Professional competitive video gaming continues to rapidly gain popularity in the U.S., with 14% of the 13+ population now a fan of this form of competitive entertainment, up from just 8% last year. While eSports* may not rival the size of many traditional sports fan bases just yet, it’s gaining the attention of many sports leagues, teams, owners and even players—both as a formidable threat and a potentially lucrative complement to the sports status quo.

Traditional sports fandom is near-ubiquitous among eSports fans, consistent with the broader U.S. population. And when it comes to avid fanship of key sports leagues, the opportunity for synergies looks strong, with eSports fans on the whole more likely to be fans across leagues. While the NFL and NCAA football score highest among eSports fans in the absolute, the NBA is the only league to rank in the top five traditional sports leagues both in terms of avid fanship in the absolute and relative to the general population. This is noteworthy given the major investments that NBA teams, owners and players have made recently in the eSports space.

But eSports fans aren’t just rooting for these top leagues. They also show a stronger affinity than the average American for three key sport types: combat/fighting sports, racing, and U.S./European soccer. In fact, the eSports audience is at least three times as likely to be an avid fan of these three sports, which is noteworthy given that these parallel three of the most popular genres of sports video games.

Beyond sports fanship, the eSports audience also consumes traditional sports in its own unique way. True to their heavily male (77%), Millennial (61% aged 18-34) profile, eSports fans are nearly twice as likely to have streamed a traditional sports event online than the typical U.S. sports fan even though their TV viewing rates are on par with the broader audience. This is wholly consistent with their eSports viewing habits, as streaming is by far the most popular way to consume eSports content, with 71% of fans viewing eSports events online.

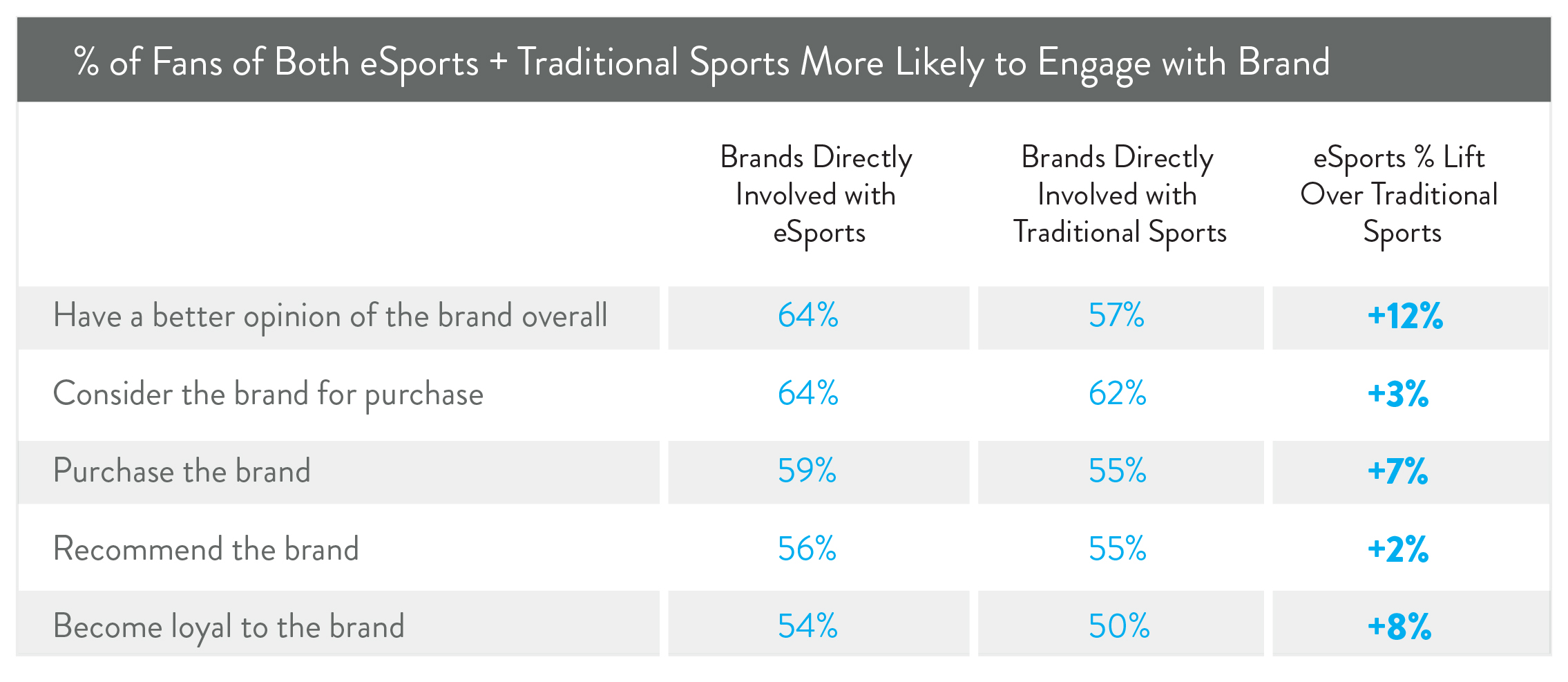

It’s no secret that brands are diving head first into eSports for a chance to connect with its invaluable young, male, online fan base. But what opportunity does eSports represent on top of brands’ current traditional sports activations?

For fans of both eSports and traditional sports, direct involvement in eSports can especially elevate fans’ opinion of a brand on top of its gains via traditional sports involvement (+12%). eSports integrations also offer the prospect of growing purchase intent (+7%) and brand loyalty (+8%) beyond what sports activations generate.

Note

*Wondering why we’ve stuck with the “eSports” spelling in 2016? Because at Nielsen, we always give consumers the final word. We asked fans their preferred capitalization for the term, and 56% told us “eSports” (versus 22% for Esports and 6% for esports; 16% had no preference).

For more information about Nielsen’s 2016 eSports report, click here.

METHODOLOGY

The insights in this article were derived from the 2016 Nielsen eSports Report. Data for this report was collected online in October 2016 among 1,000 active (past 12 month) eSports fans aged 13+. Additional perspective on the interaction between traditional sports and eSports was sourced from the 2016 Nielsen Sports 360 report, based on an online survey of 2,500 U.S. general population consumers aged 13+.