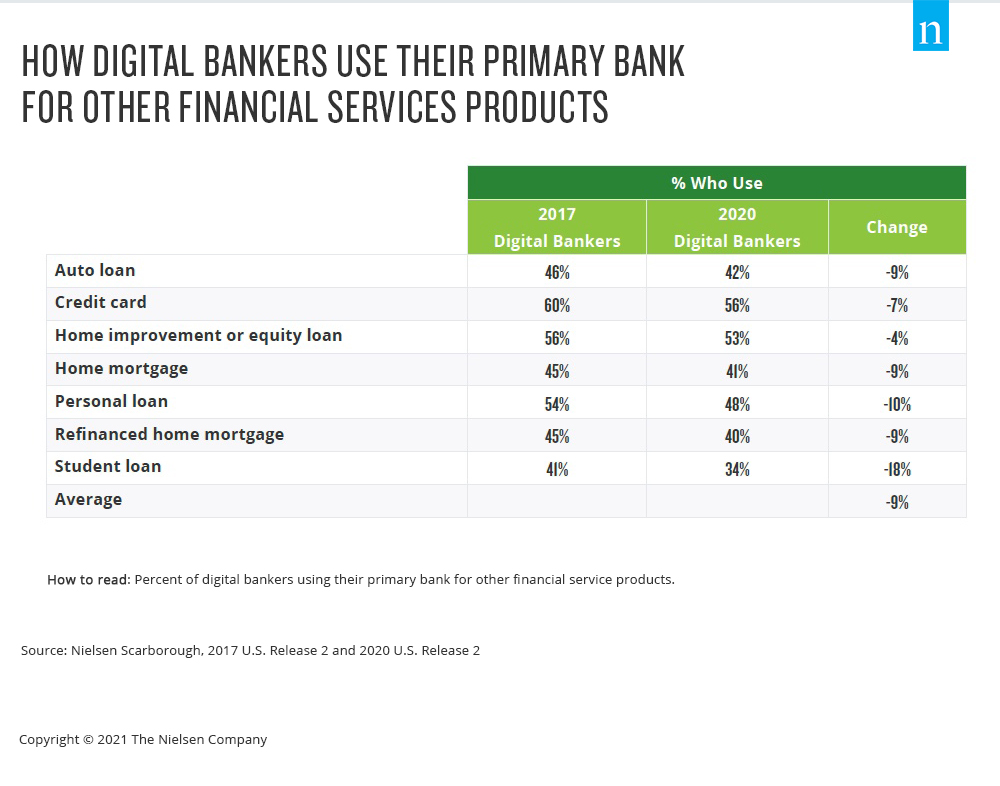

The downside amid the progressively digital landscape is that financial services consumers are increasingly gravitating to new companies—not their primary banks—for their financial services needs. To many people, banks are steadfast financial services institutions, but the relationship between traditional banks and consumers has been fragmenting for years. Fewer than half of U.S. bank customers consider their bank to be their primary financial services provider, according to data from Nielsen Scarborough, and the number is declining. What’s more, consumers are increasingly less inclined to use their primary bank for financial services products like home loans and credit cards.

Tech-driven democratization has been a factor in the fragmenting relationship between banks and customers. In fact, digital bankers are 20% less likely than non-digital bankers to use their primary bank for ancillary financial services needs. The increase in non-traditional players in financial services has the same effect as new entrants in the video streaming space: more choice means more for consumers to investigate and try. When you combine this choice with the historically passive nature of relationships between financial services organizations and consumers, a new product or service entrant with a vocal marketing effort is often all it takes to get people thinking about making a change.

This means that while consumer demand for digital services has grown, virtual experiences that mirror traditional ones don’t capture the full opportunity. Facing a world where habits and preferences have shifted, the marketers in financial services that are leading the way are doing so by engaging with customers in meaningful ways—they are focusing on always-on marketing strategies that build familiarity and connection.

For additional insights, download our Evolving Customer Relationships for Financial Services Marketers report.