Australian shoppers are seeking more information about the products and services they are buying online and are increasingly price savvy. Fortunately, the age of online shopping is well and truly alive and providing a plethora of opportunities to educate, engage and inform the shopper throughout the purchase journey.

The 18th edition of Nielsen’s annual Australian Connected Consumers Report found nearly all online Australians have used the Internet to do some form of purchasing activity; and around one-in-four purchase items online at least weekly.

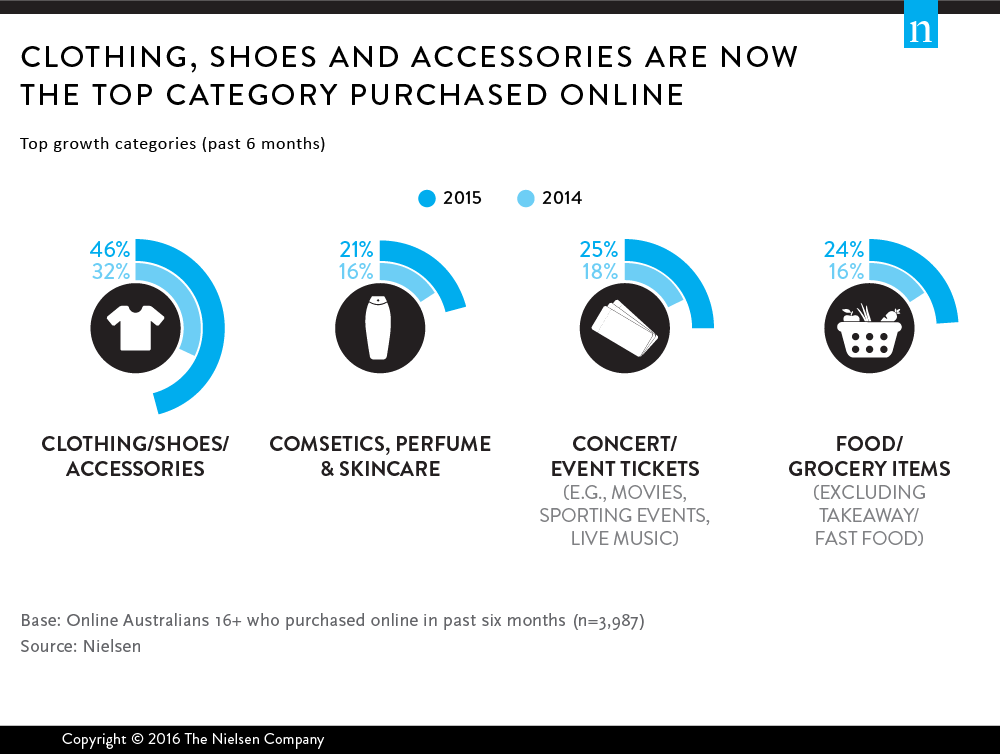

Looking at purchasing trends by category, it is evident there are some major shifts in the Australian online retailing landscape. For the first time, consumers are purchasing more clothing, shoes and accessories online than travel related purchases. Entertainment purchases such as concert, movie and event tickets as well as food and grocery (excluding fast food) also experienced growth.

TIME OF DAY SHOPPING NOT THE SAME FOR ALLDespite the growing trend of consumers trying their hand at shopping across more categories online, this has not affected any changes in the time people are logging on. Online shopping in general occurs throughout the day, with a major peak in the evenings between 6pm and 10pm and a smaller peak at the start of the work day – a pattern that has been consistent over the past few years.

However, while most online shopping occurs in the hours between 6pm and 10pm, the important 60+ age group is the opposite, with the majority of online shopping occurring between 9am and 12pm. This age band is also far more likely than any other to purchase wine online (26%). Retailers and manufacturers need to be equipped to understand the differing demographics accessing their products and sites so as to engage the right person with the right message at the right time.

MOBILE DEVICES ARE A KEY TOOL IN ALL STAGES OF SHOPPINGAlthough the traditional PC still prevails as the key device used for online shopping, it is in sharp decline as mobile usage increases. Use of mobile devices to research products while in-store is also a popular activity to aid in decision making; over half the online population research and compare prices in-store at least sometimes before making a purchase. Huge opportunities exist for retailers and brands that can develop online sales processes and marketing campaigns that are more conducive to mobile devices.

AT THE CHECK OUT, IT’S TAP, PAY AND GO!Two-thirds of online Australians use a form of contactless payment (PayWave or PayPass) with a credit or debit card in shops; an increase of six percentage points vs. 2014. Regular usage of this form of payment has also increased three points to 33% compared to last year, indicating further entrenchment of this convenient payment function. The wider adoption of contactless payments may pave the way for the mobile wallet, (i.e. ‘tapping’ your mobile phone for payments) however security issues are still a concern for half of online Australians regarding this method.

THE MORE DETAIL THE BETTER FOR THE FOOD AND GROCERY CATEGORYOnline food and grocery experienced a significant jump in consumer engagement, with almost one-quarter (24%) of online shoppers making a purchase in this category in the past six months (up from 16% in 2014). This was largely driven by steep increases in purchases by males and those aged under 45.

More than seven in ten online grocery shoppers say price is most important followed by product details (such as ingredients and nutritional information which is closely investigated by just over half who purchase online. In fact, there is a growing interest particularly among younger consumers for specific product details and nutritional information highlighting the need for retailers and manufacturers to be very explicit and transparent with their product information online.

Adding to the fact that consumers are seeking out more detail about the product and services they are buying online; there is an increasing trend of online Australians seeking out products and information direct from the source. When researching food and groceries, the number of consumers going directly to the retailer’s online destination is still dominant but in decline, whereas visiting the manufacturer’s site or app grew by 11% to a total of 40%.

The continued growth of connected commerce is inevitable and the shopper journey of the Australian connected consumer is becoming more complex and fluid. We are incorporating digital touchpoints along the entire process; from reviewing products online at home, to using smartphones as personal shopping assistants in the store. Nearly six-in-10 consumers will look at an item in-store, but ultimately buy it online instead.

With consumers easily shifting between online and offline retail channels and demanding an abundance of information at hand, retailers and manufacturers must understand individuals’ behaviours and provide easily accessible product information and compelling offers in both environments.

Purchase the Australian Connected Consumers Report 2016 here.

About the Australian Nielsen Connected Consumers Report, 2016The Nielsen Australian Connected Consumers Report 2016 is a one-of-a-kind industry tool to guide your business’ marketing and media strategy in alignment with today’s connected consumers. The comprehensive insights and data sets provide your business with a unique ability to identify core audience segments and deep-dive into their device and cross-platform content consumption, purchase behaviours and influences, and the way they interact with brands.

Having more than 18 years of historical data from the annual Nielsen Australian Connected Consumers report allows you to see how trends have changed as well as forecast what’s around the corner-so you can capture and maximise the opportunities of this increasingly connected consumer.