Marketing is evolving faster than ever, powered by cutting-edge tech and changing consumer habits. And marketers aren’t just keeping up—they’re leading the charge.

AI is now a game-changer, with 59% of marketers worldwide recognizing it as key for campaign personalization and optimization, underscoring its power to streamline operations and free up valuable time. That same momentum is driving strong investment in connected TV (CTV), which has firmly secured its place as a top-tier channel. In fact, 56% of marketers are ramping up their CTV, making it one of the few digital channels consistently seeing year-over-year growth as they capitalize on evolving viewing behaviors. Retail Media Networks (RMNs) are also stepping into the spotlight. No longer just a bottom-funnel tool, RMNs are now a strategic force across the entire consumer journey. A strong 65% of marketers globally are embracing their potential to unlock deeper insights and deliver impact at every stage.

While these global trends set the stage, regional priorities bring unique nuances. In the Asia Pacific (APAC) region, for example, 2025 marketing goals are clear. Brand awareness is a primary focus for 32% of marketers, showing a slight rise from 31% the previous year. Beyond market visibility, marketers place a strong emphasis on tangible outcomes, with revenue growth remaining a key objective for 25% of them.

The prioritization of these goals means APAC marketers are balancing spreading market presence with the imperative for strong financial performance. A balanced approach where top-of-funnel awareness builds long-term equity, and bottom-funnel conversions prove market success, directly shapes the demands placed on media planning.

Aligning media strategies with objectives

A consistent emphasis on brand awareness naturally steers media strategies toward methods that maximize reach and consistent exposure. To meet that need for broad reach, APAC marketers are driving a significant shift, with 79% saying they’re moving spending to digital channels. The move leverages widespread internet and mobile usage across the region, allowing for consistent presence and vast audience engagement. Digital thus proves itself as the go-to platform for achieving wide visibility, which is essential for brand recall.

What channels, in particular, are APAC marketers investing in? Social media tops the list, with 68% of marketers saying they planned to increase spend. Online/mobile (video) also receives substantial budget increases, with 67% of marketers investing more budget. Similarly, online/mobile (display) sees 66% of marketers boosting spend. These platforms are clearly favored for their wide reach and engaging visual formats. Native advertising also shows a particularly sharp shift, with 54% of marketers planning to increase spend compared to 46% in 2024, underscoring its growing strategic role in seamless content integration.

Complementing the move to digital is a clear drive for efficiency and direct results. A substantial 69% of marketers intend to spend more on performance marketing while reducing investment in traditional brand building efforts. Tactical choices like this directly support objectives of revenue growth and customer acquisition, where measurable impact and conversions are very important for proving success. In a related trend, 69% also said they’re focusing on less expensive marketing channels (including options other than traditional TV).

Marketers are also actively embracing innovation to enhance their reach and targeting. A significant 77% plan to increase spend on newer channels such as connected TV (CTV) and influencer marketing. Newer channels offer dynamic avenues for engaging audiences, providing opportunities for richer content experiences. APAC marketers are meticulously aligning their media resource allocation with their strategic objectives, ensuring every investment contributes directly to their defined goals for the year, providing a results-oriented approach to success.

Understanding APAC measurement tools

To truly confirm the efficacy of their meticulously aligned strategies and substantial investments, APAC marketers rigorously turn to measurement. While the push toward proactive and data-driven approaches is evident, mastering the art of gauging marketing performance and proving its worth is not without its hurdles. So, what specific tools are organizations leveraging, and what challenges persist in gaining a truly holistic view of ROI?

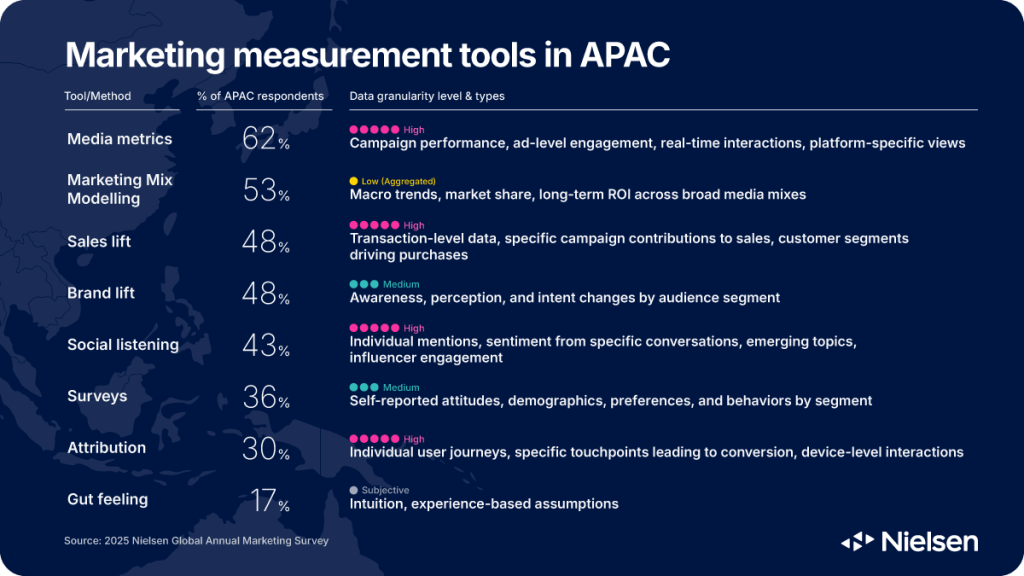

Across the board, marketers in the APAC region are deploying a variety of tools to evaluate the holistic ROI of their marketing performance. A notable 53% of organizations adopt marketing mix modeling as a foundational method for evaluating performance. Reflecting a balanced strategic intent, both sales lift and brand lift studies are equally prioritized by 48% of marketers, affirming their dual focus on driving lower-funnel conversions and strengthening upper-funnel brand impact.

Complementing these broader assessments, APAC marketers also tap into more granular data for immediate insights. For a significant 62% of them, media metrics prove absolutely pivotal, providing that immediate pulse on campaign performance. Attribution models are leveraged by 30% to precisely understand the contributions of each touchpoint along the customer journey. And to fully round out these detailed insights, surveys prove essential for 36% of marketers, capturing nuanced customer perspectives often missed by purely quantitative data.

Even as marketers embrace sophisticated measurement techniques, gaining a truly holistic view of performance remains a challenge. In fact, a surprising 17% of APAC marketers still rely on gut feeling to assess marketing ROI. Such reliance points to a persistent gap between the availability of advanced tools and how consistently they are applied. Effective decision-making requires not only access to data but also its thorough and reliable use to drive meaningful results. Our latest report explores this disconnect between perceived channel effectiveness and actual ROI in greater depth.

To uncover deeper insights, identify hidden value in your current strategy, and take meaningful steps toward more accountable, performance-focused marketing, download the 2025 Annual Marketing Report: From Chaos to Clarity: Unlocking the Power of Data-Driven Marketing now.