As more of the U.S. becomes eligible for vaccinations, consumers and companies are seeing the light at the end of the tunnel. “Vaccine small talk” is infiltrating video conferences, and companies and consumers are beginning to talk and plan for a post-pandemic future. And when we look at who’s most eager to move forward, minority groups are leading the charge.

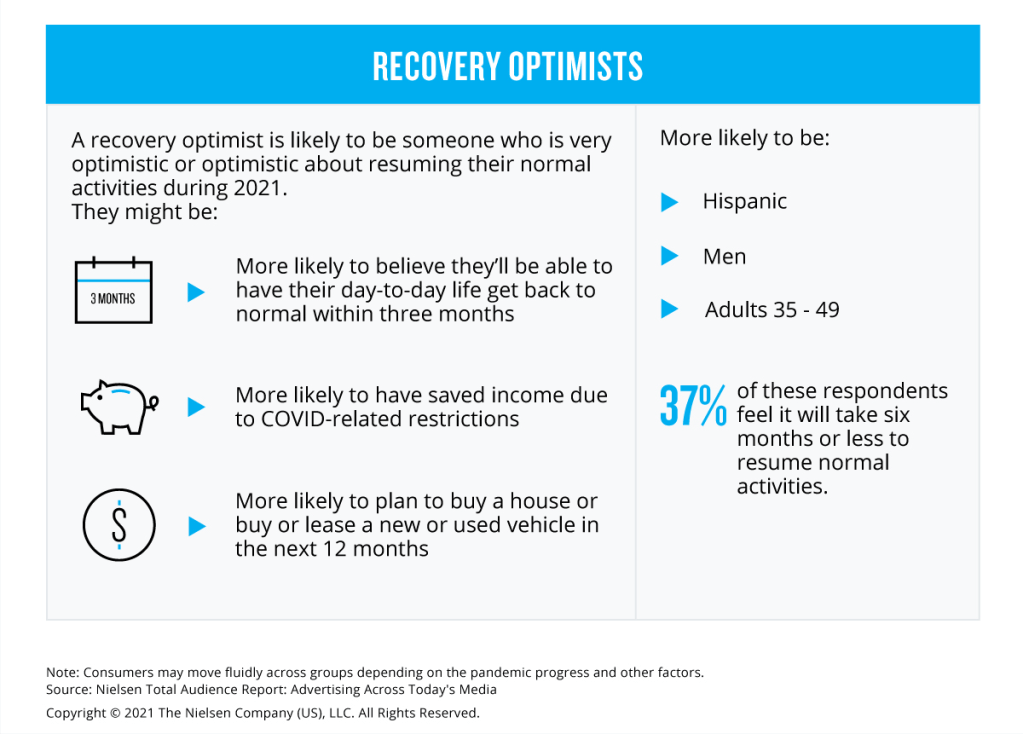

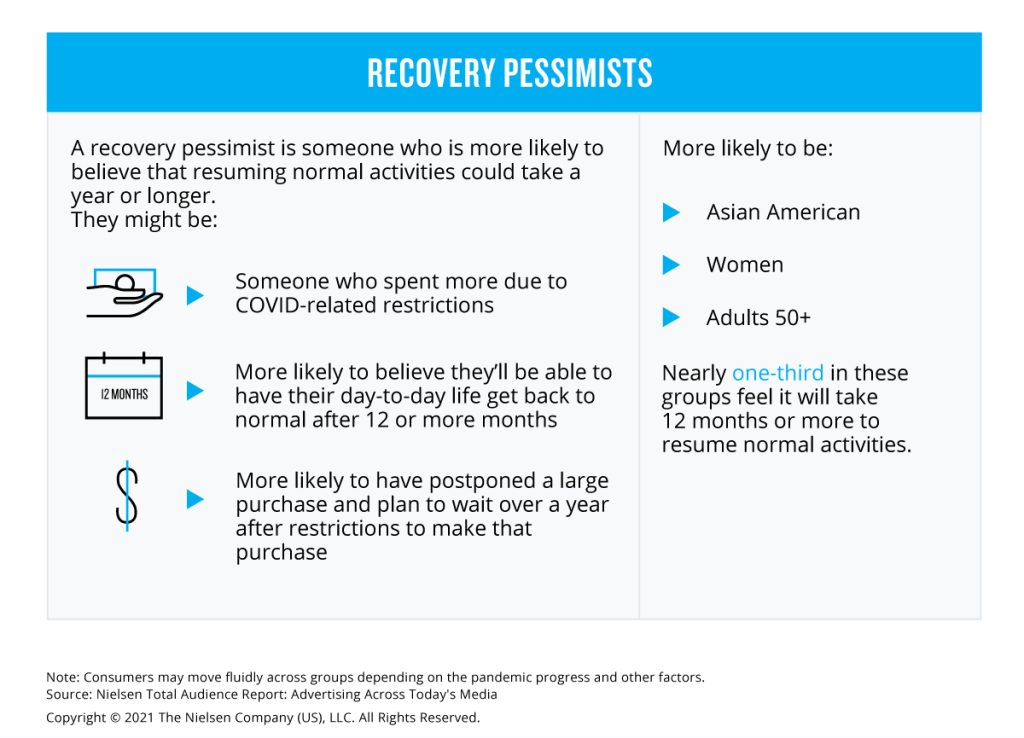

Early on in the pandemic, we saw how COVID-19 impacted different communities and industries unequally. As more states reopen and people resume “normal” activities, it’s clear that these communities and industries will bounce back at different tempos. Using data from the latest Nielsen Total Audience Report: Advertising Across Today’s Media, we’ve identified three primary consumer recovery groups: Recovery Optimists, Cautious Optimists and Recovery Pessimists. While consumers who identify with these categories may change as the vaccine rollout progresses, age, gender and ethnicity are a few of the factors advertisers can consider when looking at who’s most optimistic and eager to spend.

Despite research from the CDC showing that Black, African Americans and Hispanic or Latino persons are two to three times more at risk of COVID-related hospitalizations and death than their White, non-Hispanic counterparts, these consumers are among the most optimistic and eager to spend.

Based on the results from a recent Nielsen survey, Hispanic consumers are more likely to be Recovery Optimists. During COVID-19, these respondents reported that they were moderately impacted by COVID-related restrictions, with 44% saying they were able to save more compared with 39% of all adults 18+. Over half (53%) said they were able to make “major” purchases ($500+) during the pandemic compared with 43% of adults 18+.

In the next 12 months, Hispanic respondents say they are 2x more likely to buy a new house than the average adult and more likely to buy or lease a new or used vehicle. These consumers are most eager to plan or book a vacation (71%), dine out at restaurants (70%) and visit coffee shops / cafes (69%). Advertisers can reach this consumer group while on their smartphone, where they spent more than 18 hours a week watching video, streaming audio and social networking in second-quarter 2020.

Black consumers are more likely to be Cautious Optimists, because a larger percentage reported believing it’ll take longer to recover and have been more hesitant to make larger purchases during the past year. Black respondents indicated they were moderately impacted by COVID-related restrictions, with 52% saying they were able to save more income. Yet nearly six-in-10 indicated that they did not make a “major” ($500+) purchase in 2020, which is more than any other multicultural consumer group.

Once restrictions lift, African American consumers have indicated that they are ready to spend. They were 1.3x and 1.7x more likely to say that they plan to purchase or lease a car or purchase a house in the next year, respectively. On a smaller spending scale, African American consumers are eager to go to a hair/barber or nail salon (72%), dine out at restaurants (66%) and visit coffee shops and cafes (65%). Good news for the travel industry, two thirds (64%) of African Americans are interested in travel via airplanes, making them the most willing of all the multicultural consumers.

Advertisers looking to engage with Black consumers should keep in mind the social activism and diversity pledges made over the last year, as well as how that translates into the omnichannel experience, which is especially relevant to this consumer group that over-indexes on time spent across TV, the computer and smartphones. For Cautious Optimists, the messaging can be positive, but should not abandon health-safety considerations.

Many factors play into who falls into the Recovery Pessimists category, including confidence in vaccine information, protocol and ease of access. These individuals are more likely to have been significantly or severely impacted by the pandemic financially and could belong to more at-risk communities, are caretakers, or are managing additional burdens due to the pandemic. This includes women, who are more likely to be caretakers and take on household responsibilities as well as people who are 50+.

Advertisers shouldn’t dismiss this group. Instead, they should understand that these consumers may need more reassurance and continued promotion of health-safety protocols. The good news is that while these individuals may not be ready to spend immediately, they are likely spending more time doing socially distanced activities such as watching television and streaming.

It’s important to note that these consumer groups are not static. The enhanced rollout of the vaccine program, successful re-opening of schools and sustained falling COVID-19 cases could improve the overall optimism of Recovery Pessimists and allow them to step into the Cautious Optimists category. While set-backs and re-closures may downgrade consumer optimism.

For additional insights download the latest Nielsen Total Audience Report: Advertising Across Today’s Media or see past reports and trends on our Nielsen Total Audience Report Hub.