During the holidays, retailers are presented with their best opportunities to accelerate sales momentum and reach their revenue goals before the end of the year. Over the last five years, $71.6 trillion dollars have been spent on advertising for the top 20 product categories in the last quarter of the year—almost 30% of total advertising spend. In such a crowded advertising space, it is imperative for retailers, and mass merchandisers in particular, to reach consumers and get the best bang for their advertising buck during the holiday season.

When it comes to holiday ads, mass merchandisers comprise over half of the total retail category’s Gross Ratings Points (GRPs), measuring ad impressions, during the holiday months. And not surprisingly, there is a significant increase in mass merchandiser ad spend (and overall retail ad spend) during the holidays compared to the rest of the year. However, that is not the case across all advertiser categories.

When comparing GRPs during the months of November and December to the GRPs over the rest of the year, the retail and technology categories see a significant increase in media weight while other categories see relatively equal spend or in some cases, less media weight than in other parts of the year.

While the retail category as a whole increases its media weight during the holiday season, this increase in GRPs is more significant within the mass merchandiser subcategory than all of the other retailer brands combined. Mass merchandiser brands doubled down on a weekly basis leading up to the holidays in 2015, particularly in early November and the week leading up to Black Friday.

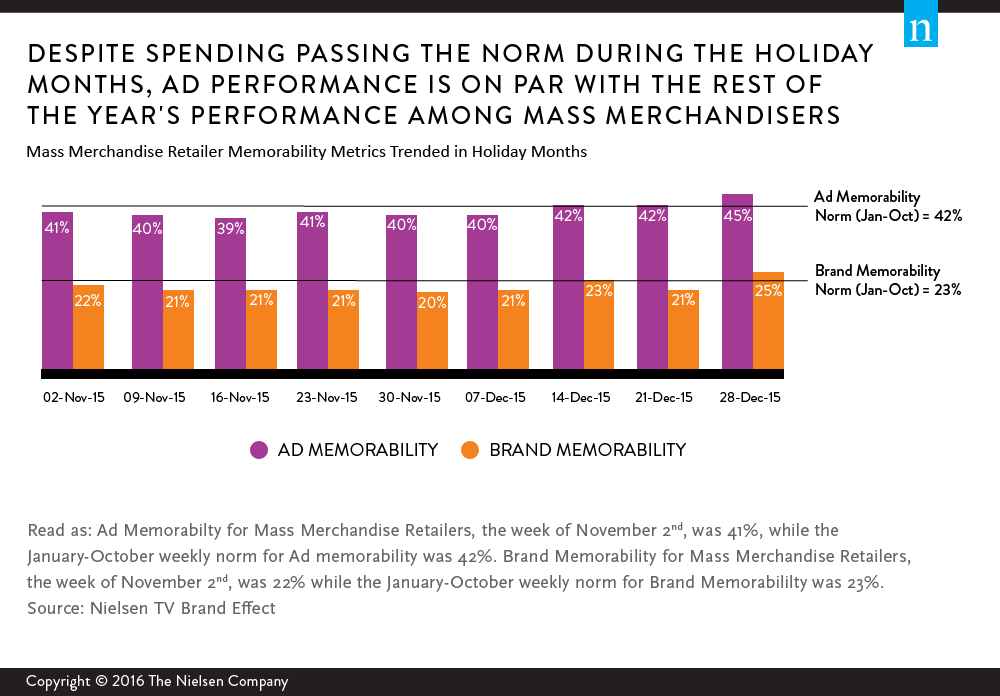

So, does all of this extra media weight pay off? Despite the cluttered environment resulting from significantly higher ad spend across the category, ad performance for mass merchandiser retailers who increase their media weight do not suffer during the cluttered holiday months. In fact, Ad and Brand Memorability performance for these advertisers during November and December in 2015 was on par compared to their performance the rest of the year.

How is it that these retailer ads are just as memorable during the busy holiday period as they are the rest of the year? While one might expect to see an influx of new creatives during the holidays, only 39% of the mass merchandiser ad spend consisted of new ads in a given week during the period in 2015. Existing ads are typically more memorable than new ads due to the wear-in effect, and since most of the spend went to existing ads, overall ad performance during the holiday months remained on par with the rest of the year.

When it comes to breaking through the clutter, it’s important to differentiate your ad versus the competition. Nielsen continues to believe that relying on solid creative best practices—and developing distinctive, memorable executions that are strongly associated with your brand—is the path towards advertising success. With that said, there are additional challenges during a highly cluttered environment like the holiday season.

Some advertisers, such as those in the retail category, may be well served to increase their media spend in order for their ads to be as memorable as other times of the year when fewer GRPs are needed. Along the same lines, some advertiser categories, such as automotive or telecom, put fewer GRPs on air during the holidays, and happen to see lower Brand Memorability than other times during the year.

As we find ourselves in another holiday season where the competition for air time is fierce, advertisers need to strike the right balance of quantity and quality in order to have a successful advertising campaign.

Methodology

Nielsen TV Brand Effect is based on survey responses from the 2015 broadcast year (Dec. 29, 2014–Jan. 3, 2016) among adults 18+. Data is limited to primetime, non-sports programming on English-language broadcast and cable networks within TV Brand Effect coverage. New ads are defined as first airing within TV Brand Effect coverage in the respective week. Analysis based on day-after exposure to TV ads.